Section 7 of Integrated Goods and Services Tax Act 2017 – Interstate supply

Section 7 of Integrated Goods and Services Tax Act 2017 – Interstate supply

(1) Subject to the provisions of section 10, the supply of goods, where the location of the supplier and the place of supply are in-

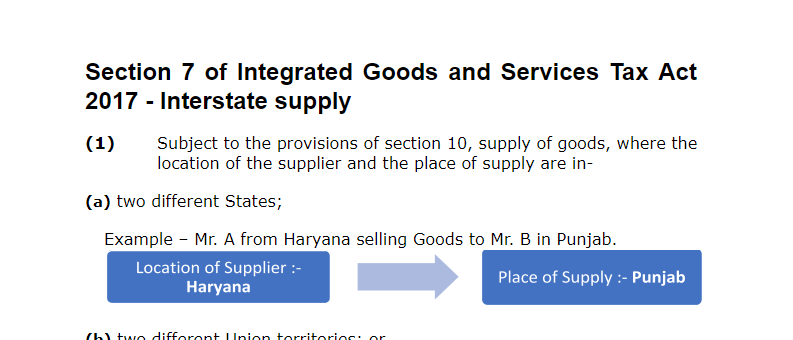

(a) two different States;

Example – Mr. A from Haryana selling Goods to Mr. B in Punjab.

Location of Supplier:- Haryana → Place of Supply:- Punjab

(b) two different Union territories; or

Example – Mr. A from Lakshadweep selling Goods to Mr. B in Daman & Diu.

Location of Supplier:- Lakshadweep → Place of Supply:- Daman & Diu

(c) a State and a Union territory,

shall be treated as a supply of goods in the course of inter-State trade or commerce.

Example – Mr. A from Haryana selling Goods to Mr. B in Daman & Diu.

Location of Supplier:- Haryana → Place of Supply:- Daman & Diu

(2) Supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-State trade or commerce.

Example – Mr. A Imported Goods from Germany to India

Location of Supplier:- Germany → Place of Supply:- India

(3) Subject to the provisions of section 12, the supply of services, where the location of the supplier and the place of supply are in-

(a) two different States;

Example – Mr. A from Haryana Providing Services to Mr. B in Punjab.

Location of Supplier:- Haryana → Place of Supply:- Punjab

(b) two different Union territories; or

Example – Mr. A from Lakshadweep Providing Services to Mr. B in Daman & Diu.

Location of Supplier:- Lakshadweep → Place of Supply:- Daman & Diu

(c) a State and a Union territory

shall be treated as a supply of services in the course of inter-State trade or commerce.

Related Topic:

Scope of supply : section 7 of the CGST Act

Example – Mr. A from Haryana Providing Services to Mr. B in Daman & Diu.

Location of Supplier:- Haryana → Place of Supply:- Daman & Diu

(4) The supply of services imported into the territory of India shall be treated to be a supply of services in the course of inter-State trade or commerce.

Example – Mr. A Received Services in India from Mr. X in Germany.

Location of Supplier of services:- Germany → Place of Supply:- India

(5) Supply of goods or services or both,-

when the supplier is located in India and the place of supply is outside India;

Example – Mr. A in India Supplied goods or Services or both to Mr. X in Germany. [Export]

Location of Supplier of services:- India → Place of Supply:- Germany

to or by a Special Economic Zone developer or a Special Economic Zone unit;

Example – Mr. A Supplied Goods or Services or Both to Mr. Y in Special Economic Zone

Location of Supplier of services:- India → Place of Supply:- SEZ

or

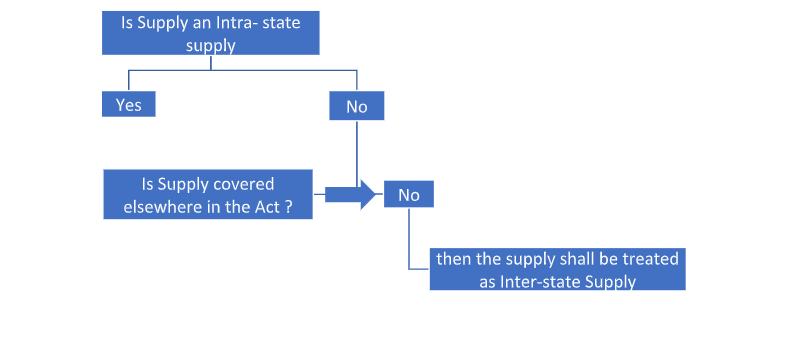

in the taxable territory, not being an intra-State supply and not covered elsewhere in this section,

(shall be treated to be a supply of goods or services or both in the course of inter-State trade or commerce.

Example – Supply from a state to a place located in the Exclusive Economic Zone (EEZ)/Continental shelf & Vice versa.

Read the Copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.