Issues Relating to SEZ

Table of Contents

- Issues Relating to SEZ

- Disclaimer

- 1. SEZ – Migration to GST

- 2. The requirement of Legal Undertaking

- 3. Refund of taxes charged on supplies to SEZ

- 4. Sales by SEZ to DTA

- 5. Bill to DTA but ship to SEZ and vice versa – explain the workings and applicability of the law

- 6. Why import of services by SEZ needs exemption specifically?

Issues Relating to SEZ

Credit: CA Jatin Christopher, CA. Yeshwanth GN

Disclaimer

The views expressed in this article are of the author(s). The Institute of Chartered Accountants of India may not necessarily subscribe to the views expressed by the author(s).

The information cited in this article has been drawn from various sources. While every effort has been made to keep, the information cited in this article error-free, the Institute or any office of the same does not take the responsibility for any typographical or clerical error which may have crept in while compiling the information provided in this article.

1. SEZ – Migration to GST

1.1. Statutory Provision

- 1st proviso to Rule 8 of the Central Goods and Services Rules, 2017 provides that an SEZ unit/developer shall make a registration application for registration as a business vertical which will be separate from other units located outside the SEZ;

- Application for registration under GST is required to be filed in Form GST REG 01. Sl No 12 and 13 of the Form requires the applicant to confirm if they are applying for registration as an SEZ unit / Developer and also asks for the details of the SEZ approval;

- Section 7 of the Integrated Goods and Services Tax Act, 2017 provides that all the supplies of goods and services to SEZ would be treated as inter-State supplies and accordingly the same will be liable to IGST based on Section 5(1) of the IGST Act, 2017;

- A supplier to SEZ is required to provide the GST Number of the customer while filing the returns of Outward Supply in Form GSTR 1. If the GST Number of the customer is registered as SEZ on the GST Portal, then based on the provisions of Section 7 of the IGST Act, 2017, the portal automatically treats the supply as interstate even though the supplier and the SEZ are located in the same State.

Related Topic:

How to change status from/to SEZ in GST registration

1.2. Implementation Challenge

- The taxpayers registered under the pre-GST laws (Excise, VAT, Service Tax, etc) were required to migrate into GST between January 2017 and March 2017 and obtain the GST Number;

- The requirement of obtaining a separate business vertical registration was introduced in the Rules which were available in the public domain only in the month of June 2017. Further, the requirements in table 12 and table 13 where not available at the time of migration from the pre-GST laws into GST, and accordingly all the SEZ registrants were migrated as “Regular” registrants in GST;

- The GST Portal recognized this issue – Self or based on recommendations received from various quarters based on which mails were received by certain SEZ from the GST Helpdesk to confirm if they were SEZ and if they would like to convert their registration type to “SEZ”. SEZ’s have responded to this mail but the registration type appearing on the portal has not been changed from “Regular” to “SEZ”.

1.3. Tax Effect

- In case the supplier supplies the goods or services to SEZ on payment of tax then based on the provisions of Section 7 of the IGST Act, 2017, they are required to charge IGST and not CGST + SGST. However, since the GST portal does not recognize the customer as “SEZ” but recognizes it as a “Regular” taxpayer, the supplier is unable to file the return by disclosing tax applicable as IGST.

Related Topic:

SEZ Online – New Functionalities/Features

1.4. Possible Solution

- The supplier can choose Place of Supply as “097 – Other ” while uploading the returns based on which the type of supply will change from “Intra State” to “Inter-State” on the basis that SEZ is the territory outside India. However, this option has been provided to report transactions covered under Section 7(5)(c) ie Supply of Goods or services or both in the taxable territory, not being an intrastate supply and not covered elsewhere in this Section and accordingly, this workaround would be incorrect;

- Additionally, the SEZ will not be able to claim credit for the taxes charged since the place of supply is different from the location of the registration. This restriction of no credit when the place of supply is different from the location of the registration is not provided for in the GST Law but is based on the limited experience of filing return of inward supplies in Form GSTR 2 where the portal did not allow for claiming of CGST portion of the Hotel Accommodation Charges when the location of the supply (being the location of the hotel) was different from the location of the recipient (being a place of registration of the recipient);

- In the recently concluded meeting of GST officials at the office of one of the Industrial Associations in Maharashtra, it was informed that SEZ can approach their jurisdictional officers and inform them about the registration problem. The officers would in turn be required to contact GSTIN to update them on the issue and get the same resolved. We are not sure if this solution will work;

- Recent update dated March 19, 2018 – News and Updates tab on the GST Portal provides that “taxpayers who have not migrated as SEZ, can send their request to become SEZ on the email reset.sezflag@gst.gov.in and attach the copy of Letter of Approval as SEZ unit/developer”

2. The requirement of Legal Undertaking

2.1. Statutory Provision

- Section 16(1) of the IGST Act, 2017 provides that supplies to SEZ units and developers will be treated as zero-rated. Further Section 16(3) of the IGST Act, 2017 provides that the supplier will have two options to claim a refund for supplies made to SEZ units and developers

– Option 1 – Refund of unutilized credits provided supplies are made under bond / Legal Undertaking

– Option 2 – Refund of IGST charged on supplies made.

