Delhi HC in the case of Rishi Bansal Propertor of Bansal Sales Corporation

Table of Contents

Case Covered:

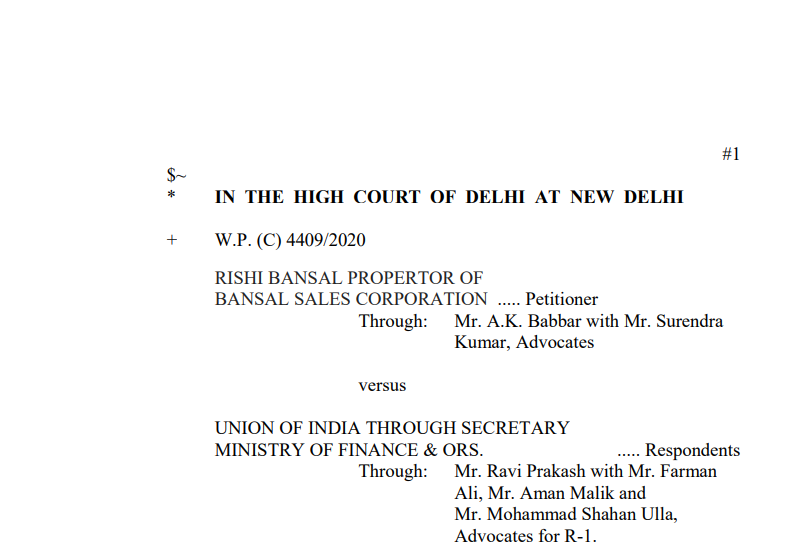

Rishi Bansal Propertor of Bansal Sales Corporation

Versus

Union of India

Facts of the Case:

The petition has been listed before this Bench by the Registry in view of the urgency expressed therein. The same has been heard by way of video conferencing.

The present writ petition has been filed challenging the letter dated 11th June 2020 and summon dated 06th July 2020 issued by respondent No.3 whereby the petitioner has been asked to deposit Rs.2,69,21,228/- being alleged as an inadmissible input tax credit and file DRC-03 challan without initiating any adjudication process either under Section 73 or Section 74 of Central Goods and Services Tax Act, 2017 (for short “CGST Act”).

Observations of the Court:

Learned counsel for the petitioner states that the alleged amount is being asked to be deposited without issuing any show-cause notice or mentioning any tax period. He further submits that to pressurize the petitioner, a summon dated 06th July 2020 under Section 70 has been issued to the petitioner asking him to appear for the recording of his statement and for submitting DRC-03 for Rs.2,69,21,228/-.

The aforesaid statement made by learned counsel for respondent nos. 2 and 3 is accepted by this Court and said respondents are held bound by the same. It is clarified, as a matter of abundant caution, that as the demand is disputed by the petitioner, no coercive steps shall be taken for recovery of the said demand without following the adjudication process. However, the petitioner is directed to appear before the respondent nos. 2 and 3 and cooperate in the investigation process.

The judgement of the Court:

Keeping in view the aforesaid, learned counsel for petitioner states that he does not wish to press the writ petition any further. Consequently, the writ petition and application stand disposed of.

The order is uploaded on the website forthwith. Copy of the order is also forwarded to the learned counsel through e-mail.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.