Online Information Database Access And Retrieval: OIDAR

Table of Contents

- Online Information Database Access And Retrieval: OIDAR

- Registration: OIDAR

- Registration Process [Key Points]: OIDAR

- Place of supply for OIDAR

- Supply of OIDAR Services through an Intermediary

- Liability for Paying Tax

- Filing of Returns

- GSTR-5A –Table Summary

- Late Fees for Delay in GSTR-5A

- FAQ: OIDAR

- Question 1. Who is required to be registered as OIDAR Service Providers?

- Question 2. What are the pre-requisites for registration in respect of such NonResident Online Services Providers?

- Question 3. What is GSTR-5A?

- Question 4. Do all OIDAR Service providers have to file GSTR-5A?

- Question 5. Can OIDAR services provider claim ITC in GSTR-5A?

- Read the Copy:

Online Information Database Access And Retrieval: OIDAR

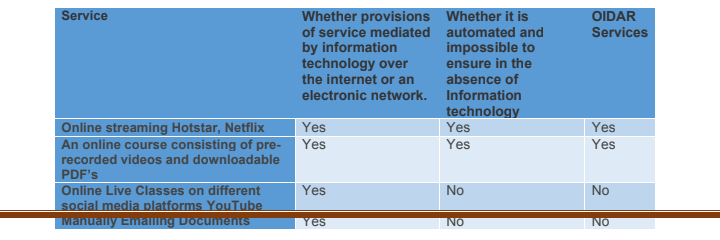

OIDAR Services are a category of services whose Delivery is mediated through the internet & its supply is essentially automated involving minimum or zero human intervention also its supply is impossible without information technology.

Examples of OIDAR services:

• Online gaming (Steam, Origin)

• Advertising on the internet

• Providing cloud services (Google Drive, One Drive)

• Providing data or information, retrievable or otherwise, to any person, in electronic form through a computer network;

• Provision of e-books, movies, music, software & other intangibles via the internet (Netflix, Amazon prime video/Music, Crunchyroll)

Also using the internet to communicate or facilitate service does not always mean that a business is providing OIDAR services.

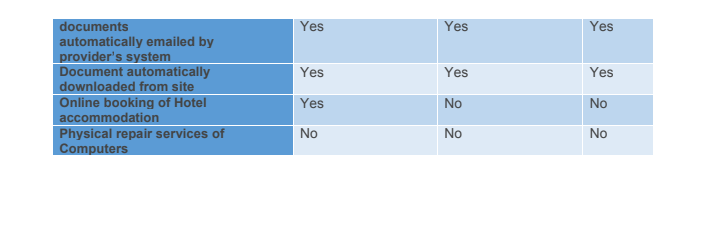

Registration: OIDAR

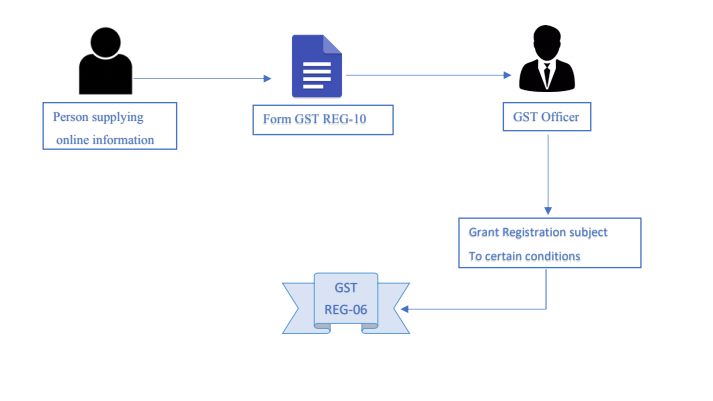

The supplier (or intermediary) of OIDAR services shall, for payment of Integrated tax, take a single registration under the GST regime through filling form GST REG-10.

In case the supplier is from overseas and they have a representative in the taxable territory(India), such a person shall get registered under the GST regime.

In case the supplier is from overseas and they do not have a physical presence in taxable territory(India). Then they may appoint a representative in Taxable territory(India), Such a representative will have to get registered under the GST regime.

