Gujarat HC in the case of M/s Surat Mercantile Association Versus Union of India

Table of Contents

Case Covered:

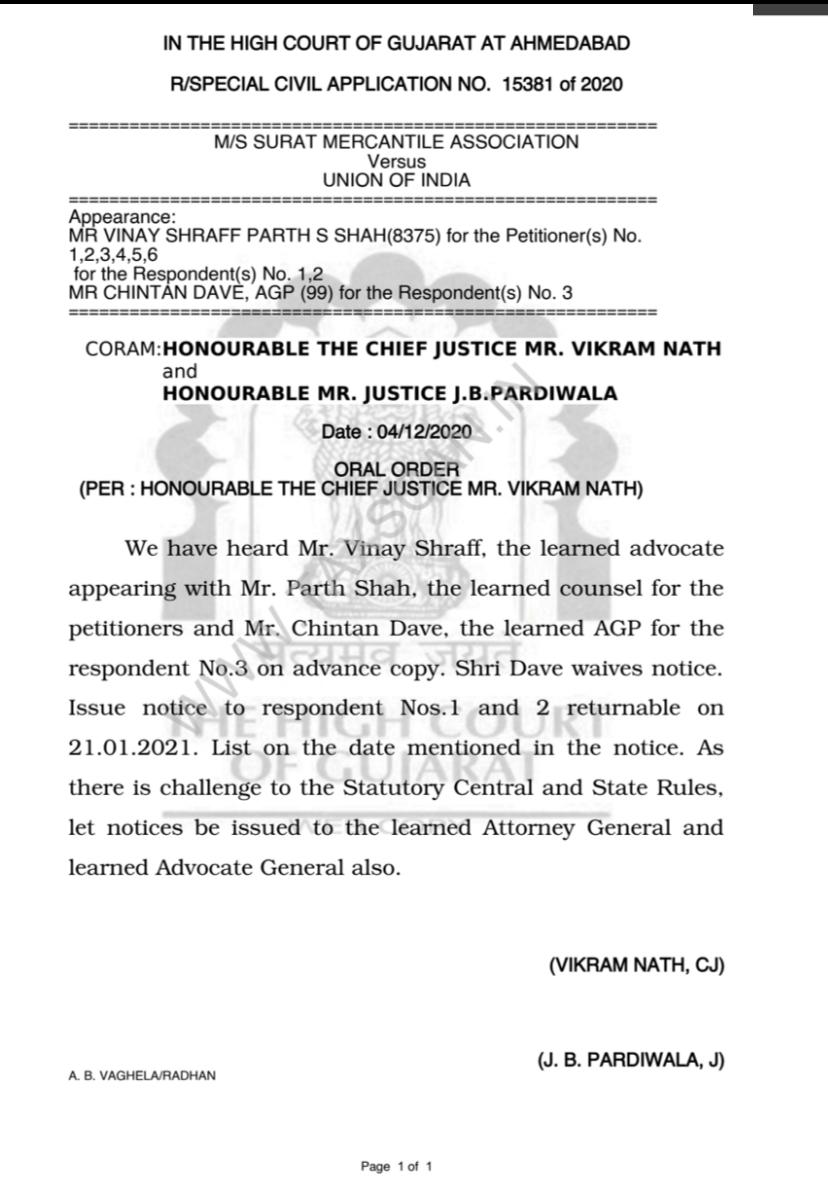

M/s Surat Mercantile Association

Versus

Union of India

Facts of the Case:

The Petitioner in the present writ petition under Article 226 of the Constitution of India, 1950 is challenging the constitutional validity and vires of the Rule 86A of the Central Goods and Services Tax Rules, 2017 and the Rule 86A of the Gujarat Goods and Services Tax Rules, 2017 (hereinafter the Central Goods and Services Tax Rules, 2017 and the Gujarat Goods and Services Tax Rules, 2017 are collectively referred to as the Rules). The Rule 86A of the Rules is ultra vires the Section 74, Section 75, Section 83 & Section 107 of the Central Goods and Services Tax Act, 2017 and the Section 74, Section 75, Section 83 & Section 107 of the Gujarat Goods and Services Tax Act, 2017 (hereinafter the Central Goods and Services Tax Act, 2017 and the Gujarat Goods and Services Tax Act, 2017 are collectively referred to as the Act). The Rule 86A is also ultra vires Article 14, Article 19(1)(g), and Article 300A of the Constitution of India.

Prayer:

In the aforesaid circumstances, the Petitioners most humbly pray before your Lordship:

To issue a writ of mandamus and/or any other appropriate writ(s) to hold and declare the Rule 86A of the Central Goods and Services Tax Rules, 2017 and the Rule 86A of the Gujarat Goods and Services Tax Rules, 2017 to be unconstitutional and ultra-virus the Central Goods and Services Tax Act, 2017 and the Gujarat Goods and Services Tax Act, 2017;

To Grant ad-interim relief with respect to prayer under Para (a) above by prohibiting the respondents from unilaterally blocking the electronic credit ledger of any registered taxable person till final disposal of this petition;

To issue an order(s), direction(s), the writ(s), or any other relief(s) as this Hon’ble Court deems fit and proper in the facts and circumstances of the case and in the interest of justice;

To award costs of and incidental to this application be paid by the Respondents;

And for this act of kindness, the Petitioners shall, as in duty bound, ever pray.

Order:

We have heard Mr. Vinay Shraff, the learned advocate appearing with Mr. Parth Shah, the learned counsel for the petitioners, and Mr. Chintan Dave, the learned AGP for respondent No.3 on an advance copy. Shri Dave waives notice. Issue notice to respondent Nos.1 and 2 returnable on 21.01.2021. List on the date mentioned in the notice. As there is a challenge to the Statutory Central and State Rules, let notices be issued to the learned Attorney General and learned Advocate General also.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.