- Rule 96A(1) r/w Rule 96A(6) of the CGST Rules, 2017 provides that any person availing the option to supply goods/services to SEZ without payment of IGST shall furnish, prior to such supply, a bond / legal undertaking binding himself to pay the tax along with interest if the payment for such services is not received within 1 year + 15 days from the date of invoice or if the goods are not exported within 3 months + 15 days from the date of the invoice.

2.2. Implementation Challenge

- Section 16(3) of the IGST Act, 2017 provides for execution of Bond / Legal Undertaking only in a case where the supplier to SEZ intends to supply goods/services without payment of tax and claim refund of the unutilized input tax credit;

- However, Section 96A(1) r/w Rule 96A(6) of the CGST Rules, 2017 which deals with a refund of taxes provides for execution of LUT in case of supplies to SEZ without payment of duty even when the supplier does not file a claim for refund of any unutilized input tax credit.

2.3. Tax Effect

- Based on the CGST Rules, the taxpayer is required to execute LUT / Bond for the purpose of supplies to SEZ, though there is no requirement under the Act;

- Execution of LUT / Bond comes with indirect compliance of annual renewal (which is again coming out of various circulars and the online application form for LUT available on the GST portal and from the law) and also requires the supplier to ensure that supplies of services are realized or goods are exported within the prescribed time;

- In case the supplier is unable to meet the prescribed timeline for export of goods or realize the export proceeds in case of services, then as per Rule 96A(3) of the CGST Rules, 2017, the facility of the LUT / Bond would be withdrawn and the tax payable on such supplies would be recovered with interest;

- Additionally, Rule 96A(4) provides that the facility of LUT / Bond will be restored upon payment of tax dues and interest. This would mean that in case the supplier has missed tracking payment of say a particular invoice which was outstanding for more than a year and realizes the same only after say 3 years then his facility of LUT / Bond is withdrawn at the expiry of the 1st year and all the exports made by him in the next two years will be liable to GST. This could prove dangerous to suppliers of SEZ.

2.4. Possible Solution

- Execution of LUT / Bond has been held to be procedural even in the excise laws where there was a requirement to furnish a Legal Undertaking for export of goods without payment of excise duty on manufactured goods. The same principle can be applied here;

- Circular No. 37/11/2018-GST dated March 15, 2018, in the context of refund of the unutilized input tax credit with respect to the export of goods without payment of IGST, provides relaxation in case of delay in furnishing of LUT and provides that “The delay in furnishing of LUT in such cases may be condoned and the facility for export under LUT may be allowed on ex post facto basis taking into account the facts and circumstances of each case”.

3. Refund of taxes charged on supplies to SEZ

3.1. Statutory Provision

- Section 54 of the CGST Act, 2017 read with Rule 89 of the CGST Rules, 2017 lays down the procedure to be followed for claiming a refund of IGST paid on supplies made to SEZ. The Rules provide that the refund application should be accompanied by an endorsement from the specified officer of the zone that the goods have been admitted in full in the SEZ for authorized operations or services have been received in the zone for authorized operations.

3.2. Implementation Challenge

- While the specified officer can definitely endorse the fact that goods have been admitted to SEZ (based on delivery of goods into the zone), how can the officer endorse if such goods have been admitted for authorized operations? Additionally, how will the specified officer endorse the receipt of services/use of such services for authorized operations given that the services are intangible and could have been entirely performed outside the SEZ?

3.3. Tax Effect

- The vendor claiming refund of taxes charged on SEZ supplies need to obtain a declaration from SEZ that the unit/developer has not availed tax credit of the taxes paid by the supplier. Since the invoices are uploaded online and there is a possibility of the SEZ inadvertently claiming credit of taxes charged by the vendor at the time of filing the GSTR 2. The refund will in this case be denied in the hands of the supplier due to non-compliance by the SEZ;

- Additionally, the refund will be allowed only if the supplies are used for “authorized operations”. The supplier is unaware of the use of his supplies by the SEZ and hence the obligation cast of the supplier when the manner of utilization of goods/services is with SEZ can create an issue for suppliers;

- SEZ having non-SEZ business may seek exemption of employee-related ineligible credits like say rent cab services by stating that such supplies are for their SEZ business and the supplier will have no way to cross-check this claim.

