Rajasthan HC in the case of M/s Gr Infraprojects Limited

Table of Contents

Case Covered:

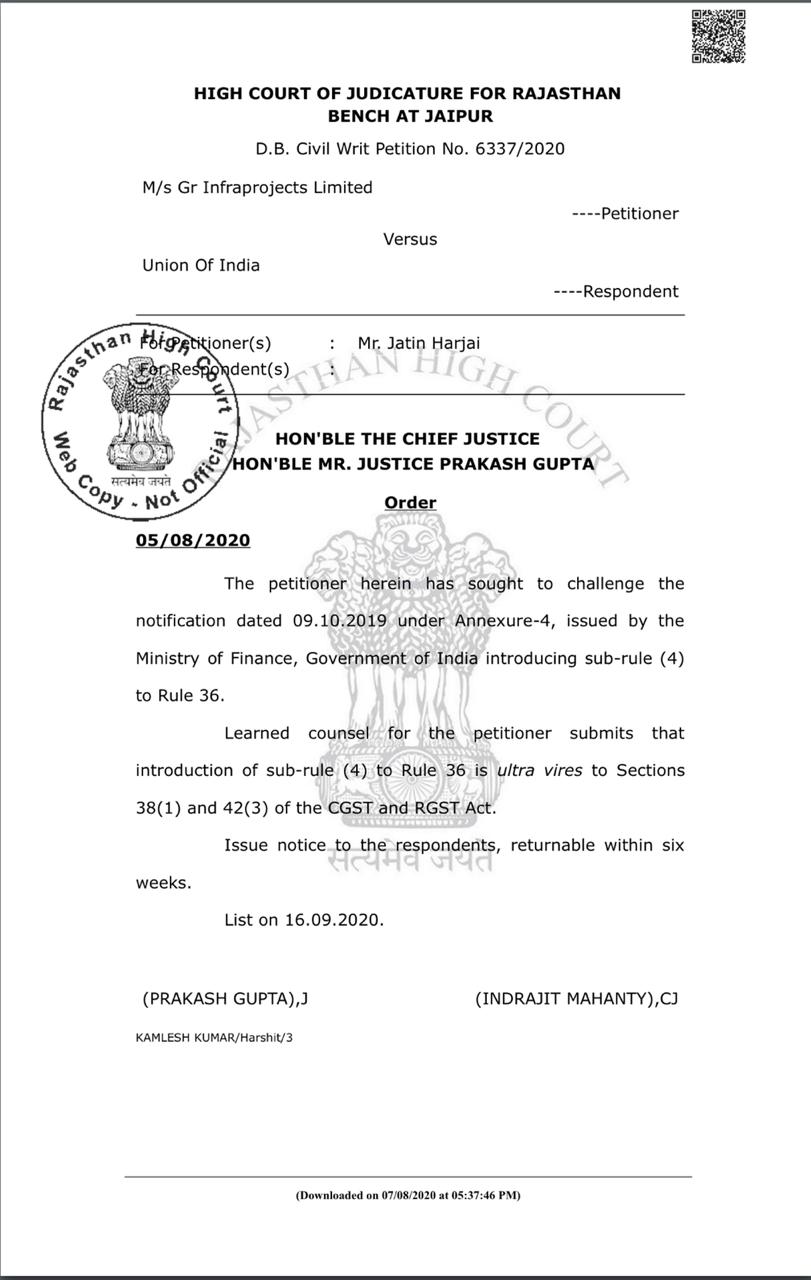

M/s Gr Infraprojects Limited

Versus

Union of India

Order:

The petitioner herein has sought to challenge the notification dated 09.10.2019 under Annexure-4, issued by the Ministry of Finance, Government of India introducing sub-rule (4) to Rule 36.

Learned Counsel for the petitioner submits that introduction of sub-rule (4) to Rule 36 is ultra vires to Sections 38(1) and 42(3) of the CGST and RGST Act.

Issue notice to the respondents, returnable within six weeks.

List on 16.09.2020.

Crux:

Hon’ble Rajasthan High Court has issued notice to govt, in case of Rule 36(4), which places a restriction on availment of ITC @10/20% over and above amount reflected in GSTR 2A, despite having valid Tax Invoice.

Read the Copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.