GST ‘Intermediary’ Services

Table of Contents

GST ‘Intermediary’ Services

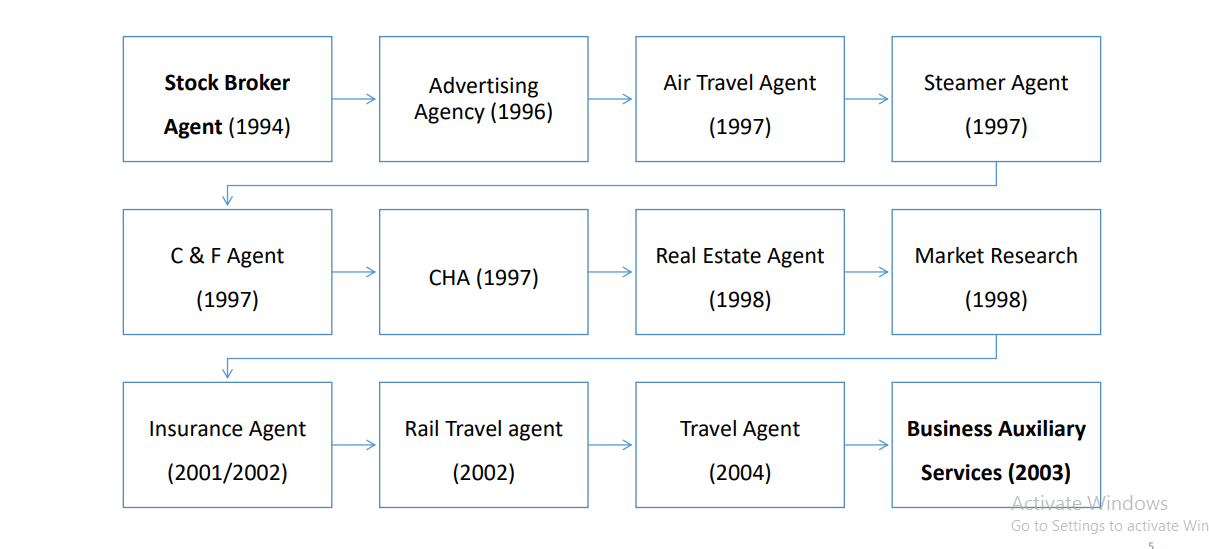

Agent – Positive List regime

Agent – Evolution!

“Commission Agent”

• Not. No. 13/2003 dated 20.06.2003 to exempt ‘Commission Agent’ services

• Explanation.– For the purposes of this notification, “commission agent” means a person who causes sale or purchase of goods, on behalf of another person for a consideration which is based on the quantum of such sale or purchase.

• JUBILIANT ENPRO (P) LTD 2015 (38) S.T.R. 625 (Tri. – Del.)

• As is evident from the “sales representative agreements” the appellants’ role includes promotion of the services recipients’ goods/services and is thus clearly different from that of a commission agent’s as defined above.

BAS – “Commission Agent”

Section 65(19) “business auxiliary service” means any service in relation to –

(i) promotion or marketing or sale of goods produced or provided by or belonging to the client; or

(ii) promotion or marketing of service provided by the client;

(iii) any customer care service provided on behalf of the client; or

(iv) procurement of goods or services, which are inputs for the client; or … …

and includes services as a commission agent,

Explanation. – For the removal of doubts, it is hereby declared that for the purposes of this clause, –

(a) “commission agent” means any person who acts on behalf of another person and causes sale or purchase of goods, or provision or receipt of services, for a consideration, and includes any person who, while acting on behalf of another person –

(i) deals with goods or services or documents of title to such goods or services; or

(ii) collects payment of sale price of such goods or services; or

(iii) guarantees for collection or payment for such goods or services; or

(iv) undertakes any activities relating to such sale or purchase of such goods or services;

Three people – Supplier, Agent, and Customer!

Two parallel developments!

Agent→Agent →Amount

Export→Recipient→Use

Circular 56/2003 dated 25.04.2003

• I am directed to clarify that the Service Tax is a destination-based consumption tax and it is not applicable to the export of services.

• Another question raised is about the taxability of secondary services which are used by the primary service provider for the export of services, Since the secondary services ultimately get consumed/merged with the services that are being exported no service tax would be leviable on such secondary services. However, in the case where the secondary service gets consumed in part or toto for providing service in India, the service tax would be leviable on the secondary service provider.