Registration Process [Key Points]: OIDAR

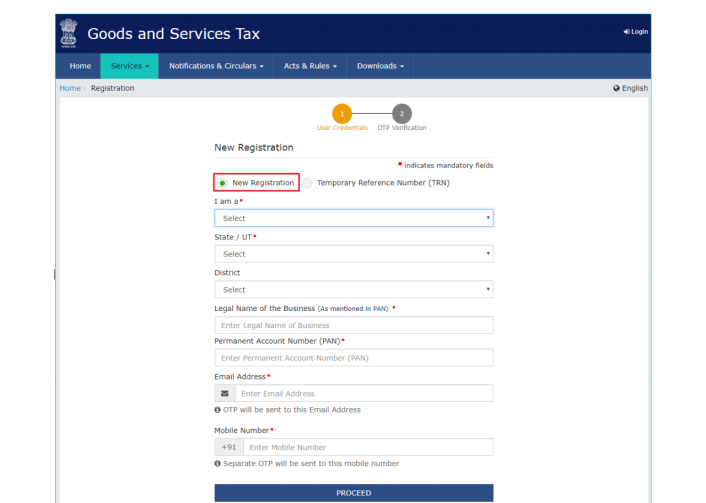

➢ Apply for a New Registration.

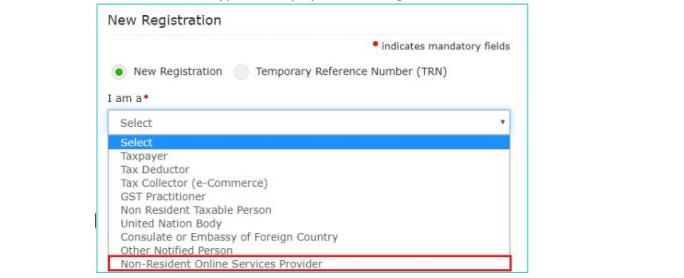

➢ From I am a drop-down list, select the Non-Resident Online Services Provider as the type of taxpayer to be registered.

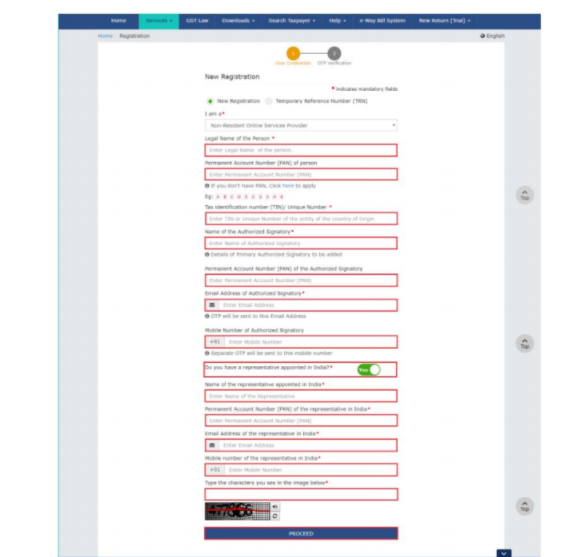

➢ Fill all the details required. Although filling Pan field is not mandatory but in case you want to mention PAN details & you don’t have PAN, you can apply for PAN. To do so, click the here link.

➢ Verify Your Application Via OTP & You will Receive Temporary Reference Number(TRN).

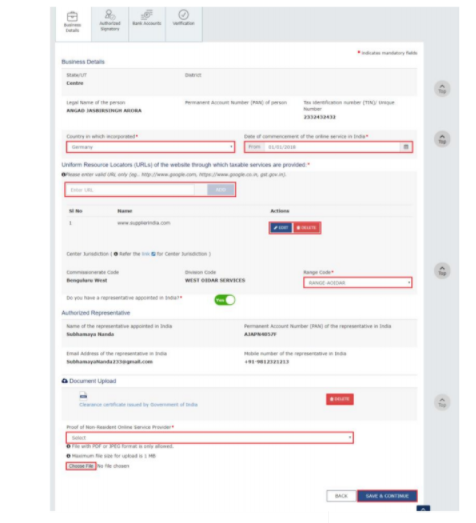

➢ Fill all Required Details of Your business [ Country, Date of commencement, URL of Website, etc.]

➢ Fill details of Authorised Signatory.

➢ Fill details of Bank Account.

