Maharashtra AAR in the case of DRS Marine Services Private Limited

Table of Contents

Case Covered:

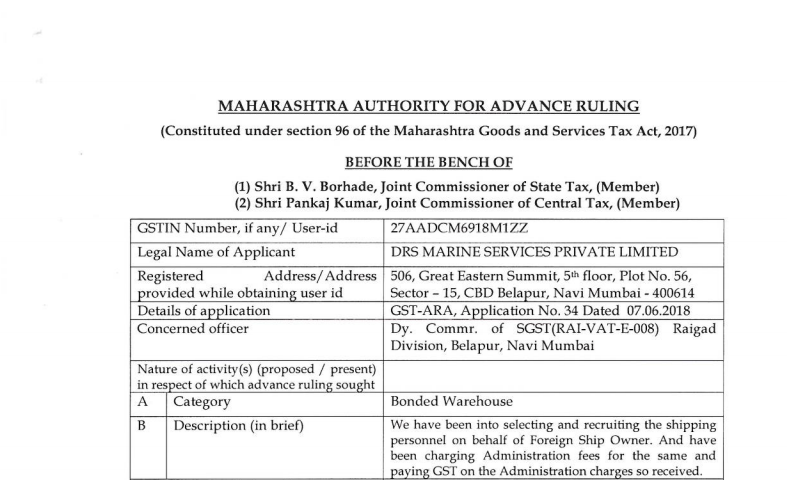

DRS Marine Services Private Limited

Facts of the Case:

The present application has been filed under Section 97 of the Central Goods and Services Tax Act, 2017, and Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and the MGST Act” respectively] by DRS Marine Services Private Limited, the applicant, seeking an advance ruling in respect of the following issues.

“Whether GST is applicable on Reimbursement of salary on behalf of a foreign entity.”

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the MGST Act.

Observations:

We have gone through the facts of the case, documents on record, and submissions made by both, the applicant and the department.

The applicant is a Crew Recruitment and Placement Agency, and are involved in selecting and recruiting shipping personnel on behalf of their principal/ client who is a Foreign Ship Owner and for which they are charging Administration fees and paying GST on such Administration charges so received. The applicant has submitted that their principal has requested them for disbursal of salary to the crew members from the applicant’s side, for which the principal would be transferring the sum of total salary to the applicant who in turn will be disbursing the salary to the crew member through banking channels into their respective accounts. For this activity, the applicant would be charging/ invoicing services charges to the principal and on the said charges they would be discharging their GST liability.

Order:

For reasons as discussed in the body of the order, the questions are answered thus-

Question:- Whether GST is applicable to Reimbursement of salary on behalf of a foreign entity.

Answer:- Answered in the negative as per detailed facts of the present case discussed above.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.