e Book of Schemes for Micro, Small and Medium Enterprises (MSMEs)

Table of Contents

eBook of Schemes for Micro, Small and Medium Enterprises (MSMEs)

MSME: Who we are?

The MSME sector is an important pillar of the Indian economy as it contributes greatly to the growth of the Indian economy with a vast network of around 30 million units, creating employment of about 70 million, manufacturing more than 6000 products, contributing about 45% to manufacturing output and about 40% of exports, directly and indirectly. There was a long pending demand from the sector to redefine MSME definition. The GoI has redefined MSME classification from July 1st, 2020 as follows:

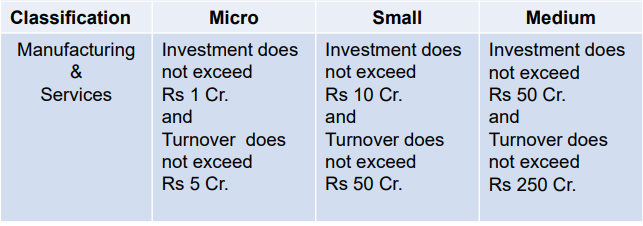

New MSME Classification w.e.f July 1st, 2020

Composite Criteria of Investment in Plant & Machinery or Equipment and Turnover

i. A composite criterion of investment in Plant & Machinery or Equipment and Turnover, as detailed in the matrix above, shall apply for classification of an enterprise as micro, small or medium.

ii. The criteria are applicable to the enterprise for both manufacturing and services sectors.

iii. If an enterprise crosses the ceiling limits specified for its present category in either of the two criteria of investment or turnover, it will cease to exist in that category and be placed in the next higher category but no enterprise shall be placed in the lower category unless it goes below the ceiling limits specified for its present category in both the criteria of investment as well as turnover.

iv. All units with Goods and Services Tax Identification Number (GSTIN) listed against the same Permanent Account Number (PAN) shall be collectively treated as one enterprise and the turnover and investment figures for all of such entities shall be seen together and only the aggregate values will be considered for deciding the category as a micro, small or medium enterprise.

Related Topic:

E-book on meaning of important terms used in GST by CA Ashok Batra

Udyam Registration

About

The government has organized a system to facilitate the registration of MSMEs. An enterprise for the purpose of this process will be known as Udyam and its Registration Process will be known as ‘Udyam Registration’. A permanent registration number will be given after registration.

After completion of the process of registration, a certificate will be issued online. This certificate will have a dynamic QR Code from which the web page on the Portal and details about the enterprise can be accessed. There will be no need for renewal of registration. The Registration Process is totally free of cost.

Related Topic:

Delayed payment to Micro and Small Enterprise’s & its Disclosure

Single window systems at Champions Control Rooms and at DICs will help in the process.

Any person who intends to establish a micro, small or medium enterprise may file Udyam Registration online in the Udyam Registration portal, based on self-declaration with no requirement to upload documents, papers, certificates, or proof.

Related Topic:

Download Updated GST E-book on Real estate

Basic Features

• MSME registration process is fully online, paperless and based on self-declaration.

• No documents or proof are required to be uploaded for registering an MSME, only an Aadhaar Number will be enough.

• PAN & GST linked details on investment and turnover of enterprises will be taken automatically from Government databases.

• Online system will be fully integrated with Income Tax and GSTN systems.

• PAN & GSTIN would be mandatory from 01.04.2021.

• Erstwhile EM-II or UAM registration or any other registration issued by any authority under the Ministry of MSME, will have to re-register under Udyam Registration.

• No enterprise shall file more than one Udyam Registration. However, any number of activities including manufacturing or service or both may be specified or added in one Registration.

Credit and financial assistance

• Prime Minister’s Employment Generation Programme (PMEGP)

• Credit Linked Capital Subsidy for Technology Upgradation (CLCSS)

• Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

• 2% Interest Subvention Scheme

• Rs 20,000 crore Subordinate debt for stressed MSMEs

Prime Minister’s Employment Generation Programme (PMEGP)

Objectives

• To generate employment opportunities in rural and urban areas of the country through the setting up of new self-employment projects/micro-enterprises in the non-farm sector.

• To provide continuous and sustainable employment to all segments of traditional and prospective artisans and rural/urban unemployed youth in the country, so as to help arrest migration of rural youth to urban areas.

• To increase the wage-earning capacity of artisans and contribute to increasing the growth rate of rural and urban employment.

Eligibility/ Applicability

• Any individual, above 18 years of age can apply (For project costing above 10 lakh in manufacturing and 5 lakh in the service sector, the applicant should have passed at least VIII standard).

• Self Help Groups, Institutions registered under Societies Registration Act 1860; Production Co-operative Societies and Charitable Trusts are also eligible.

Nature of Assistance

• The maximum cost of the project/unit eligible: Rs. 25 lakhs in case of the manufacturing sector and Rs. 10 lakhs in the case of the business/service sector.

• Subsidy under PMEGP (of project cost)//General category 15%.(Urban), 25%(Rural)/Special Category (including SC/ ST/ OBC/ Minorities/Women, Ex-servicemen, Physically handicapped, NER, Hill, and Border areas, etc.): 25%(Urban),35%(Rural).

• Second financial assistance up to Rs. 1.00 crore available for existing and better-performing PMEGP/ MUDRA/REGP registered units for expanding/upgrading existing units with a subsidy of 15% (20% in NER/Hilly States).

Read & Download the full copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.