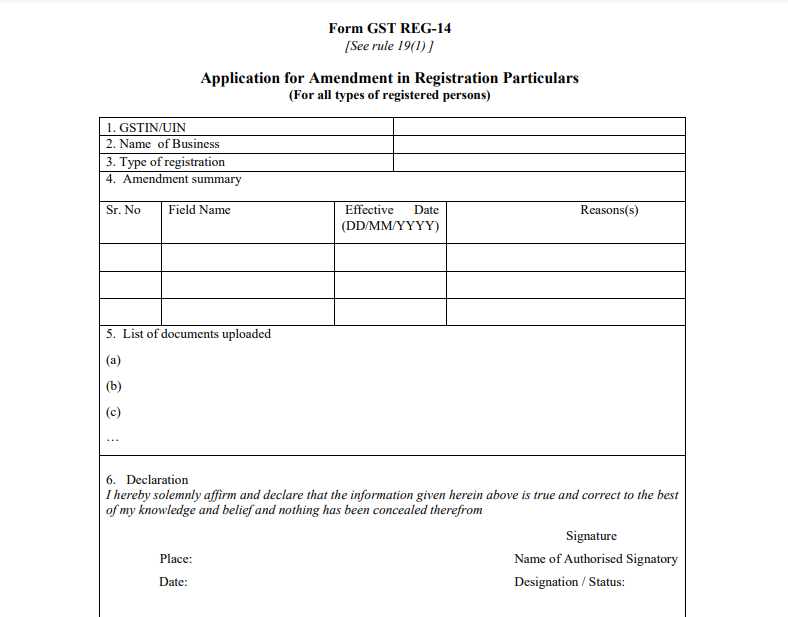

Format of “Form” – REG 14

Table of Contents

Introduction

Many times applicants commit mistakes at the time of filing an application for registration. Such mistakes can be updated or corrected at the time application is being processed. If business is already registered then after application is processed. REG 14 is a form for making changes in registration particulars.

Updations/changes allowed

Following is the list:

- Name of the business

- Address of principal place of business

- Additional place of business

- Addition, deletion or retirement of partners or directors, Managing Committee, CEO i.e., people who are responsible for day to day affairs of the business

- Mobile number or e-mail address of the authorized signatory*

*Mobile number or e-mail ID can be changed by submitting REG 14 and after doing online verification through common portal.

Core & Non core fields

Core fields are the changes in specific information that requires approval of authorised officer. So, changes relating to- Name of Business, Principal Place of Business, additional place(s) of business and details of partners or directors, karta, Managing Committee, Board of Trustees, Chief Executive Officer or equivalent, responsible for day to day affairs of the business which does not warrant cancellation of registration, are core fields which are approved by the Proper Officer after due verification.

For amendment in Non Core field, no officer approval required.

PAN updation allowed ?

No. If there is any mistake in the PAN, the applicant will have no other choice except to file for a fresh registration using FORM GST REG-01.

Process Flow

Step 1: Submit FORM GST REG-14 along with required documents.

Step 2: Two possibilities :

A) Officer satisfied:

The GST officer will verify and approve within 15 days in FORM GST REG-15. The change will take effect from the date of occurrence of the event.

Related Topic:

Format of “Form” – REG 21

B) Officer is Unsatisfied:

Issue show cause notice in FORM GST REG 03 where not satisfied with documents furnished:

a) The applicant must reply in FORM GST REG-04 within 7 days.

b) Reject application on unsatisfaction and pass order in FORM REG 05.

No action by officer will lead to deemed approval of changes.

Related Topic:

Format of “Form” – REG 25