E-invoicing in India!

Table of Contents

- E-invoicing in India!

- E-invoicing – Status update!

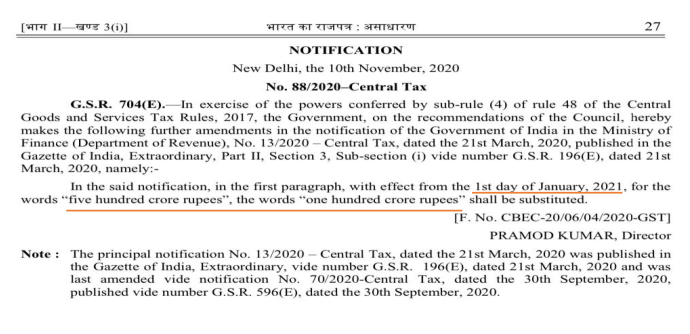

- E-invoicing applicable for above INR 100 crore turnover from 1.01.2021 [Not. No. 88/2020-CT]

- E-invoicing – How it has fared?

- How e-invoicing has fared in India from 1.10.2020?

- List of e-invoice registered suppliers!

- E-invoicing – Press Releases and Update!

- Press Release dated 2nd Nov. 2020

- Attention – Entities with turnover above 100 crores!

- Tax Payers with Aggregate Turnover of Company less than Rs. 500 Crores – E-invoice API Access Mechanism

- Read & Download the full Copy in pdf:

E-invoicing in India!

Concept and Challenges!

E-invoicing – Status update!

Already implemented – 1.10.2020 → • Aggregate turnover above INR 500 crore!

From – 1.01.2021 → • Aggregate turnover between INR 100 crore to 500 crores (Vide Not. No. 88/2020-CT)

Likely from – 01.04.2021 → • Aggregate turnover above INR 5 crore (hopefully not for below 5 crore taxpayers!)

Related Topic:

E-Invoice Schema Format – Mandatory Fields

E-invoicing applicable for above INR 100 crore turnover from 1.01.2021 [Not. No. 88/2020-CT]

E-invoicing – How it has fared?

How e-invoicing has fared in India from 1.10.2020?

4.95 crore e-invoices → • Raised by 27,400 Taxpayers

8.4 lakhs e-invoices → • Raised on 1.10.2020 i.e. first day itself

35 lakhs e-invoices → • Raised on 31.10.2020

85% of the Taxpayers → • Used API to raise e-invoices

15% of the Taxpayers → • Used an offline tool to raise e-invoices

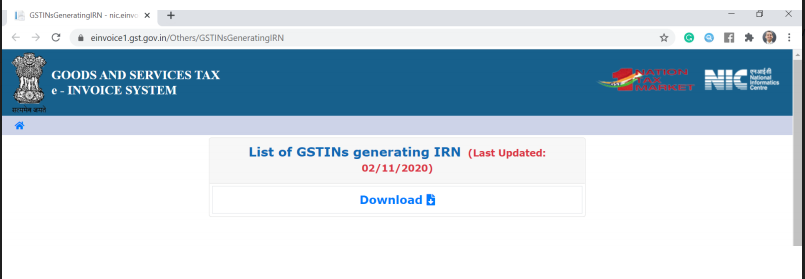

List of e-invoice registered suppliers!

• NIC has issued a list of GSTINs who have issued #e-invoices.

E-invoicing – Press Releases and Update!

Press Release dated 2nd Nov. 2020

• ‘The Government is planning to reduce the aggregate turnover cut off to Rs 100 Crores for the generation of IRN by the taxpayers in the coming days. NIC has already enabled the API and offline tool based trial sites for these taxpayers and geared up with the required infrastructure to handle the generation of e-invoices from these taxpayers.

• Keeping requirements of small taxpayers in view, who need to prepare 5-10 B2B invoices in a day, NIC is also developing an offline Excel-based IRN preparation and IRN printing tool which will allow them to enter the invoice details, prepare the file to upload on NIC IRN portal, download the IRN with QR code and print the e-invoice with QR code.’

Related Topic:

E-Invoicing mandatory for Businesses having aggregate turnover above Rs.100 crore from 1st Jan’2021

Attention – Entities with turnover above 100 crores!

• E-Invoice System is enabled on Trial sites (for APIs & Offline tools) for taxpayers with PAN-based turnover more than Rs. 100 Cr. in a financial year

Tax Payers with Aggregate Turnover of Company less than Rs. 500 Crores – E-invoice API Access Mechanism

• Through GSPs – The GSTIN (Tax Payer) generates his own username and password and ties up with GSPs to get access to API using the Client Id and Client Secret of the GSPs.

• Through ERPs – The GSTIN (Tax Payer) generates his own username and password and ties up with ERPs to get access to API using the Client Id and Client Secret of the ERPs.

• Through Companies having direct Access to APIs’ – If the taxpayer has tie-up or using the ERP of the ‘Company which has direct access to API, then he/she can use the API through that company. The GSTIN (Tax Payer) generates his own username and password and gets access to API using the Client Id and Client Secret of the Company, which has access.

• Tax Payers having access to E-Way Bill APIs – If the taxpayer has direct access to E-Way Bill APIs, then he/she can use the same Client Id, Client Secret, username, and password to get access to the e-Invoice system.