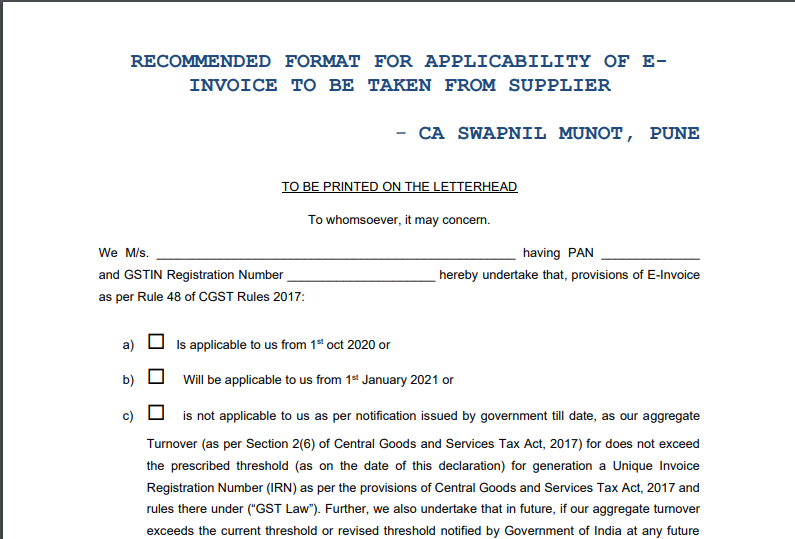

Recommended Format For Applicability of E-Invoice To Be Taken From Supplier

TO BE PRINTED ON THE LETTERHEAD

To whomsoever, it may concern.

We M/s. ___________________________________________________ having PAN ______________ and GSTIN Registration Number _____________________ hereby undertake that, provisions of E-Invoice as per Rule 48 of CGST Rules 2017:

a) Is applicable to us from 1st Oct 2020 or

b) Will be applicable to us from 1st January 2021 or

c) is not applicable to us as per notification issued by the government to date, as our aggregate Turnover (as per Section 2(6) of Central Goods and Services Tax Act, 2017) does not exceed the prescribed threshold (as of the date of this declaration) for generation a Unique Invoice Registration Number (IRN) as per the provisions of Central Goods and Services Tax Act, 2017 and rules thereunder (“GST Law”). Further, we also undertake that in the future, if our aggregate turnover exceeds the current threshold or revised threshold notified by the Government of India at any future date, then we shall issue e-invoice and credit/debit note in compliance with the required provisions of GST Law.

[ Select anyone from above (a), (b), (c) as applicable and strike out which is not applicable]

In case of any queries from any State or Centre Goods and Services Tax Authorities on applicability of Einvoice, M/s. __________________________________________will be solely responsible.

Yours Truly,

For M/s

Authorized Signatory

Name:____________________

Designation:_________________

Swapnil Munot

Swapnil Munot

Delhi, India

CA Swapnil Munot is having keen interest & expertise in Indirect Tax and Foreign Trade policy. He has authored a book on GST, titled “HANDBOOK ON GST”. Also authored E-Book on “GST E Way Bill” and “GST Amendment Act”. He has conducted 290+ Seminars across India on GST for Government Officers, Commissioners, Professionals and Industries at the various forums – FIEO, ICAI, MCCIA, MSME, WMTPA, CII, NACIN, ICMA (Now ICAI), YASHADA, Various Associations, Institution, and Colleges, etc.