External Trade – Facilitation – Export of Goods and Services: RBI

Table of Contents

External Trade – Facilitation – Export of Goods and Services: RBI

To,

All Category – I Authorised Dealer Banks

Madam / Sir,

External Trade – Facilitation – Export of Goods and Services

Please refer to the Statement on Development and Regulatory Policies announced as part of the Bi-monthly Monetary Policy Statement dated December 4, 2020. With a view to further enhance the ease of doing business and quicken the approval process, it has been decided to delegate more powers to the Authorised Dealer Category – I banks (AD banks) in the following areas:

1. Direct Dispatch of Shipping Documents

1.1 In terms of Paragraph 2 of A. P. (DIR Series) Circular No. 6 dated August 13, 2008, AD banks have been allowed to regularise cases of dispatch of shipping documents by the exporter direct to the consignee or his agent resident in the country of the final destination of goods, up to USD 1 million or its equivalent per export shipment.

1.2 With a view to simplifying the procedure, it has been decided to do away with the limit of USD 1 million per export shipment.

1.3 Accordingly, AD banks may regularize such direct dispatch of shipping documents irrespective of the value of the export shipment, subject to the following conditions:

a) The export proceeds have been realized in full except for the amount written off, if any, in accordance with the extant provisions for write off.

b) The exporter is a regular customer of AD bank for a period of at least six months.

c) The exporter’s account with the AD bank is fully compliant with Reserve Bank’s extant KYC / AML guidelines.

d) The AD bank is satisfied with the bonafide of the transaction.

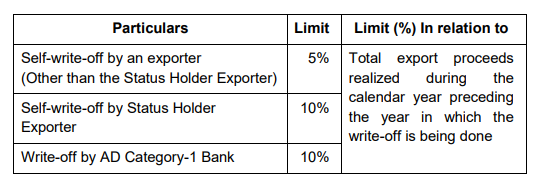

2. “Write-off” of unrealized export bills

2.1 Attention is invited to A.P. (DIR. Series) Circular No. 88 dated March 12, 2013, on “write-off” of unrealized export bills. To provide greater flexibility to the AD banks and to reduce the time taken for according such approvals, the extant procedure is revised as under:

2.2 The above limits of self-write-off and write-off by the AD bank shall be reckoned cumulatively and shall be available subject to the following conditions:

a) The relevant amount has remained outstanding for more than one year;

b) Satisfactory documentary evidence is furnished indicating that the exporter had made all efforts to realize the export proceeds;

c) The exporter is a regular customer of the bank for a period of at least 6 months, is fully compliant with KYC/AML guidelines and AD Bank is satisfied with the bonafide of the transaction.

d) The case falls under any of the under noted categories:

i) The overseas buyer has been declared insolvent and a certificate from the official liquidator, indicating that there is no possibility of recovery of export proceeds, has been produced.

ii) The unrealized amount represents the balance due in a case settled through the intervention of the Indian Embassy, Foreign Chamber of Commerce, or similar Organization;

iii) The goods exported have been auctioned or destroyed by the Port / Customs / Health authorities in the importing country;

iv) The overseas buyer is not traceable over a reasonably long period of time.

v) The unrealized amount represents the undrawn balance of an export bill (not exceeding 10% of the invoice value) remaining outstanding that turned out to be unrealizable despite all efforts made by the exporter;

vi) The cost of resorting to legal action would be disproportionate to the unrealized amount of the export bill or where the exporter even after winning the Court case against the overseas buyer could not execute the Court decree due to reasons beyond his control;

vii) Bills were drawn for the difference between the letter of credit value and actual export value or between the provisional and the actual freight charges but the amounts have remained unrealized consequent to dishonor of the bills by the overseas buyer with no prospects of realization.

Related Topic:

Extension of Realization Period of Export Proceeds

2.3 Notwithstanding anything contained in para 2.1 and 2.2 above, the AD bank may, on request of the exporter, write-off unrealized export bills without any limit in respect of cases falling under any of the categories specified at 2.2 (d) (i), (ii) and (iii) above provided AD bank is satisfied with the documentary evidence produced.

2.4 AD banks may also permit write-off of the outstanding amount of export bills up to the specified ceilings indicated in para 2.1 above, where the documents have been directly dispatched by the exporter to the consignee or his agent resident in the country of the final destination of goods if the case falls under any of the categories specified at 2.2 (d) (i), (ii) and (iii) above.

2.5 The AD bank shall ensure that the exporter seeking write-off has submitted documentary evidence towards surrendering of proportionate export incentives, if any, availed of in respect of the relative export bill.

2.6 In case of self-write off, the AD bank shall obtain from the exporter, a certificate from Chartered Accountant indicating the export realization in the preceding calendar year and details of the amount of write-off, if any, already availed of during the current calendar year along with the requisite details of the EDF/Export Bill under the write-off request. The certificate shall also indicate that the export incentives, if any, availed by the exporter have been surrendered.

