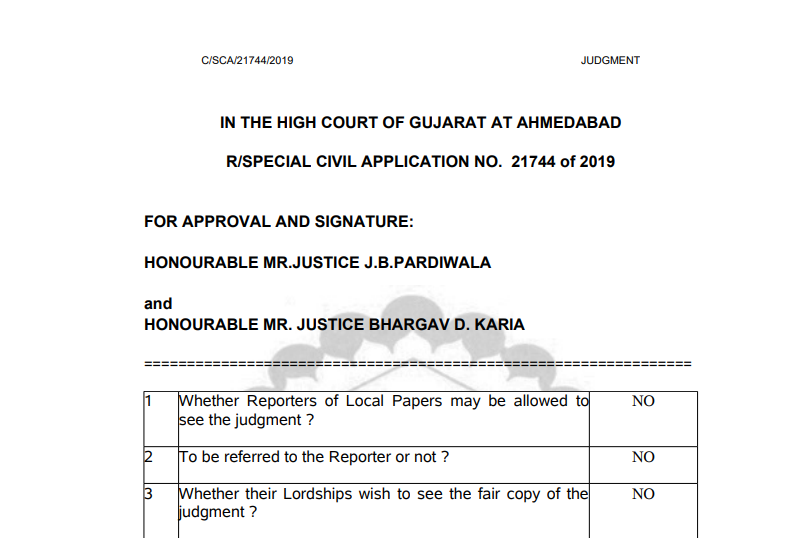

Gujarat HC in the case of Messrs Synpol Products Pvt. Ltd. Versus Union of India

Table of Contents

Case Covered:

Messrs Synpol Products Pvt. Ltd.

Versus

Union of India

Facts of the Case:

By this petition under Article 226 of the Constitution of India, the petitioners have prayed for the following reliefs:

(A) That Your Lordships may be pleased to issue a writ of Certiorari or any other appropriate writ, direction or order, quashing and setting aside orders of the Designated Committee (Annexure“G”) made under Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 thereby directing the Respondents, their servants and agents to treat the declarations /applications filed by the Petitioners under Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 as valid declarations;

(B) Your Lordships may be pleased to issue a Writ of Mandamus or any other appropriate writ, direction, or order. directing the Respondents, their servants, and agents to accept the declarations filed by the Petitioners, which are rejected vide orders submitted at Annexure“G” to the petition, and further directing the Respondents, their servants, and agents to issue discharge certificates for all such declarations under Section 127(8) of the Finance Act, 2019;

(C) Pending the hearing and final disposal of the present petition, Your Lordships may be pleased to direct the Respondents herein to allow the Petitioners to deposit requisite amounts for each of the declarations, which are rejected vide orders submitted at Annexure-“G” to the petition and be further pleased to direct the Respondents, their servants and agents to accept such deposits under the Sabka Vishwas (Legacy Dispute Resolution) Scheme for the discharge of tax dues under the Scheme:

(D) An ex-parte ad-interim relief in terms of para 18(C) above may kindly be granted.

(E) Any other further relief that may be deemed fit in the facts and circumstances of the case may also please be granted.”

Observations of the Court:

In view of the above facts and situation, when the respondents had issued a show-cause notice demanding excise duty together with confiscation of the goods in terms of Rule 25 (a) and (d) of the Central Excise Rules, 2002 and redemption fine in lieu of confiscation under Rule-25 as goods were not available for confiscation, it is clear that by issuing the show cause notice, the respondent has invoked Rule-25 of the Central Excise Rules, 2002 for levy of redemption fine in lieu of confiscation as goods which were sought to be confiscated were not available for confiscation. Therefore, the levy of the redemption fine equivalent to the demand of central excise duty under Rule-25 of the Central Excise Rules, 2002 would be an amount in arrears as defined in Section 121 (c) of the Scheme along with the amount of duty which is recoverable as arrears of duty under indirect tax enactment. Therefore, the test which is required to be applied to ascertain what is the amount in arrears as per the Scheme, it would include both the amount of duty as well as the amount of redemption fine which is required to be recovered from the taxpayers. The amount of redemption fine cannot be treated separately then the amount of the duty under the Scheme. Therefore, the interpretation made by the Board in the communication dated 20.12.2019 in order to consider the declaration made by the declarant, the payment of redemption fine is a prerequisite, is not tenable in law, because as per Section 125 of the Scheme a declarant cannot be made ineligible to file a declaration for non-payment of redemption fine. Moreover, the declarant is required to include redemption fine as part of the duty demanded, so as to calculate the amount in arrears as per Section 121 (c) of the Scheme.

Related Topic:

Gujarat HC in the case of Messrs Vishnu Aroma Pouching Pvt Ltd Versus Union Of India

The Decision of the Court:

In view of the foregoing reasons, the petition succeeds and is accordingly allowed. The declaration filed by the petitioners and other similarly situated persons is required to be considered by the designated committee without payment of redemption fine by the declarant. The impugned orders passed by the designated committee are therefore quashed and set aside. As observed by the Coordinate Bench of this court, the order passed in this petition would also apply to the similarly situated declarants who have not approached this Court, in order to reduce the multiplicity of proceedings. Accordingly, this order would apply to the cases of all the declarants involving confiscation/redemption fine. In such circumstances, the respondent authorities are directed to issue the necessary discharge certificate under Section 129 of the Finance Act, 2019 to the petitioners subject to fulfillment of all other conditions as per the Scheme. The rule is made absolute to the aforesaid extent, with no order as to costs.

Read & Download the Full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.