Kerala AAR in the case of M/s. Habitat Technology Group

Table of Contents

Case Covered:

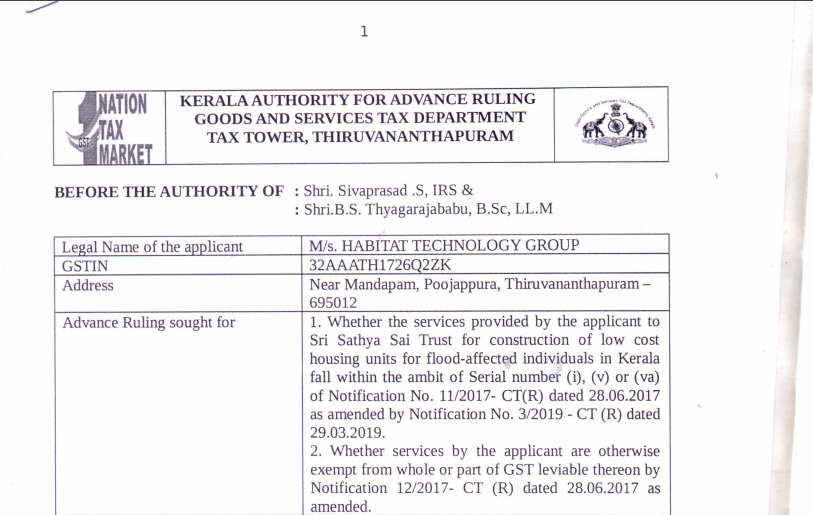

M/s. Habitat Technology Group

Facts of the Case:

Habitat Technology Group (hereinafter referred to as the “applicant”) is a nongovernmental organization in the shelter sector having sustainable building solutions and green and humane architecture. They are registered as a charitable society. They are providing services in the field of construction of residences and affordable housing, architectural advisory services, execution of government contracts, etc with a special focus on environment-friendly construction. Mis. Sri Sathya Sai Trust, Kerala a charitable organization engaged in various charitable activities across Kerala has awarded a rehabilitation project to the applicant for providing affordable shelter to the 2018 flood victims.

The applicant has sought advance ruling on the following;

i. Whether the services provided by the applicant to Sri Sathya Sai Trust for construction of low-cost housing units for flood-affected individuals in Kerala fall within the ambit of Serial number (i), (v) or (va) of Notification No.11/2017- CT(R) dated 28.06.2017 as amended by Notification No. 03/2019 – CT (R) dated 29.03.2019.

ii. Whether services by the applicant are otherwise exempt from whole or part of GST leviable thereon by Notification 12/2017- CT (R) dated 28.06.2017 as amended.

Observations:

The matter was examined in detail. As per the agreement dated 16.11.2019 entered by the applicant with Sri Sathya Sai Trust the applicant is awarded the work of construction of 45 residential units ad-measuring approximately equal to or less than 450 Square feet in different locations each along with residential facilities on the land belonging to the flood victims identified by the Trust. The applicant shall design the houses, obtain the statutory permits, and construct the houses and hand them over on a turnkey basis.

Ruling:

In view of the observations stated above, the following rulings are issued;

i. Whether the services provided by the applicant to Sri Sathya Sai Trust for construction of low-cost housing units for flood-affected individuals in Kerala fall within the ambit of Serial number (i), (v) or (va) of Notification No. 11/2017- CT(R) dated 28.06.2017 as amended by Notification No. 03/2019 – CT (R) dated 29.03.2019. The services provided by the applicant to Sri Sathya Sai Trust for construction of low-cost housing units fall within the ambit of Sl No.3 (v) of Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 as amended and is liable to GST at the rate of 12% [6% CGST and 6% SGST].

ii. Whether services by the applicant are otherwise exempt from whole or part of GST leviable thereon by Notification 12/2017- CT (R) dated 28.06.2017 as amended.

Related Topic:

Kerala AAR in the case of M/s Synthite Industries Ltd

Read & Download the Full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.