QRMP Boon or Bane

Table of Contents

QRMP Boon or Bane

As a trade facilitation measure and in order to ease the process of doing business, the GST Council in its 42nd meeting held on 05.10.2020, had recommended that registered person having aggregate turnover up to five (5) crore rupees be allowed to furnish return on a quarterly basis along with monthly payment of tax, with effect from 01.01.2021.

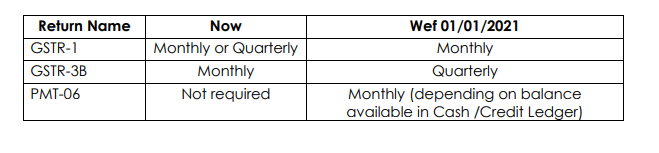

Towards fulfilling the recommendation, the Government has issued notifications and Circular to implement the Scheme of Quarterly Return filing and Monthly Payment of taxes (hereinafter referred to as “QRMP Scheme”) as below

⎯ Notification No. 81/2020 – Central Tax, dated 10.11.2020. (Notifies amendment carried out in sub-section (1), (2), and (7) of section 39 of the CGST Act vide Finance (No.2) Act, 2019.)

⎯ Notification No. 82/2020 – Central Tax, dated 10.11.2020. ( Makes the Thirteenth amendment (2020) to the CGST Rules 2017.)

⎯ Notification No. 84/2020 – Central Tax, dated 10.11.2020. (Notifies class of persons under proviso to section 39(1) of the CGST Act.)

⎯ Notification No. 85/2020 –Central Tax dated 10.11.2020. (Notifies special procedure for making payment of tax liability in the first two months of a quarter)

⎯ Circular No. 143/13/2020- GST dated 10.11.2020

This new Scheme QRMP will be effective from 01.01.2021 and a registered person who is required to furnish a return in FORM GSTR-3B, and who has an aggregate turnover of up to 5 crore rupees in the preceding financial year, is eligible for the QRMP Scheme.

The facility to opt for the QRMP Scheme on the common portal would be available throughout the year. A registered person can opt-in for any quarter from the first day of the second month of the preceding quarter to the last day of the first month of the quarter. Registered persons are not required to exercise the option every quarter. Where option has been exercised once, they shall continue to furnish the return as per the selected option for future tax periods, unless they revise the option.

As per the Circular supra, for the first quarter of the Scheme i.e. for January 2021 to March 2021, all the registered persons, whose aggregate turnover for the FY 2019-20 is up to 5 crore rupees and who have furnished the return in FORM GSTR-3B for the month of October 2020 by 30th November 2020, would be migrated on the common portal as per the default migration plan for the convenience of registered persons based on their anticipated behavior. However, registered persons are free to change the option as above, if they so desire, from 5th of December, 2020 to 31st of January, 2021.

Related Topic:

Payment of Tax By Fixed Sum Method Under QRMP Scheme

Some salient feature with reference to opting for the scheme are as under:

⎯ In case the aggregate turnover exceeds 5 crore rupees during any quarter in the current financial year, the registered person shall not be eligible for the Scheme from the next quarter

⎯ All persons who have obtained registration during any quarter or the registered persons opting out from paying tax under Section 10 of the CGST Act during any quarter shall be able to opt for the Scheme for the quarter for which the opting facility is available on the date of exercising the option

⎯ The option to avail of the QRMP Scheme is GSTIN wise and therefore, distinct persons as defined in Section 25 of the CGST Act (different GSTINs on the same PAN) have the option to avail the QRMP Scheme for one or more GSTINs. In other words, some GSTINs for that PAN can opt for the QRMP Scheme, and remaining GSTINs may not opt for the Scheme.

Filing of Return:

The registered persons opting for the Scheme would be required to furnish FORM GSTR-1 and GSTR-3B quarterly. However, they have to make monthly payments using PMT-06 as per the Fixed sum payment or self-assessment based on the availably of sufficient balance in the Electronic credit/cash ledger. Further, as a facilitation measure registered person will have the facility (Invoice Furnishing Facility- IFF) to furnish the details of outward supplies to a registered person, as he may consider necessary, between the 1st day of the succeeding month till the 13th day of the succeeding month, for each of the first and second months of a quarter, and the details of outward supplies shall not exceed the value of fifty lakh rupees in each month.

