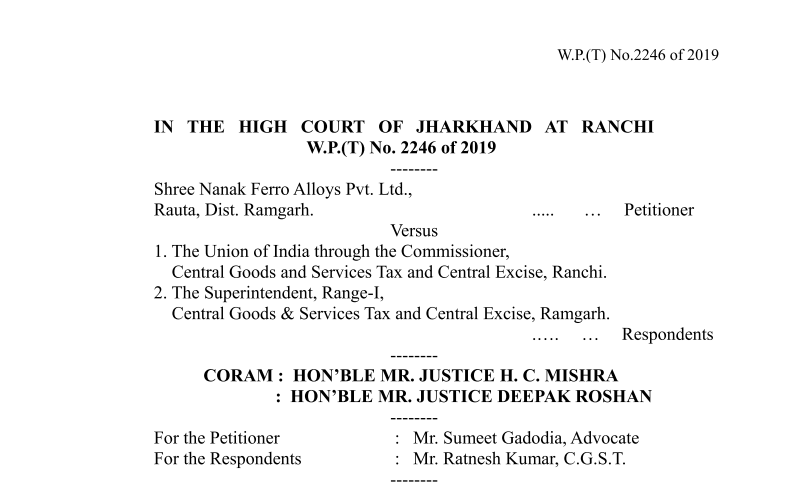

Jharkhand HC in the case of Shree Nanak Ferro Alloys Pvt. Ltd. Versus The Union of India

Table of Contents

Case Covered:

Shree Nanak Ferro Alloys Pvt. Ltd.

Versus

The Union of India

Facts of the Case:

The petitioner is aggrieved by the letter dated 26.04.2019, issued by the respondent No.2, as contained in Annexure-7 to the writ application, whereby the petitioner Company has been saddled with the liability to pay the short paid IGST, amounting to Rs.41,98,642/-, along with due interest within a period of one week, failing which, appropriate action under the provisions of the Central Goods & Services Tax Act, 2017, and the Rules framed thereunder, was to be initiated against the petitioner for recovery of the IGST amount along with due interest.

The petitioner is a company registered under the provisions of the Central Goods & Services Tax Act, 2017, (hereinafter referred to as the ‘CGST Act’), and the Integrated Goods and Services Tax, Act, 2017, (hereinafter referred to as the ‘IGST Act’). The dispute relates to the month of September 2017, i.e., soon after the implementation of the aforesaid Acts, wherein the petitioner filed its GSTR-1, showing his total Integrated Tax liability for that month at Rs.74,51,127/-, the Central Tax liability to be Rs.2,68,470/-, and State Tax liability for Rs.2,68,470/-. Subsequently, the petitioner submitted its GSTR- 3B, in which the Integrated Tax liability was shown to be Rs.32,52,484.58/- as against the actual liability of Rs. 74,51,127/-, and Central Tax liability was shown to be Rs.44,67,113.71/- as against the actual liability of Rs.2,68,470/-. In other words, in the liability shown under the IGST, there was a deficient liability amounting to Rs.41,98,642.42/-, whereas in the CGST the excess was shown to the tune of Rs.41,98,643.71/-, and the tax was also paid accordingly. This remained unnoticed for a period of about one year, and subsequently by letter dated 01.11.2018, as contained in Annexure-3 to the writ application, the petitioner Company was informed that in course of audit by CERA, it was observed after the scrutiny of GSTR-I and GSTR-3B filed by the petitioner, that the petitioner had short paid Integrated tax to the tune of Rs.41,98,842/- and accordingly, the petitioner was asked to make the payment along with the interest.

Observations of the Court:

Coming to the facts of the present case, we find that admittedly, the petitioner Company had discharged their tax liability under the IGST head, but inadvertently or otherwise, the petitioner deposited the amount under the CGST head. It is not the case that the petitioner Company has concealed the transplant case in which the tax has been paid by the petitioner to the Central Government, but not under the IGST head, rather under the CGST head. The contention of learned counsel for the CGST is that there was some ulterior motive behind the deposit of tax under the CGST head, which is evident from the fact that the petitioner had filed its GSTR-1 in which the tax liability was correctly shown, showing the supply to be the inter-State supply, but the stand was changed in the Form GSTR-3B. From the letter dated 05.04.2019, issued by the respondent No.2 as contained in Annexure-6 to the writ application, it is apparent that for discharging his liability of tax, the petitioner had deposited cash in its electronic cash ledger, as admitted in the letter itself. Had there been otherwise intention on the part of the petitioner, the same cash could have been deposited by the petitioner in the electronic cash ledger used to deposit the tax under the IGST head, but it is the claim of the petitioner that inadvertently due to the fact that it was the initial stages of the GST regime, the cash was deposited in the electronic cash ledger of CGST head. There appears to be substance in the submission of learned counsel for the petitioner, inasmuch as, by deliberately depositing the cash in the electronic cash ledger for the CGST head, at the place of IGST head, possibly no benefit was going to be derived by the petitioner Company. In that view of the matter, we are not in a position to doubt the bona fides of the petitioner Company, that due to the initial stage of the CGST regime, there might be some confusion, and the cash was wrongly deposited in the wrong electronic cash ledger.

The Decision of the Court:

We are not entering into the question whether the amount deposited by the petitioner wrongly under the CGST head could be adjusted under the IGST head, as learned counsel for the petitioner has very fairly conceded that the petitioner can deposit the amount of tax within a week and shall either claim the refund of the amount wrongly deposited under the CGST head or the same may be adjusted against their future liabilities under the CGST head.

In that view of the matter, we direct the petitioner Company to deposit the amount of Rs. 41,98,642/-, under the IGST head within a period of 10 days from today, towards the liability of September 2017. The petitioner shall not be liable to pay any interest on the said amount. The petitioner shall also be entitled to get the refund of the amount of Rs.41,98,644/- deposited by them under the CGST head, or they may get the amount adjusted against their future liabilities, in accordance with the law, as they may choose.

Consequently, the letter dated 26.04.2019, issued by the respondent No.2, as contained in Annexure-7 to the writ application, saddling the petitioner Company with the liability to pay the short paid IGST, amounting to Rs.41,98,642/-, along with interest, is hereby, quashed.

This writ application is accordingly, allowed, with the directions and observations as above.

Read & Download the Full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.