2.7 The following cases, however, would not qualify for the “write-off” facility:

a. Exports made to countries with externalization problem i.e. where the overseas buyer has deposited the value of export in local currency but the amount has not been allowed to be repatriated by the Central Bank authorities of the country concerned.

b. EDF/Softex which are under investigation by agencies like, Enforcement Directorate, Directorate of Revenue Intelligence, Central Bureau of Investigation, etc. as also the outstanding bills which are the subject matter of civil/criminal suit.

2.8 AD banks shall report write-off of export bills in the Export Data Processing and Monitoring System (EDPMS).

2.9 AD banks shall put in place a system to carry out random check/percentage check of the export bills so written-off by their internal Inspectors/Auditors (including external Auditors).

2.10 Requests of write-off not covered under the above instructions may be referred to the Regional Office concerned of the Reserve Bank.

3. Set-off of Export receivables against Import payables

3.1 Presently, AD banks are allowing exporters/importers to set-off their outstanding export receivables against outstanding import payables from/to the same overseas buyer/supplier. The Bank has been receiving requests from AD banks, on behalf of their Importer/Exporter constituents, for allowing such set-off with their overseas group/associate companies either on a net basis or gross basis, through an in-house or outsourced centralized settlement arrangement.

3.2 Accordingly, it has been decided to delegate powers to AD banks to also consider such requests of set-off, and the revised guidelines, in supersession of the instructions contained in circular A.P. (DIR Series) Circular No 47 dated November 17, 2011, are issued as under:

The AD bank may allow set-off of outstanding export receivables against outstanding import payables, subject to the following conditions:

a) The arrangement shall be operationalized/supervised through/by one AD bank only

b) AD bank is satisfied with the bonafide of the transactions and ensures that there are no KYC/AML/CFT concerns;

c) The invoices under the transaction are not under investigation by Directorate of Enforcement/Central Bureau of Investigation or any other investigative agency;

d) Import/export of goods/services has been undertaken as per the extant Foreign Trade policy

e) The export/import transactions with ACU countries are kept outside the arrangement;

f) Set-off of export receivables against goods shall not be allowed against import payables for services and vice versa.

g) AD bank shall ensure that import payables/export receivables are outstanding at the time of allowing set-off. Further, set-off shall be allowed between the export and import legs taking place during the same calendar year.

h) In case of a bilateral settlement, the set-off shall be in respect of the same overseas buyer/supplier subject to it being supported by verifiable agreement/mutual consent.

i) In case of settlement within the group/associates companies, the arrangement shall be backed by a written, legally enforceable agreement/contract. AD bank shall ensure that the terms of the agreement are strictly adhered to;

j) Set-off shall not result in tax evasion/avoidance by any of the entities involved in such an arrangement.

k) Third-party guidelines shall be adhered to by the concerned entities, wherever applicable;

l) AD bank shall ensure compliance with all the regulatory requirements relating to the transactions;

m) AD bank may seek Auditors/CA certificate wherever felt necessary.

n) Each of the export and import transaction shall be reported separately (gross basis) in FETERS/EDPMS/IDPMS, as applicable

o) AD bank to settle the transaction in E/IDPMS by utilizing the ‘set-off indicator’ and mentioning the details of shipping bills/bill of entry/invoice details being settled in the remark column (including details of entities involved)

4. Refund of Export Proceeds

4.1 Attention is invited to A. P. (DIR Series) Circular No.37 dated April 05, 2007, in terms of which AD banks, through whom the export proceeds were originally realized, were allowed to consider requests for refund of export proceeds of goods exported from India and being reimported into India on account of poor quality.

4.2 There have been instances when re-importing of goods has not been possible as the exported goods had reportedly been auctioned or destroyed in the importing country.

4.3 The instructions have been reviewed and henceforth AD banks while permitting refund of export proceeds of goods exported from India, shall:

(i) Exercise due diligence on the track record of the exporter;

(ii) Verify the bona-fides of the transaction/s;

(iii) Obtain from the exporter a certificate issued by DGFT / Custom authorities that no export incentive has been availed of by the exporter against the relevant export or the proportionate export incentives availed, if any, have been surrendered;

(iv) Not insist on the requirement of re-import of goods, where exported goods have been auctioned or destroyed by the Port / Customs / Health authorities/ any other accredited agency in the importing country subject to the submission of satisfactory documentary evidence.

4.4 In all other cases AD banks shall ensure that procedures as applicable to normal imports are adhered to and that an undertaking from the exporter, to re-import the goods within three months from the date of refund of export proceeds, shall be obtained.

5. AD banks may bring the contents of this Circular to the notice of their constituents concerned. The Master Direction No 16/2015 dated January 01, 2016 is being updated to reflect the above changes.

6. The directions contained in this Circular have been issued under Section 10(4) and 11(1) of Foreign Exchange Management Act, 1999 (42 of 1999) and are without prejudice to permissions/approvals, if any, required under any other law.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.