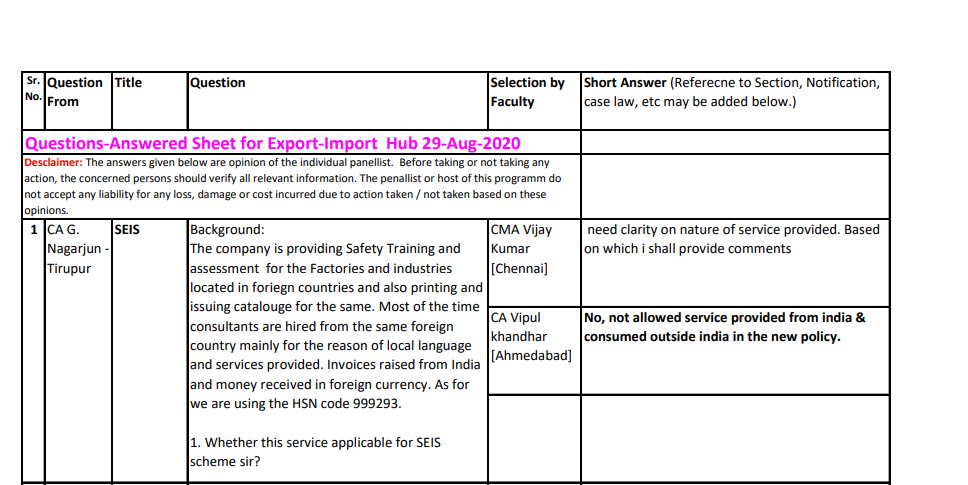

Questions-Answered Sheet for Export-Import Hub 29-Aug-2020

Questions-Answered Sheet for Export-Import Hub 29-Aug-2020

| Sr. No. |

Question From |

Title | Question | Selection by Faculty |

Short Answer (Reference to Section, Notification, case law, etc may be added below.) |

| Questions-Answered Sheet for Export-Import Hub 29-Aug-2020 | |||||

| Disclaimer: The answers given below are the opinion of the individual panelist. Before taking or not taking any action, the concerned persons should verify all relevant information. The panelist or host of this program does not accept any liability for any loss, damage, or cost incurred due to action taken / not taken based on these opinions. | |||||

| 1. | CA G. Nagarjun – Tirupur | SEIS |

Background: The company is providing Safety Training and assessment for the Factories and industries located in foreign countries and also printing and issuing catalog for the same. Most of the time consultants are hired from the same foreign country mainly for the reason of local language and services provided. Invoices raised from India and money received in foreign currency. As we are using the HSN code 999293. 1. Whether this service applicable for the SEIS scheme sir? |

CMA Vijay Kumar [Chennai] | need clarity on the nature of the service provided. Based on which I shall provide comments |

| CA Vipul khandhar [Ahmedabad] | No, not allowed service provided from India & consumed outside India in the new policy. | ||||

| 2. | Continued |

If SEIS is applicable in the above case, I have a few more doubts. SEPC Registration Doubts: If I am registering for FY 20-21 in SEPC. am I eligible for SEIS for FY 2018-19 & 2019-20? or separate registration is required for every year? |

CMA Vijay Kumar [Chennai] | Yes, you shall be eligible. it is mandatory in the year of filing. | |

| 3. | Continued | To make the registration in SEPC it is asked to submit the CA Certificate for the last three financial year Turnover. But the company is started on FY 2018-19 only. How should I proceed, sir? | CMA Vijay Kumar [Chennai] | please check with the spec office once. generally, they allow | |

| CA Vipul khandhar [Ahmedabad] | Sir, they allowed you to get registration. ca certificate for their data & fee purpose only | ||||

| 4. | Continued |

DGFT site: 1. I have gone through the DGFT site, sir. But there is an option for application available for SIES 2015-16 to 2018-19. However, there is no Application for 2019-20 available? shall we wait? |

CMA Vijay Kumar [Chennai] | list of services and rates not notified so not available for filing | |

| CA Vipul khandhar [Ahmedabad] | Due to the fund distribution problems between the commerce ministry & finance ministry, DGFT has not opened the tab, which has been clarified by the ministry of commerce also. It is so for the MEIS also | ||||

| 5. | Continued |

Calculation As per Chapter 3 of Trade policy Net Foreign Exchange has to be considered. i.e Gross Earnings of Foreign Exchange – expenses/remittances in Foreign currency. if so, the company has paid certain consultancy charges to a foreigner in foreign currency. whether this has to be deducted from the Export Turnover? |

CMA Vijay Kumar [Chennai] | yes, have to be deducted. | |

| 6. | Pinal Shah | Refund for Capital Goods ITC for Export Under LUT |

Software dev firm – 100% export billing under LUT – claimed refund of ITC on capital goods and received a refund for two years [2017-18 & 2018-19]. Now, client wants to pay the incorrect refund back and wants to claim this ITC via export of services with payment of IGST. I understand that we have to pay the incorrect refund via DRC03. Q1. Will the amount of refund which is now being paid back voluntarily be available in Electronic Credit Ledger for future use? Q2. While filling up DRC03 – which section to be used – Section 73 / Section 74 |

CA Vipul khandhar [Ahmedabad] | No such process in GSTN. you have to reclaim via GSTR-3B only. while filling DRC-03 sec 74(5) voluntary to be select |

| 7. | Continued | Continued |

The refund application for the year 2019-20 is not yet filed and all the export invoices were under LUT and for April to June-2020, all invoices were under LUT. During the entire period of 15 months, all the GSTR 3B are having ITC. Total ITC for the period is say Rs 100,000. Is it possible for the client, during the single month of August 2020, to issues 5 invoices of different clients with payment of IGST (as 5 invoices will cover the available ITC of Rs. 1 lakh and the remaining 5-7 invoices under LUT)? Or in a single month, only one option is available – either to issue all the invoices under LUT or all the invoices with payment of IGST. |

CA Vipul khandhar [Ahmedabad] | It has been your choice for the export bill-wise for the LUT or with payment |

| 8. | Continued | Continued | Is it also required to file the GST Refund application for all the 15 months for which invoices were issued under LUT and all 15 GSTR 3B is showing ITC only? Or it is possible to use the accumulated ITC by raising the Export invoice on payment of duty so that we get a refund on export with duty? | CA Vipul khandhar [Ahmedabad] | You can use ITC for the current bill payment & get a refund |

Read the Copy:

CA Vipul Khandhar

CA Vipul Khandhar