It is understood that the QRMP scheme is aimed at the MSME sector and expected to reduce furnishing numbers GSTR-1 and GSTR-3B Returns. It is said that the QRMP will reduce the total number of GSTR-1/GSTR-3B filing from 24 to 8 or 16 to 8 if GSTR-1 is filed quarterly. Though it appears to be reduced to compliance, the fact is otherwise and there are lots of issues to be addressed and clarified by the CBIC and State Tax Authorities.

This article wishes to highlight such issues:

Issues with reference to furnishing outward supply:

1. As per the scheme GSTR-1 and GSTR-3B have to be filed Quarterly only. In view of this, the availment of ITC by the recipient, refund claims on the export of goods/service, zero-rated supply to SEZ, and Deemed export is delayed considerably.

2. It is stated that in order to avail input tax credit, optional Invoice Furnishing Facility (IFF) has been provided, wherein the Registered person can upload the B2B invoices, Debit and Credit notes as per his requirements either all invoice issued or certain invoices only and such uploaded invoices will be made available in GSTR-2A and GSTR-2B for the recipient. Here the issue invoices up to the value of Rs.50 Lakhs’ can only be uploaded. Please also note that the IFF Scheme is optional and if the Outward supplier chose to upload only after the Quarter End. The recipient has to wait for more than 3 months to get the ITC credit to be reflected in GSTR-2A and GSTR-2B. Large taxpayer may try to avoid supplies from QRMP optee’s.

3. In the IFF, there is no provision to upload the invoices relating to Zero rated supply. Zero-rated supply can only be uploaded only after the end of the quarter. Now, IGST refunds are available within 15 days after filing GSTR-1 and GSTR-3B. In the QRMP scenario, this IGST refund would be possible only after 120 days. A big blow for the QRMP optee’s/MSME Exporters!

4. As per the Circular, the details furnished in IFF need not be shown again in GSTR-1. However, what about the amendments if any required? Such as incorrect GSTN date and other details and changes in the Tax category ie CGST/SGST to IGST vice versa. The amendment if any required, can be possible only after 6 months. To that extent, there will be a delay in availing of ITC also.

Issues with reference to payment of tax:

As per Notification no: 85/2020 CT dated 10/11/2020 and CBIC Circular on the QRMP, the Taxpayer opting for QRMP can opt deposit a fixed amount, 35% tax paid in cash in the preceding quarter where the return was furnished quarterly or equal to the tax paid in the preceding month where the return was furnished monthly or based on assessment -based payment in cash through PMT-06. This notification is w.e.f. 18/01/2021.

1. As of now there is no provision to make quarterly payment as GST-3B is monthly even if the GSTR-1 is filed quarterly. Hence for quarters Jan-2021 to March-2021, there is no way to opt for 35% tax paid in cash in the preceding quarter. So, the fixed payment if opted the Registered person has to make 100% of the amount paid in Cash.

2. Assuming that in the preceding month only CGST/SGST is paid in cash and for the QRMP first month the payment is required in IGST. What would be auto-generation of Challan by the portal if it generated for IGST or vice-versa and supply is otherwise? It is pertinent to note that ITC can be cross utilized but not Cash payment? Thus, it is seen that opting for the fixed payment mode lack clarity. Hope the CBIC issues necessary clarification immediately.

3. As the fixed mode needs clarity, is opting for self-assessment mode solves the issue. Unfortunately, it is not. As per the Rules if a sufficient balance is available in electron cash or electronic credit ledger no need to make payment using PMT-06. The ITC credit is credited in the Electronic credit ledger only after filing of GSTR-3B. GSTR-3B is filed Quarterly. Then how can a Register person ensure that sufficient balance is available in the Electronic credit ledger for the first month of the Quarter and the second month?

The scheme does not reduce the compliance burden but increased it by one more filing of information in Form PMT 06. The MSME has to reconcile the monthly GSTR 1 reporting and quarterly GSTR 3B to work out the liability.

This apart, now the Department has to monitor non-payment of PMT-06. More litigations.

Now, a new GSTR-2B is made available to avail ITC based on GSTR-1, and in order to avoid errors is in filing Auto-generated GSTR-3B has been provided. By and large many of the issues wrt GSTR-1 and GST-3B are settled.

In view of the foregoing, registered persons below Rs. 5 crores turnover are advised very cautiously to opt for the QMRP Scheme.

Please note GSTN has enabled opting-in for quarterly filing of GST returns under QRMP scheme.