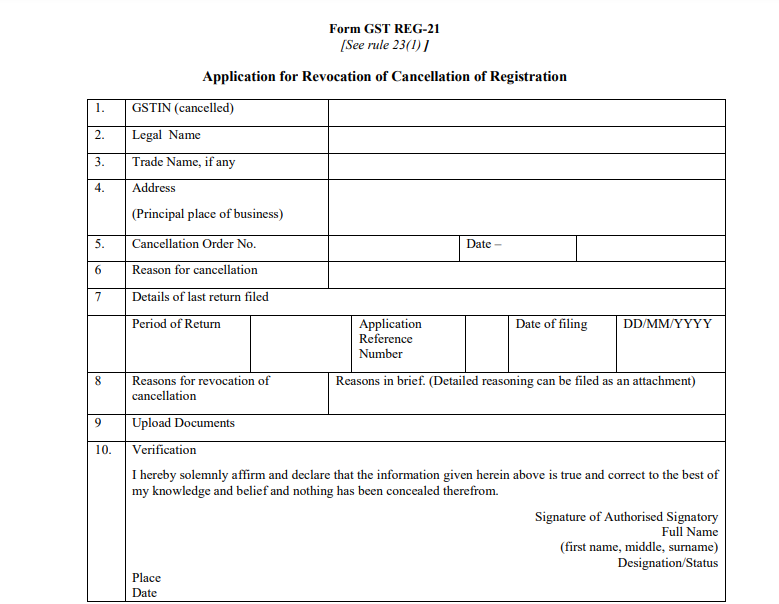

Format of “Form” – REG 21

Table of Contents

Introduction

Form REG 21 is application for revocation of cancellation of registration under GST. What does revocation mean? Revocation means official cancellation. So revocation of cancellation of registration means reversal of decision to cancel the registration. It means registration is still valid.

Requirement to file FORM GST REG 21

Application is made in this form where registration is cancelled by a tax officer on his own motion. Such taxable person can apply to the officer for revocation of cancellation within thirty days from the date of the cancellation order.

Related Topic:

Format of “Form” – REG 14

Procedure for application

- Apply for revocation of cancellation of registration in REG 21 where officer suo moto cancels registration.

- Submit this form within 30 days from the date of service of the cancellation order at the Common Portal.

- Proper officer may, on satisfaction, revoke the cancellation of registration by an order in REG 22 within 30 days from the date of receipt of application.

Related Topic:

Format of “Form” – REG 25

- Record reasons for revocation of cancellation of registration in writing.

- The proper officer can reject the application for revocation by an order in FORM GST REG-05 and communicate the same to the applicant.

- Before rejecting, the proper officer must issue a show cause notice in FORM GST REG–23 for the applicant to show why the application should not be rejected.

- The applicant must reply in FORM GST REG-24 within 7 working days from the date of the service of notice.

- Proper officer will give decisions in FORM GST REG 24 within 30 days from date of receipt of clarification from the applicant.

Where registration is cancelled due to reason for non filing of returns. File such returns first along with all payment of all dues of tax, interest and penalty, if any. Then apply for application for revocation.