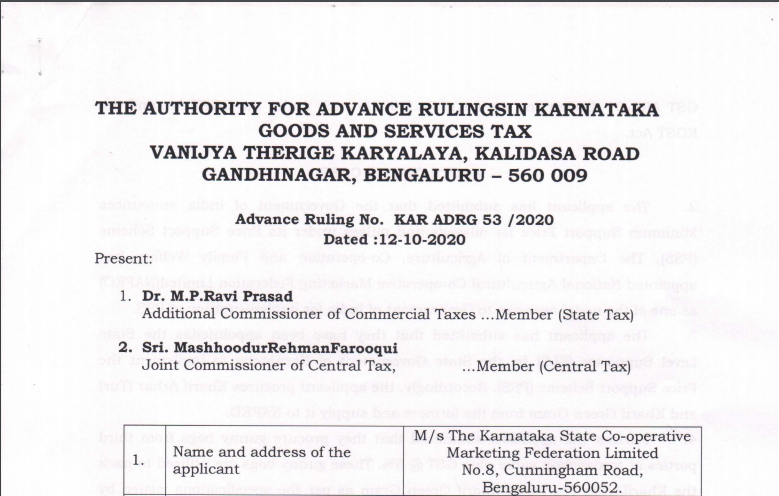

Karnataka AAR in the case of M/s. The Karnataka State Co-operative Marketing Federation Limited

Table of Contents

Case Covered:

M/s. The Karnataka State Co-operative Marketing Federation Limited

Facts of the Case:

The applicant has submitted that the Government of India announces the Minimum Support Price of oilseeds and pulses under its Price Support Scheme (PSS). The Department of Agriculture, Co-operation, and Family Welfare has appointed National Agriculture Co-operative Marketing Federation Limited (NAFED) as one of the nodal agencies to the Government of India for the implementation of PSS.

The applicant has submitted that they have been appointed as State Level Supporter (SLS) by the State Government of Karnataka to implement the Price Support Scheme (PSS). Accordingly, the applicant procures Kharif Arhar (Tru) and Kharif Green Gram from the farmers and supply it to NAFED.

Observations:

On verification of the nature of the activity carried out by the applicant, it was observed that the Government of India announces Minimum Support Price for oilseeds and pulses under its Price Support Scheme (PSS). The Department of Agriculture, Co-operation, and Family Welfare has appointed National Agriculture Co-operative Marketing Federation Limited (NAFED) as one of the nodal agencies to the Government of India for the implementation of PSS. However, in the State of Karnataka, the Government has appointed the applicant as the State Level Supporter (SLS) to implement the Price Support Scheme (PSS) announced by the Government of India. As per the scheme, the applicant procures Kharif Arhar (Tru) commonly known as Pigeonpea ( Cajanuscajan) and Kharif Green Gram ( Vigna radiate) from the farmers and supply it to NAFED.

Ruling:

- The supply of Kharif Arhar (Tru) and Green Gram to NAFED is an exempted supply as per entry No. 45 of Notification No. 2/2017- Central Tax(Rate) dated 28th June 2017.

- GST paid on the purchase of Gunny bags shall not be claimed as input tax credit as per sub-section 2 of section 17 of the CGST Act, 2017.

- The provisions of TDS as prescribed under Section 51 of the CGST/KGST Act, 2017 do not apply to the applicant.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.