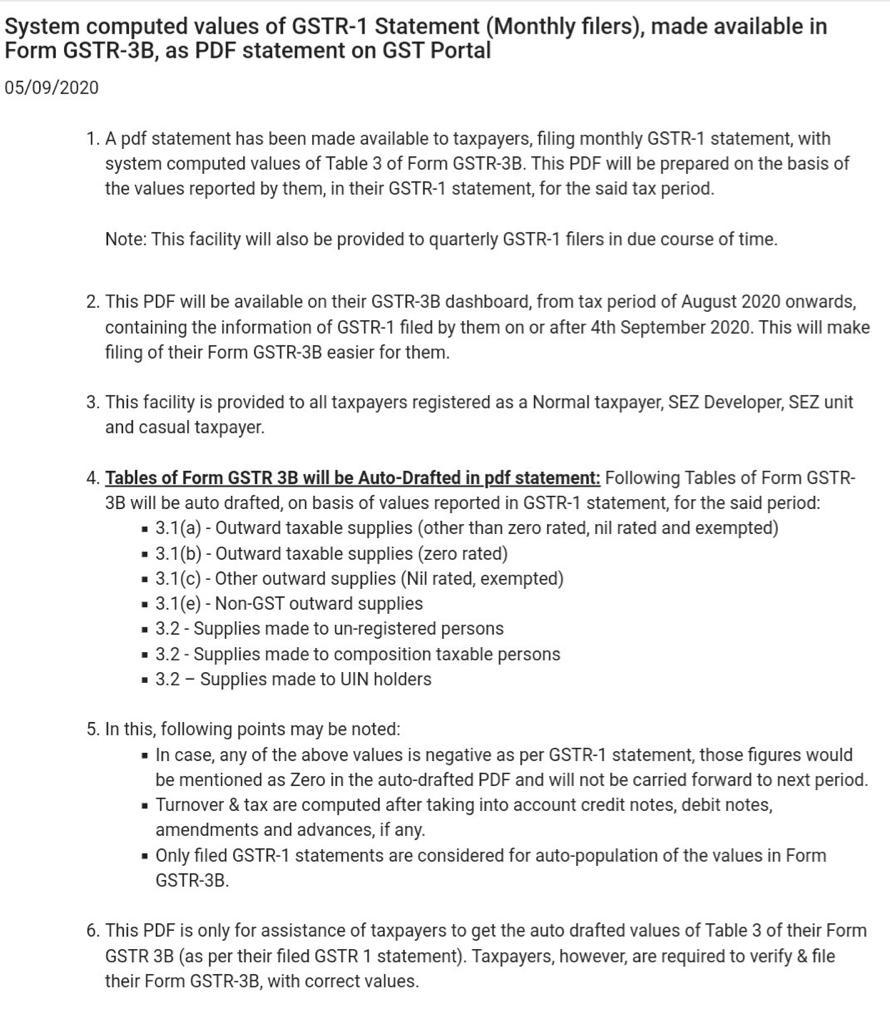

System Computed values of GSTR-1 Statement (Monthly Filers), made available in Form GSTR-3B, as PDF statement on GST Portal

System Computed values of GSTR-1 Statement (Monthly Filers), made available in Form GSTR-3B, as PDF statement on GST Portal

- A pdf statement has been made available to taxpayers, filing monthly GSTR-1 statement, with system computed values of Table 3 of Form GSTR-3B. This PDF will be prepared on the basis of the values reported by them, in their GSTR-1 statement, for the said tax period.

Note: This facility will also be provided to quarterly GSTR-1 filers in due course of time.

2. This pdf will be available on their GSTR-3B dashboard, from the tax period of August 2020 onwards, containing the information of GSTR-1 filed by them on or after 4th September 2020. This will make the filing of their Form GSTR-3B easier for them.

3. This facility is provided to all taxpayers registered as a Normal taxpayer, SEZ Developer, SEZ Unit, and Casual taxpayer.

4. Tables of Form GSTR-3B will be Auto-Drafted in pdf statement: Following Tables of Form GSTR-3B will be auto-drafted, on the basis of values reported in GSTR-1 statement, for the said period:

- 3.1(a) – Outward taxable supplies (other than zero-rated, nil rated and exempted)

- 3.1(b) – Outward taxable supplies (zero-rated)

- 3.1(c) – Outward taxable supplies (Nil rated, exempted)

- 3.1(e) – Non-GST outward supplies

- 3.2 – Supplies made to un-registered persons

- 3.2 – Supplies made to the composition taxable persons

- 3.2 – Supplies made to UIN holders

5. In this, the following may be noted:

- In case, any of the above values is negative as per the GSTR-1 statement, those figures would be mentioned as Zero in the auto-drafted PDF and will not be carried forward to the next period.

- Turnover and tax are computed after taking into account credit notes, debit notes, amendments, and advances if any.

- Only filed GSTR-1 statements are considered for the auto-population of the values in Form GSTR-3B.

6. This PDF is only for the assistance of taxpayers to get the auto-drafted values of Table 3 of their Form GSTR-3B (as per their filed GSTR-1 statement). Taxpayers, however, are required to verify & file their Form GSTR-3B, with correct values.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.