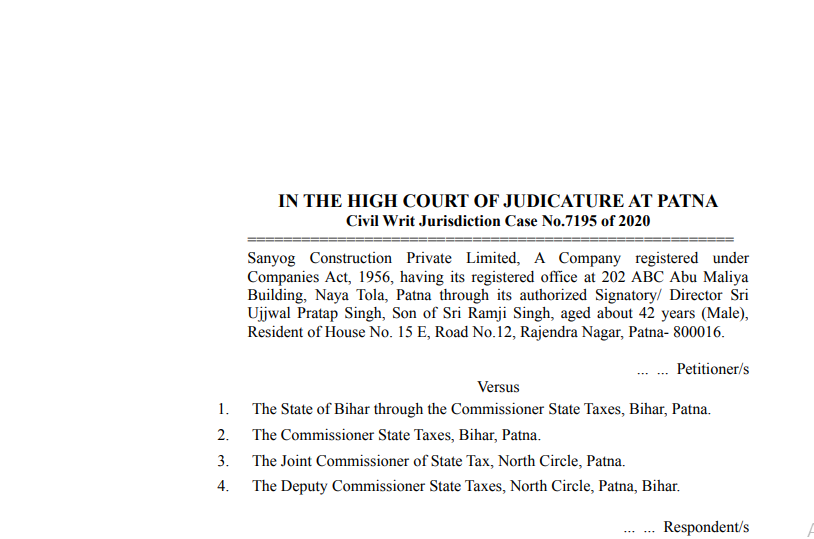

Patna HC in the case of Sanyog Construction Private Limited

Table of Contents

Case Covered:

Sanyog Construction Private Limited

Versus

The State of Bihar

Facts of the Case:

Petitioner has prayed for the following reliefs:

“I. To the respondent no. 4 to permit the Petitioner to file/upload statutory appeal on the GST web portal under section 107 of the GST Act, 2017 (as contained in Annexure-4) without adjusting the amount of prerequisite 10% (Rs. 71,842/-) amount of the assessed/disputed amount of tax against the demand (as contained in Annexure4/1) for filing of appeal against Assessment order dated 30.05.2019/30.8.2019 passed under section 62 of GST,2017 (as contained in Annexure-1) for the month of April 2019 whereby demand of Rs. 7,18,413.34 has been asked to pay by issuing demand DRC-07 dated 02.09.2019 (as contained in Annexure-1/1);

II. For not recover the amount in dispute as stated in the demand notice DRC-07 dt 02.09.2019 (as contained in Annexure-1/1) till the filing of the Appeal before the Appellate Authority;

III. And or alternatively, a direction may be given to respondent No. 2 the Commissioner of State Taxes to decide the application dated 5.3.2020 on merit as contained in Annexure-5 within the specified period granted by this Hon’ble Court and in the meantime, no coercive steps shall be taken.

IV. To any other relief to which the Petitioner is found to be entitled.”

Observations of the Court:

At the time of the hearing, learned counsel for the petitioner Shri Chiranjiva Ranjan, emphatically, under instructions from the petitioner, states that the petitioner will deposit the amount towards tax, interest, fine, fee, and penalty as admitted by him and also a sum equal to 10% of the remaining amount of tax in dispute arising from the impugned order and be permitted to file the statutory appeal assailing the order subject matter of the appeal, which is sought to be preferred by the petitioner, and upload it on the GST Web Portal as is required under Section 107 of the Central Goods and Services Tax Act, 2017/ Bihar Goods and Services Tax Act, 2017.

Learned counsel for the petitioner, under instructions from the petitioner, further states that the petitioner shall fully cooperate and not take any unnecessary adjournment.

The statement of the learned counsel for the petitioner is accepted and taken on record.

The decision of the Court:

Let the needful be positively done within a period of four weeks from today.

If the petitioner complies the undertaking as given before this Court within a period of four weeks from today, we direct the appellate authority to hear the appeal through virtual mode on account of circumstances arising from the current Pandemic Covid-19 and decide it expeditiously, preferably within a period of three months from the date of its filing.

Petition stands disposed of in the above terms.

Interlocutory Application, if any, stands disposed of.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.