Maharashtra AAR in the case of Portescap India Private Limited

Table of Contents

Case Covered:

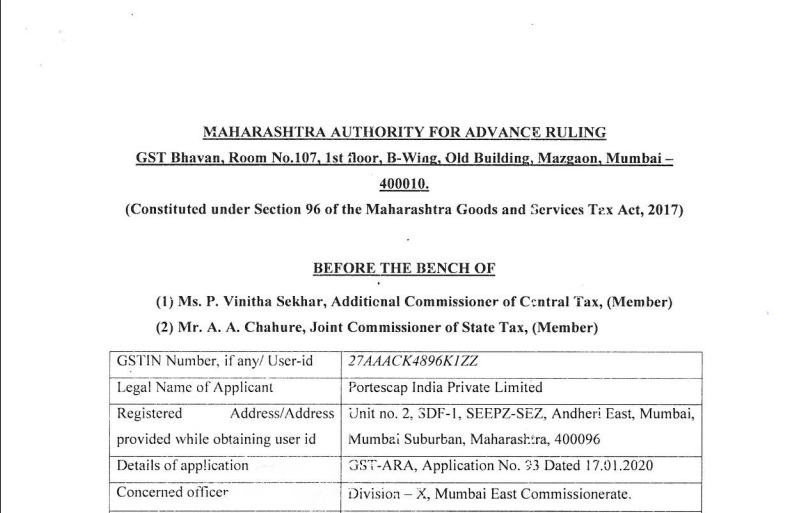

Portescap India Private Limited

Facts of the case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017, and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by Portescap India Private Limited, the applicant, seeking an advance ruling in respect of the following questions.

- Whether Portescap India Private Limited is required to pay tax under reverse charge mechanism on procurement of renting of immovable property services from Seepz Special Economic Zones Authority (Local Authority) in accordance with Notification No. 13/2017 dated 28th June 2017 read with notification No. 03/2018- Central Tax (Rate) dated 25th January 2018?

- Whether Portescap India Private Limited is required to pay tax under reverse charge mechanism on any other services in accordance with Notification No. 13/2017 dated 28th June 2017 read with notification No. 03/2018- Central Tax (Rate) dated 25th January 2018?

- If, answer to the above is in the affirmative, then the tax under reverse charge mechanism is required to be paid under which tax head i.e., IGST or CGST and SGST?

Observations:

We have gone through the facts of the case, documents on record, and written submissions of the applicant and oral contention of the jurisdictional officer.

In the subject case, we find as per sublease agreement 09.01.2020 that, the applicant is the procurer of domestic services like renting of immovable property services from Seepz Special Economic Zones Authority (Local Authority). Thus, the applicant has raised the subject questions as a recipient of services.

Therefore, before we decide the questions raised by the applicant in this application, it is essential that we first determine whether or not the activities undertaken by the applicant pertains to the supply of goods or services or both, being undertaken or proposed to be undertaken by the applicant.

Order:

For reasons as discussed in the body of the order, the questions are answered thus-

“The present application filed for advance ruling is rejected, as being non-maintainable as per the provisions of law”.

Read & Download full decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.