➢ At last select authorized signatory, then submit Your application & Verify it Via OTP. You will receive the acknowledgment in the next 15 minutes on your registered e-mail address and mobile phone number. The Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

Place of supply for OIDAR

In the case of Supply of OIDAR services, where the Supplier is located outside India, then the Place of supply is in India (IGST chargeable).

In the case of Supply of OIDAR services, where both the Supplier & Recipient are in India, the Place of supply will be the location of the recipient.

Location of Recipient

For this service, the recipient will be deemed to be located in the taxable territory (i.e., in India) if any two of the following conditions are satisfied-

1. Location of address presented by the recipient through the internet is in India

2. Credit card or debit card (or any other card such as store value card) which the recipient uses to pay is issued in India

3. Billing address of the recipient of services is in India

4. The IP address of the device used by the recipient is in India

5. Bank of the recipient’s account used for payment is maintained is in India

6. Country code of the subscriber identity module card used by the recipient of services is of India

7. The location of the fixed landline through which the service is received by the recipient is in India.

The government can notify any service or circumstances in which the place of supply shall be the place of effective use and enjoyment of a service. This will be done in order

• prevent double taxation

• prevent non-taxation of the supply of a service

• for the uniform application of rules

Supply of OIDAR Services through an Intermediary

If an intermediary located in outside India arranges or facilitates the supply of OIDAR services, from the service provider to the non-taxable online recipient.

then the intermediary will be deemed to be the recipient of such services.

But if the intermediary satisfies the following conditions then it will not be considered as a recipient–

(a) The invoice issued by the intermediary identifies the service and its supplier in non-taxable territory.

(b) The intermediary neither collects nor processes payment in any manner nor is responsible for the payment between the non-taxable online recipient and the supplier of such services.

(c) The intermediary does not authorize the delivery.

(d) The general terms and conditions of the supply are set by the service provider and not by the intermediary.

Liability for Paying Tax

When Supplier is located outside India

• If the Recipient is registered under GST, then the recipient is liable to pay tax under RCM.

• If the Recipient is not registered, then the Supplier is liable to pay IGST on such a supply of services.

When the Supplier is located in India

• Supplier is liable to pay tax

Filing of Returns

When the supplier is located Outside India & is providing Services to an unregistered person in India shall file return in FORM GSTR-5A on or before the 20th day of the month succeeding month.

if OIDAR services provided from India then normal return GSTR-1, GSTR 3B is to be filed.

GSTR-5A –Table Summary

| Table 1 | •GSTIN of the supplier |

| Table 2 | •Legal Name of the Registered Person & Trade |

| Table 3 | •Name of the Authorized representative in India |

| Table 4 | •Period i.e. Month & Year for which return is filed |

| Table 5 | •Taxable outward supplies made to consumers in India – including details of place of supply, the rate of tax, taxable value, integrated tax and cess |

| Table 5A | •Amendments to taxable outward supplies made to non-Table 5A taxable persons in India for the preceding period |

| Table 6 | •Calculation of interest, penalty or any other amount |

| Table 7 | •Tax Interest, Late Fee, and any other amount payable Table 7 and paid |

Late Fees for Delay in GSTR-5A

In the Case of Normal return, the late fee is Rs.200 per day.

In the Case of Nil return, the late fee is Rs.100 per day.

FAQ: OIDAR

Question 1. Who is required to be registered as OIDAR Service Providers?

Answer- Every person supplying OIDAR service from a place outside India to a person in India, other than the registered person, is required to register in GST as a provider of OIDAR Services.

Question 2. What are the pre-requisites for registration in respect of such NonResident Online Services Providers?

Answer- Such Non-Resident OIDAR Service Providers need to appoint an Authorised Signatory (Indian) in India possessing a valid PAN. That authorized person shall apply for registration at the GST portal on behalf of such NonResident Online Service Providers.

Question 3. What is GSTR-5A?

Answer- Form GSTR-5A is a Return to be furnished by OIDAR services provider, of the services provided to un-registered persons or customers, from a place outside India to a person in India.

Question 4. Do all OIDAR Service providers have to file GSTR-5A?

Answer- No, Non-Resident OIDAR who are providing services to unregistered recipients or Governments are required to file GSTR-5A.

Question 5. Can OIDAR services provider claim ITC in GSTR-5A?

Answer- No, OIDAR services provider cannot claim any ITC in GSTR-5A.