ITAT in the case of The DCIT Versus Shri Jugal Kishore Garg

Table of Contents

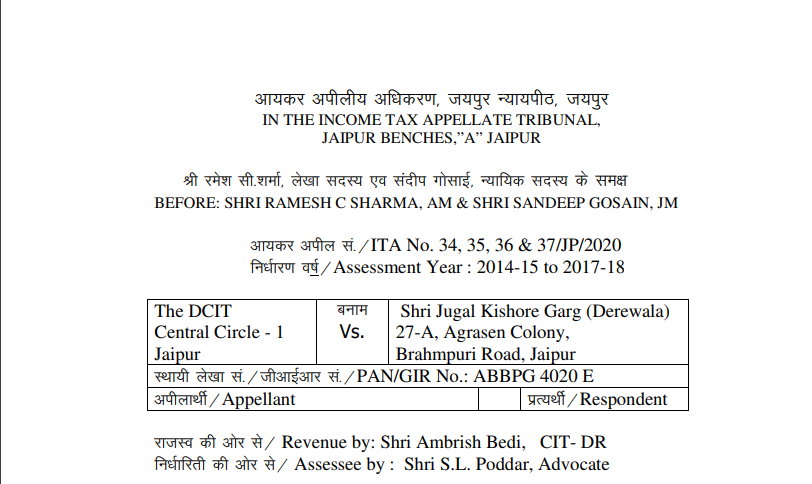

Case Covered:

The DCIT

Versus

Shri Jugal Kishore Garg

Facts of the Case:

Brief facts of the case are that the assessee is a partner in the firms M/s. J.K. Jewellers (3.3.34% shares), M/s. JK Jewellers International (20% shares), M/s. JK Jewells (50% shares), M/s. Upasand Colonizers (50% shares), M/s. JK International (33.33% shares), M/s. Neemrana Developers (40% shares) and M/s. Precious Buildcon (50% shares) respectively. The assessee has declared income from house property, capital gain, and interest from parties during this year.

Observations:

In view of the above, the ld. CIT(A) observed that it is evident that the surplus being referred to by the Ld. AO is not profit from the projects but the receipts of ‘on money’ credited to the capital accounts of the partners which have been considered in the additional income offered by MBDL and accepted by the Hon’ble Settlement Commission.

Thus on merits also since the amounts had already been added by the AO and the same had already been subjected to tax in the hands of MBDL and related entities, therefore, the ld. CIT(A) after considering all those facts had correctly deleted the addition made in various assessment years. The Bench also noted that no new facts have been brought by the Revenue in controverting the order of the ld. CIT(A) to the issue in question. In this view, of the matter, we find no reason to interfere with the order of the ld. CIT(A). Thus the appeal of the Revenue for the assessment year 2014-15 is dismissed.

Order:

As regards the appeals of the Revenue for the assessment year 2015-16 to 2017-18, the Bench noted that the grounds raised by the Revenue are similar and the facts are also similar to the case of the Revenue for the assessment year 2014-15 wherein the appeal of the Revenue for the assessment year 2014-15 is dismissed, hence taking into consideration the similar facts and circumstances of the case, the decision taken by the Bench for the assessment year 2014-15 shall be applicable mutatis mutandis in the appeals of the Revenue for the assessment year 2015-16 to 2017-18. Thus the appeals of the Revenue are dismissed.

As the result, the appeals of the Revenue are dismissed Order pronounced in the open court on 14 /09/2020.

Read & Download the full Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.