3.4. Possible Solution

- The vendor will have to ensure that the supplies to be made to SEZ are part of the list of goods or services approved by the SEZ authorities apart from the default list of services as mentioned in the Annexure to letter issued by the Ministry of Commerce (SEZ Section) F No. D12/19/2013-SEZ dated January 2, 2018. Hence, it is suggested that the vendor obtains the list of goods/services approved for authorized operations (apart from default list) before making any supplies to SEZ (whether without payment of tax or on payment of tax);

- It would be important to note that in case of services that are not forming part of the default list of services mentioned in the aforementioned list, the vendor should charge IGST unless the SEZ obtains approval from the Unit Approval Committee for such additional services as being used for authorized operations;

- With respect to employee-related services, it would be relevant to note that Rule 70 of the SEZ Rules, 2003 requires SEZ units to issue ID cards to their employees in Form K. The supplier can insist on the copy of the ID card as additional proof that the supplies executed by them have been used by the employees of SEZ.

4. Sales by SEZ to DTA

4.1. Statutory Provision

- Section 29 r/w Section 30 of the SEZ Act, 2005 provides that removal of goods (procured, produced, or manufactured) from SEZ to DTA will be chargeable to duties of customs, as leviable on such goods when imported and the rate of duty shall be the rate in force on the date of such removal. Section 53 of the said Act also provides that SEZ shall be deemed to be a territory outside the customs territory of India for the purpose of undertaking authorized operations and be deemed to be port, inland container depot, land station, or land customs station for Customs Act, 1962. Section 51 of the said Act also provides that provisions of the SEZ Act shall have the effect notwithstanding anything inconsistent with any other law;

- Section 7(2) of the IGST Act, 2017 provides that the supply of goods imported into the territory of India till they cross the customs frontiers of India shall be treated as Inter-State Supply. Further, the proviso to Section 5(1) provides that integrated tax on goods imported into India shall be levied under Customs Law;

- Section 2 of the Customs Act, 1962 defines the term imported goods to mean goods which have not been cleared for home consumption;

4.2. Tax Effect

On collective reading of the above provisions, the taxability of DTA sales by SEZ would be as under

- Supply (sale/removal) of goods into DTA will be considered as the import of goods into India. The said supply will attract customs duty including IGST under the Customs Tariff Act, 1975;

- IGST has the powers to levy a tax on supplies of goods made before the goods cross customs frontier and such transaction is outside the purview of CGST + SGST Act;

- The supply of goods which are still not imported are ejected out of the IGST Act, 2017 by the proviso to Section 5 and hence will not be liable to IGST;

- Till the SEZ does not de-bond the goods by filing a bill of entry for home consumption, these goods have not crossed customs frontier and according to supplies made before the crossing of customs frontiers is an interstate transaction which will be liable to IGST payable under the Customs Law and will not be subjected to IGST on supplies to DTA;

In addition to the above, the following grounds can also be considered

- “Imported goods” has been defined under Customs Law but “goods imported” has not been defined. In this regard, it would be relevant to note that the expression “goods imported” has the company of expressions “till they cross customs frontier”;

- If for some reason, we believe that “imported goods” are not equivalent to “goods imported” then the term “goods imported” would include goods cleared for home consumption in which case the relevance of “till they cross customs frontier” is lost since only goods which are not cleared for home consumption do not cross customs frontier. Accordingly, it would be safe to conclude that the terms “imported goods” and “goods imported” are referring to the same condition of the goods – Not cleared for home consumption;

Additionally, the supply of goods till they cross customs frontiers will be said to a transaction “in the course of import” which cannot be levied to tax based on Article 286 (1)(b) of the Constitution of India. “Supply of goods imported into the territory of India” has been deemed to be supply in the course of inter-state trade or commerce but “Supply of goods in the course of import into the territory of India” has not been deemed to be a supply of goods in the course of inter state trade and commerce and hence even on this count, goods sold by SEZ to DTA will not attract IGST.

4.3. Possible Solution

- While the interpretation of multiple provisions provide us with the answer that supplies by SEZ to DTA would not attract IGST, the majority of the SEZ are clearing the goods on payment of IGST on the ground that the credit of such tax is anyways available to the DTA and with a fear that in case the demand is confirmed on them at a later point in time then they will not be able to recover the same from their customers and the time limit of credit availment by the customer would have also expired;

- We understand that representations have been made on this issue and we may have to wait for the same before we conclude on the tax position.

