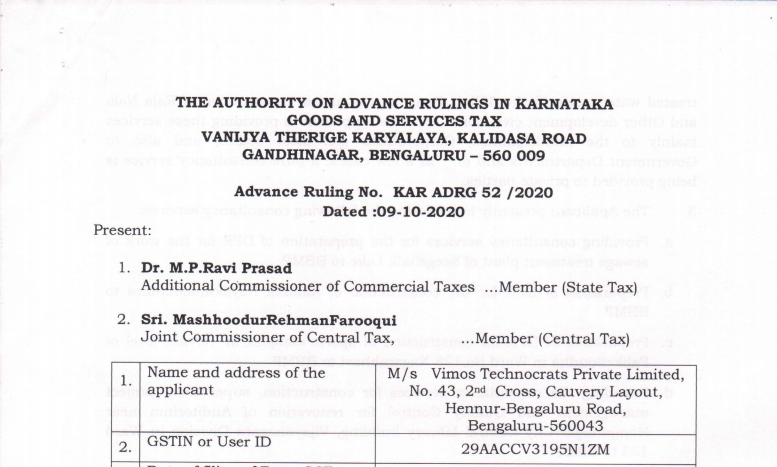

Karnataka AAR in the case of M/s. Vimos Technocrats Private Limited

Table of Contents

Case Covered:

M/s. Vimos Technocrats Private Limited

Facts of the Case:

The applicant is a private limited company rendering pure consultancy services like project management consultancy services including construction, supervision, quality control, rejuvenation, and development of lakes. Further, the applicant also involved in the preparation of a detailed project report pumping treated water, scientific landfill at Bangluru quarries, construction of Raja Nala and Other development of civil works, etc. The applicant is providing these services mainly to the Municipalities, Corporations (i.e. local bodies), and also to Government Departments and only in a few cases, a pure consultancy service is being provided to private parties.

Observations:

We have considered the submissions made by the applicant in their application for advance ruling as well as the submissions made by Sri Y.C. Shivakumar, Advocate and Duty Authorised Representative during the personal hearing. We also considered the issue involved, on which advance ruling is sought by the applicant, relevant facts & the applicant’s interpretation of the law.

On verification of the nature of the activity carried out by the applicant, it was observed that the applicant is involved in the rendering pure consultancy services like project management consultancy services including construction, supervision, quality control, rejuvenation, and development of lakes. The applicant is also involved in the preparation of detailed project reports of pumping treated water, scientific landfill at Bangluru quarries, construction of Raja Nala and Other development of civil works, etc. The applicant provides these services mainly to the Municipalities, Corporations (i.e. local bodies), and also to Government Departments, and only in a few cases, a pure consultancy service is being provided to private parties.

Ruling:

- Pure consultancy services (without a supply of goods) provided by the applicant to Municipalities, Corporations ( local bodies), and State Government Departments, as enumerated in the application, are exempt from GST as per the serial Number 3 of Notification No. 12/2017-Central Tax(Rate) dated 28.06.2017.

- Pure consultancy services provided to the private individuals are taxable at 9% under CGST and 9% under SGST as per entry No. 21 of the Notification No. 11/2017-Central Tax(Rate) dated 28.06.2017

- Input tax paid on the purchase of capital goods like furniture, computer, lab equipment, drone camera, total station, auto level instruments, etc., and on certain inputs services shall be restricted to so much of the input tax as is attributable to the taxable supplies made by the applicant as per subsection 2 of section 17 of the CGST Act, 2017.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.