GSTIN enabled facility to report negative figure in GSTR 3b

GSTIN enabled the facility to report a negative figure in GSTR 3b-

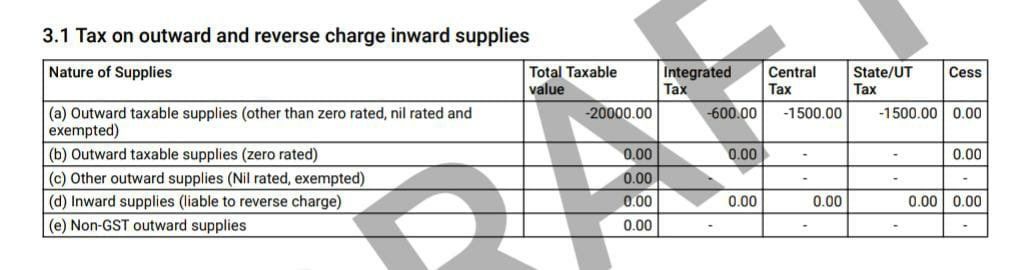

Now you can enter a negative figure in GSTR 3b. GSTIN portal has enabled the facility to report the negative figure in GSTR3b. It is a huge relief for the taxpayer. GSTIN doesn’t allow us to edit the GSTR 3b. But any errors can be rectified as per the prescribed manner. Any under-reporting can be reported in coming months. In the case of over-reporting, it is deducted from the data of the coming months. But it was hard to go for proper rectification in every case.

Example: M/s Adjacent reported a sale of Rs. 50 lac in place of Rs. 5 lac for the month of March. Now their monthly sales are in the tune with 2-3 lac only. It will take more than a year to rectify it by reducing the over-reported figure from sales of the coming months.

But now reporting of the negative figures is allowed. Thus the taxpayer can correct any over-reporting in the next month only.

This was much awaited. Also, the data of GSTR 1 is auto reflecting in GSTR 3b. It will also help in avoiding mistakes. But yes you can change that figure while filing the return.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.