5. Bill to DTA but ship to SEZ and vice versa – explain the workings and applicability of the law

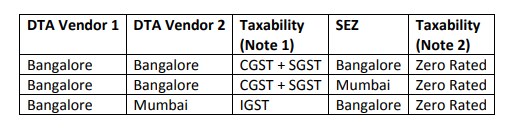

Depending on the location of the DTA and SEZ involved in the transaction, we can have multiple combinations of transactions. The same has been tabulated below with possible tax implications

5.1. Sale from DTA to DTA and then to SEZ

Note 1 – This transaction is covered under Section 10(1)(b) of the IGST Act, 2017 which provides that in case the goods are delivered by the supplier to the recipient based on the instruction of a third person then the place of supply shall be deemed to be the principal place of business of the third person.

Note 2 – This transaction is covered under Section 16 of the IGST Act, 2017 which provides that supplies to SEZ will be treated as Zero-rated.

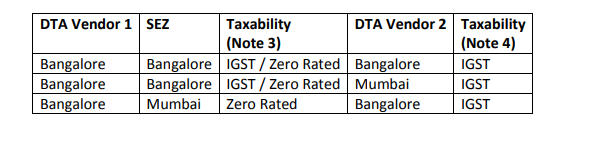

5.2. Sale from DTA to SEZ and then to DTA

Note 3 – This transaction is covered under Section 16 of the IGST Act, 2017 which provides that supplies to SEZ will be treated as Zero-rated. It would be relevant to note that the supplies to SEZ can be made on payment of tax and such tax can be claimed as refund by the supplier or the SEZ. However, for claiming the refund of the taxes, an endorsement is required from the SEZ officer that the goods have been admitted into the SEZ. This may not possible in the instant case and hence it is suggested that the supplier opts for zero-rating of such supplies by furnishing LUT instead of charging tax with an intent to claim a refund of the tax charged.

It would be important to note that in the case of supplies to SEZ, the goods are required to be admitted into the SEZ area for claiming the tax benefits (this is based on the provisions of the SEZ Law). In a bill to SEZ and ship to DTA scenario, the goods are not getting admitted to the SEZ and hence it is suggested that IGST be charged on the sale of goods instead of considering the same as a zero-rated transaction. However, where the goods are being shipped to DTA being a job worker of SEZ, the transaction can be treated as zero-rated on the ground that there has been a delay in the admission of goods to SEZ but eventually they have been admitted to SEZ.

Note 4 – This transaction is covered under Section 7(5) of the IGST Act, 2017 which provides that supplies by SEZ will be treated as Zero-rated. In this context, it would be relevant to note that Section 29 r/w Section 30 of the SEZ Act provides that removal of goods from SEZ to DTA would be considered as the import of goods and will attract customs duty. However, in the instant case, the goods are not admitted to SEZ and hence they cannot be removed from SEZ and accordingly the said provisions of the SEZ Act will not apply to the above transaction.

6. Why import of services by SEZ needs exemption specifically?

- Import of Services is liable to GST under reverse charge mechanism under Section 5(3) of the IGST Act, 2017 but the import of services by SEZ are exempt from GST vide Notification 18/2017 –IT (R) dated July 5, 2017;

- Section 26(2) of the SEZ Act enumerates the list of fiscal benefits extended to SEZ units and developers. This includes exemption from service tax on taxable services provided to SEZ units/developers. The SEZ Act has not been amended to provide for an exemption from GST on supplies made to SEZ and hence GST is applicable on rendering of services to SEZ. However, supplies to SEZ are zero-rated under Section 16 of the IGST Act and hence the domestic suppliers are not required to charge GST on rendering services to SEZ provided they furnish Legal Undertaking;

- In case of import of services, since the taxes are required to be discharged by the recipient ie SEZ and not the supplier, exemption from GST was granted on services imported by SEZ to ensure that SEZ does not end up paying taxes on import of services though there is no specific exemption provided under the GST Act;

- Alternatively, it would be relevant to note that in case of reverse charge mechanism the liability to discharge the tax shifts from the supplier to the recipient and the GST Act applies to such recipient “as if he is the person liable for paying the tax”. Thus, for transactions attracting GST under reverse charge mechanism including import of services, SEZ will step into the shoes of the vendor and will need to comply with the GST Law as if they are the supplier of services;

- A supplier of service to SEZ can comply with the requirements of Section 16 of the IGST and render services without payment of tax since the supplies made to SEZ will be treated as zero-rated. This view has been clarified vide F No 334/335/2017-TRU dated December 18, 2017, which was issued in the context of reverse charge mechanism liability on procurement of goods from unregistered dealers by International Financial Services Centre, SEZ.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.