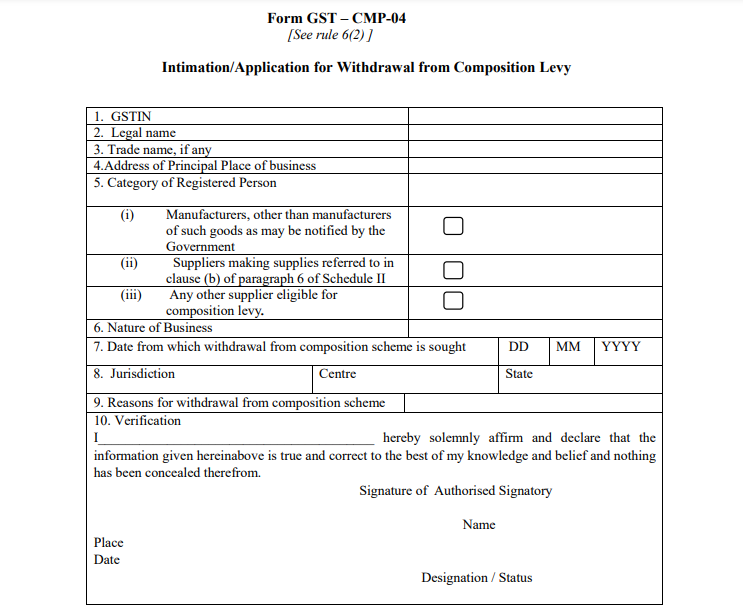

Format of “Form”- CMP 04

Table of Contents

Introduction

GST has a long list of compliances. It is easy for big corporations but small taxpayers find it hard. A composition levy is introduced to reduce the number of compliance on small taxpayers. It covers the taxpayers with turnover upto 1.5 Crores. Although in some states the turnover limit for composition is Rs. 75 lac. The special category states with a limit of Rs 75 lakhs are:

Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh.

CMP 04 is an intimation filed by a person registered under composition scheme in order to opt out from such scheme and convert into normal scheme.

Purpose

A composition dealer who wants to opt out of composition scheme has to fill this form CMP 04. This form is filed in the following three cases:

- Limit of turnover exceeds

- Who voluntarily wants to opt for regular scheme

- Failure to comply with the conditions mentioned in section 10 of CGST Act, 2017.

Conditions under section 10(2)/(2A) of CGST Act, 2017:

Registered person shall not be:

- Engaged in supply of services other than restaurant or catering services;

- Involved in non taxable supplies;

- Providing interstate outward supplies;

- Engaged in providing supplies through an e commerce operator who is liable to collect TCS u/s 52 of CGST Act;

- Manufacturer of such goods as notified.

- Casual taxable person or non resident taxable person.

Breach of these conditions shall lead to opting out of composition levy.

Due date

This form is filed within a period of 7 days from the date on which the taxpayer plans to opt out voluntarily or becomes ineligible to be covered under this scheme.

For example:

A Composition Dealers turnover exceeds the Rs 1.5 crore on 15th January 2018.

The dealer will have to file CMP-04 by 22nd January 2018.

Filing of CMP-04 is online on the GST Portal.