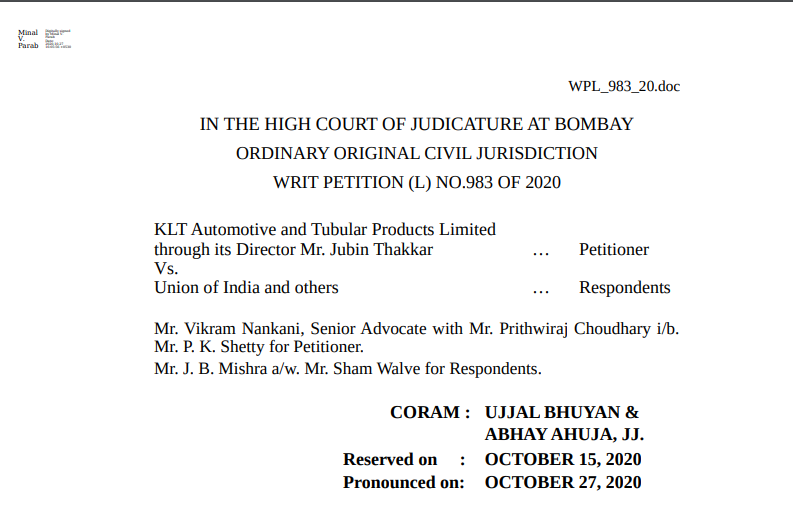

Bombay HC in the case of KLT Automotive and Tubular Products Limited

Table of Contents

Case Covered:

KLT Automotive and Tubular Products Limited

Versus

Union of India

Facts of the Case:

Though the writ petition was hotly contested by the respondents by filing a number of affidavits and was also heard at length, because of subsequent development it may not be necessary for adjudication into the rival contentions as the grievance of the petitioner has been substantially met by administrative instructions dated 18.09.2020 issued by the Central Board of Indirect Taxes and Customs.

However, for a proper perspective, we feel that it would be apposite to briefly highlight the controversy involved and the reliefs claimed.

The petitioner is a limited company having its registered office at Andheri (East), Mumbai. It is engaged in the business of the manufacture of automotive components. It is registered under the Central Goods and Service Tax Act, 2017 as well as under the Maharashtra Goods and Service Tax Act, 2017.

Observations of the Court:

From a perusal of the above, it is seen that amendment to section 50 of the Central Goods and Service Tax Act, 2017 was introduced by Finance (No.2) Act, 2019 for charging interest on the net cash tax liability. The said amendment was made effective prospectively from 01.09.2020 vide the Central Government notification No.63/2020- Central Tax dated 25.08.2020. GST Council in its 39th meeting recommended that interest should be charged on the net cash tax liability with effect from 01.07.2017. The recommendation was made for making the amendment to section 50 retrospectively with effect from 01.07.2017. It is stated that the retrospective amendment in the GST laws would be carried out in the due course through suitable legislation. After issuance of the notification dated 25.08.2020, views were expressed by taxpayers that the said notification is contrary to the recommendation of the GST Council to charge interest on the net cash tax liability with effect from 01.07.2017. To clarify this position press release was issued on 26.08.2020. However, in order to implement the decision of the GST Council in its true spirit within the present legal framework, the above instructions were issued. Firstly, for the period 01.07.2017 to 31.08.2020, field formations have been instructed to recover interest only on the net cash tax liability i.e., that portion of the tax that has been paid by debiting the electronic cash ledger or is payable through cash ledger. Secondly, in those cases where show cause notices have been issued on gross tax payable, to keep those show-cause notices in the callbook till retrospective amendment in section 50 of the Central Goods and Service Tax Act, 2017 is carried out.

The decision of the Court:

Consequently, we are of the view that no live issue survives for adjudication in this case. Recovery (garnishee) notices issued by the respondents on 16.07.2020 are hereby quashed. Respondents to intimate the petitioner about the quantum of interest payable on account of a delayed payment of GST for the period under consideration in terms of the administrative instructions dated 18.09.2020 and the same shall be paid by the petitioner, if not already paid.

Writ petition is accordingly allowed. However, there shall be no order as to costs.

This order will be digitally signed by the Private Secretary of this Court. All concerned will act on production by fax or email of a digitally signed copy of this order.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.