GSTR 3b will auto compile form GSTR 1

Table of Contents

- GSTR 3b will auto compile form GSTR 1-

- Which data of GSTR 1 will get auto reflected in GSTR 3b?

- What is the purpose of this auto reflection?

- Is it mandatory to file auto-populated data in GSTR 3b?

- GSTN Bug

- Is it applicable for quarterly returns filers also?

- Which Tables of Form GSTR 3B will be Auto-Drafted in pdf statement?

- Whether the data of filled but not filed GSTR 1 will also auto-populate?

GSTR 3b will auto compile form GSTR 1-

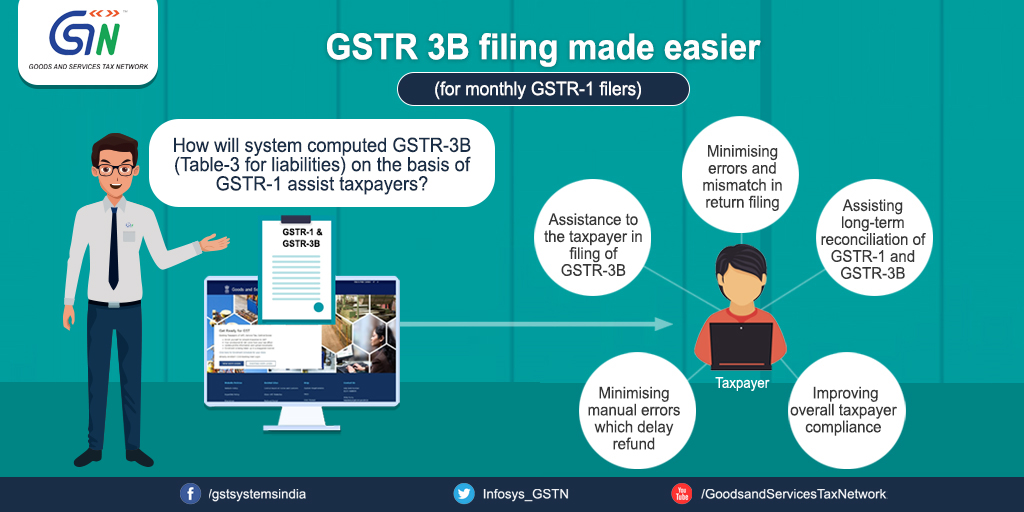

You can see that on the portal. Data filled in GSTR 1 is going to get auto reflected in GSTR 3b. Thus you can get an auto reflected GSTR 3b on the portal. GSTR 3b will auto compile form GSTR 1. Important FAQ’s related to this feature.

Which data of GSTR 1 will get auto reflected in GSTR 3b?

Data of sales entered in GSTR 1 will get auto reflected in GSTR 3b.

What is the purpose of this auto reflection?

The purpose is to reduce the possibility of errors in GSTR 3b. A taxpayer is supposed to file the GSTR 3b for payment of tax. We disclose the bill wise details of sales in GSTR 1. But the payment of tax is done via GSTR 3b. It is a monthly return. Many taxpayers file GTSR 1 correctly. But at the time of payment of tax via 3b, they miss data. Now with the auto reflection of data from GSTR 1. The chances of errors will reduce.

Is it mandatory to file auto-populated data in GSTR 3b?

No, As per the advisory of the GSTIN portal. It is not mandatory to file GSTR 3b with the auto-populated data. Amendment in auto-populate data is allowed. It is not a plan as of now but in the future CBIC may decide to implement it.

Image source- CBIC twitter post

GSTN Bug

I would like to share the observation by CA Nitin Bhuta.

This feature is available for the GSTR-1 period of July 2020 and onwards, and for the GSTR-1 filed on or after 27th August 2020. This message is flashed on the portal when GSTR 3B to be filed for the month of July 2020. whereas advisory states it would be available from Aug 2020. Point No 2 of the advisory dated 05.09.20 states as under This PDF will be available on their GSTR-3B dashboard, from the tax period of August 2020 onwards, containing the information of GSTR-1 filed by them on or after 4th September 2020. This will make the filing of their Form GSTR-3B easier for them.

Related Topic:

GSTIN enabled facility to report negative figure in GSTR 3b

Is it applicable for quarterly returns filers also?

No, it is applicable for the monthly GSTR 1 filers only. In the future, the quarterly filers may also be covered. But as per the GSTIN advisory, presently it is applicable on monthly filers only

Which Tables of Form GSTR 3B will be Auto-Drafted in pdf statement?

- The following Tables of Form GSTR-3B will be auto-drafted, on the basis of values reported in the GSTR-1 statement, for the said period:

- 3.1(a) – Outward taxable supplies (other than zero-rated, nil rated and exempted)

- 3.1(b) – Outward taxable supplies (zero-rated)

- 3.1(c) – Other outward supplies (Nil rated, exempted)

- 3.1(e) – Non-GST outward supplies

- 3.2 – Supplies made to un-registered persons

- Table 3.2- Supplies made to composition taxable persons

- 3.2 – Supplies made to UIN holder

Whether the data of filled but not filed GSTR 1 will also auto-populate?

No, The data of filed GSTR 1 auto-populate. When the GSTR 1 is filled but not filed, the data won’t get auto-populated.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.