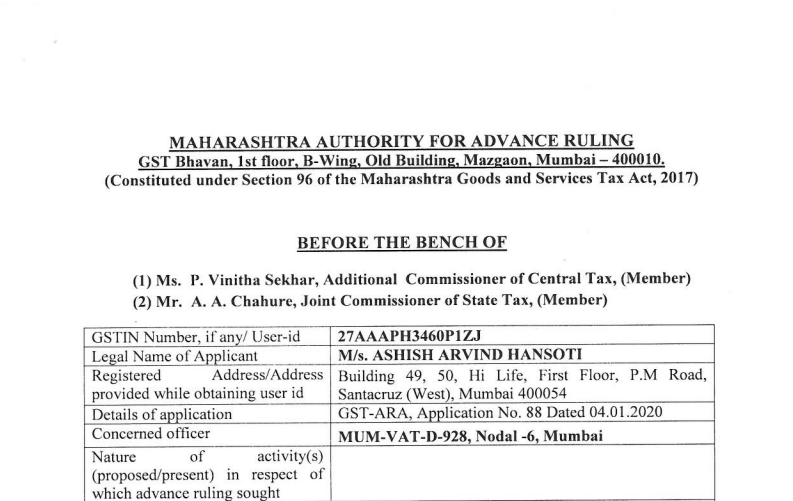

Maharashtra AAR in the case of M/s. Ashish Arvind Hansoti

Table of Contents

Case Covered:

M/s. Ashish Arvind Hansoti

Facts of the case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017, and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by M/s. Ashish Arvind Hansoti, the applicant, seeking an advance ruling in respect of the following questions.

Whether the applicant is eligible to claim an input tax credit of GST paid input & input services used for the construction of a commercial immovable property, subsequently used for renting.

The applicant is involved in the construction of immovable property for letting out to various tenants on which GST will be charged under the heading ‘renting of immovable property’. For the purposes of such construction, huge quantities of materials and other inputs were purchased by the applicant, and certain input services were also availed against which the applicant has paid GST and now wants to avail credit of such GST paid by him, for discharging the output tax liability.

Related Topic:

Original copy GST AAR of Sanofi India limited

Observations:

We have gone through the facts of the case, documents on record, and written submissions made by both, the applicant as well as the jurisdictional authority.

From a perusal of submissions made by the applicant, we observe that the applicant has raised the subject question in relation to an activity i.e., construction of a building on his own account.

Hence, in view of the above, we are of the opinion that since the case of M/s. Safari Retreats Pvt. Ltd. is pending with Hon’ble Supreme Court, has not attained finality. We also find that the Hon’ble High Court has given the relief to the party invoking its writ jurisdiction while categorically holding that they are not inclined to hold Section 17(5)(d) to be ultra vires. Therefore, we are not relying upon the judgement of the Hon’ble High Court.

Related Topic:

Maharashtra AAR in the case of M/s. Tata Motors Limited

Order:

For reasons as discussed in the body of the order, the questions are answered thus-

Question: Whether the applicant is eligible to claim an input tax credit of GST paid input & input services used for the construction of a commercial immovable property, subsequently used for renting?

Answer:- Answered in the negative.

Read & Download full decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.