Six things you should never do while investing

So many articles written by many elite experts will tell you how to create wealth and reach the goal of financial planning. We read all those things more or less everyone will tell you same kind of things or some may be there with unique ideas.

Depending on our case and understanding we try to follow them and get benefit although no one is able to make a perfect blend and it’s natural. But worst situation is when instead of creating wealth we start losing money.

Today in this article I will show you ugly face of this process of wealth creation. How we fall in trap and start losing. Why I write on this topic? Even if you are not able to follow all wealth creation techniques at least you shouldn’t be losing by committing these mistakes. Following is the list of mistakes so read them and tries to avoid these acts.

- Don’t buy an Insurance plan you don’t need: I will tell you in every 10 salaried people 9 of them are suffering from some (I can’t give the name of any company here) bad selling. Life insurance companies in India have done this via their agents who most of the time turns out to be your relative and family friends and request cum force you to buy some amazing plans.

They also offer you some payback from the commission they earn from Insurance Company. You half-heartedly and with almost zero knowledge of all risk factors buy it. As the time pass out you come to understand what has happened with you. So many people lost their hard earned money in those stupid plans who offer like 30-35-40 and upto 70% commission to their brokers. Now think when 70 out of 100 is already gone how can you expect a fair return?

If you really want a safeguard of your family buy term insurance. Which will not be suggested by many brokers as commission is less and company’s responsibility is high. And most interesting thing is that we even decline to buy it because our so called advisor doesn’t offer cash back.

I also have another suggestion don’t accept an insurance agent as a financial advisor. They just repeat the pitch taught to them in their training. There are very few genuine advisors who are selling the correct thing. But they charge for it and we refuse to pay a small amount

as fee but lose a bigger chunk as commission they get by mis selling. We really need to change our mentality.

- Trading in share market unless you are in profit or have an expertise:

In day to day life a negative things work as a hurdle in our feeling of doing the things but inequity market it is just opposite. Losses increase our desire to trade as we want to cover our losses and we have better motivation to continue trading.

Some of us get inspired by Warren Buffet and try to be like him. Let me tell you one thing Warren Buffet never ever traded in market. All of his investments were long term and most of them were not even the secondary purchase from exchange but was a stake buying from company itself. Something like Mr. Rakesh Jhunjhunwala do in India.

If you are sitting in front of terminal waiting your stocks (or futures or options ) to go up, you have nothing to do with warren buffet theory. By the way he also earned a large chunk of his money from his insurance business which was a new thing at that time and so many people in US also buy those policies.(Like we do).

- Dipping too much into PPF and FD’s: Many investors want to play it safe. Extremely safe and they never ever want to invest in market or market linked products. Well some of them are from loss making people I told you earlier when they finally find themselves unable to cover their losses and even result in bigger losses.

They start to hate equity market and utterly reject it in any form. Equity will definitely give you returns but on its terms and not on your terms. You can tame equity market or force it to behave as per your convenience. You will have to plan as per its nature. That’s why I always say invest with proper planning and expects a decent return in reasonable timeframe. You may even get exceptional return but if you will invest without planning and with dream of exceptional return you will end up in losing.

Let me share a little example: Almost 2 years back when Modi government came into power equity markets surged like anything. Some of the funds fetched even 100% returns in years. One of my newly founded clients (They even thought of investing seeing that 100% return) asked for my advice and we suggested him start an SIP as market is already high and then add a top us with every fall of market.

They utterly rejected the idea saying that if in last year someone have chosen SIP they profits would have been almost half. Now after one year market is almost 1300 points down and I answer their calls now and then telling them to hold but now their experience is sour they don’t want to continue. Now they also want to spend their life with PPF and FD’s. Please don’t do this to your investments. Over enthusiasm will always be harmful for you. Slow and steady will win the race that too with huge distance.

- Investing without a time horizon and tax consideration: It is like you wanted to be an engineer but you have chosen the art’s stream. Your investment decision should be an informed and planned decision. It shouldn’t be like you waiting for tax saving investments and then on last week of March some agent sells you as per their convenience. How can you expect them to fulfil your dream? They will try to fulfil their dreams and that will be fulfilled with maximum commission. Whatever your product is please take proper knowledge of that and also try to seek some feedback from the people already using it. Ask you advisor to tell you about all the products including MIP, FMP, Liquid funds, Tax free Bonds, NCD’s( Most of them avoid these products as they have negligible commission).

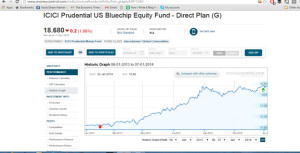

- Investment on the basis of past returns: Although SEBI has also restricted companies from selling products showing the past returns. If you will notice at most of the broachers it will be written that past returns are indicative and may or may not be repeated. Even then the only thing inspires us is the past return. Different kind of funds reacts differently in various time periods. Let me explain via an example. In 2013-14 When rupee was in downward movement the US Bluechip fund made tremendous profits(See image 1).

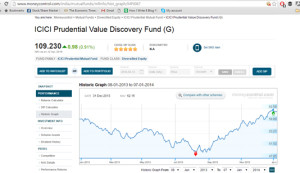

But if you will see this ICICI value discovery fund which a 5 star rated funds. Its returns were very low and in comparison to ICICI US blue-chip fund it was almost negligible.

Image:2 Return chart of ICICI value discovery fund for same period.

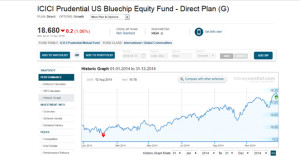

Now let us check their return in 2014

See the return on ICICI value discovery fund was very high in comparison to ICICI US blue-chip. But if decision of investment was taken on the basis of past return it should be wrong in both the years. (Image courtesy: Moneycontrol.com). It was around 12.25% for ICICI US blue-chip and around 70% for ICICI value discovery. See calculation.(you can also calculate for first period: All data is taken from Moneycontrol).

Before investing take a look on market condition and take past return as an indicative of funds reaction to various economical situations. Other factors should also be taken into care.

| Particulars | 01/01/2014 to 31/12/2014 | |

| ICICI US Blue-chip Equity Fund | ICICI value discovery fund | |

| Opening NAV | 16.00 | 62.58 |

| Closing NAV | 17.60 | 106.76 |

| Gain | 1.60 | 44.18 |

| Gain in % | 10 | 70.60 |

Image 3: Return Graph of ICICI US Bluechip for 01/01/2014 to 31/12/2014

Image: 4 Return Graph of ICICI Value Discovery fund for 01/01/2014 to 31/12/2014

- Don’t invest the savings left after expanses but spend what left after savings:

This is something wise people have always told us. I know it’s difficult but you can do it. Start 2-3 SIP’s to be deducted within a week of your salary date. This will help you in curbing your expanses and fewer amounts in bank account will work as a check. Also you can start some RD’s may be of very small amount like Rs. 500,1000,5000 as much you think you will be able to cut from the expanses. Keep your excess cash in liquid funds instead of savings account. As to spend it you will need to redeem and if you are lazy you may not be willing to do that. (Although it is also easy to redeem but not as much as you FD sweep in) Here your laziness will be able to save your money.

For any query or assistance I will be happy to hear from you at whatsapp: 9953077844

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.