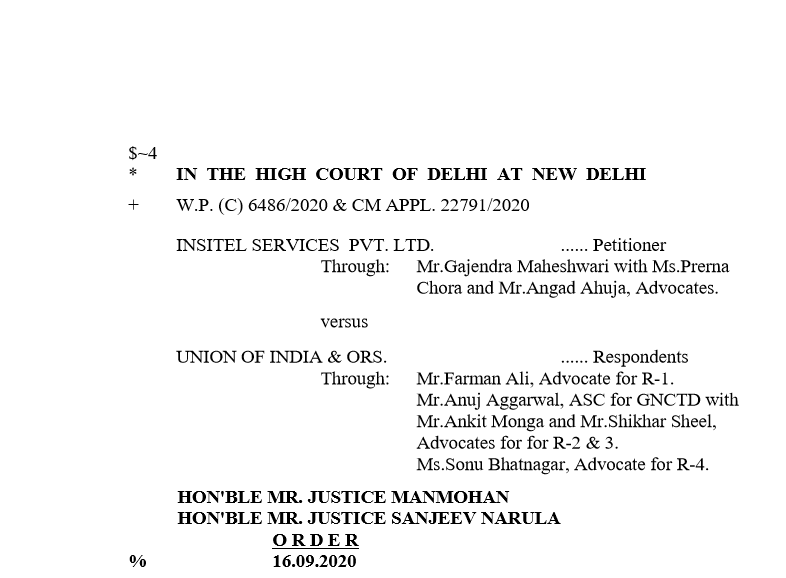

Delhi HC in the case of Insitel Services Pvt. Ltd. Versus Union of India

Table of Contents

Case Covered:

Insitel Services Pvt. Ltd.

Versus

Union of India

Facts of the Case:

The present writ petition has been filed challenging the Second Deficiency Memo dated 23rd July 2020 passed by respondent no. 3 under Rule 90(3) of the CGST Rules for the Financial Year 2019-2020 and for directions to the respondents to refund the excess tax of Rs.1,05,39,480 inadvertently paid by the petitioner along with applicable interest with effect from 17th February 2020 as well as for a declaration that Rule 90(3) of the CGST Rules is ultra vires Articles 14 and 19(1)(g) of the Constitution of India, or alternatively for Rule 90(3) of the CGST Rules to be read down to the effect that the rectification of deficiencies shall not be treated as submission of a fresh application for the purpose of computing limitation of applying for refund and grant of interest on delayed refund under the Central Goods and Services Tax Act, 2017.

Observations:

Learned counsel for the petitioner submits that the refund procedure in Rule 90(3) of the CGST Rules is arbitrary, illegal, and ultra vires for the reason that issuance of a deficiency memo effectively results in rejection of the refund application without giving any opportunity of hearing to the applicant.

He further submits that a refund application under Section 54 of the CGST Act read with Rule 89 and Rule 90(3) of the CGST Rules is automatically treated as rejected and the second refund application is treated as a fresh application and the interest amount is calculated only from the date of the second refund application or subsequent applications which are filed after receiving the deficiency memos. Thus, according to the petitioner, the applicants are deprived of their right to claim interest on a refund from the date of the initial application.

Related Topic:

References for Counter Affidavits to be filed for Writs

Issue notice.

The decision of the Court:

Mr.Farman Ali, Advocate accepts notice on behalf of respondent no.1. Mr.Anuj Aggarwal, ASC accepts notice on behalf of respondent nos.2 & 3, and Ms.Sonu Bhatnagar, Advocate accepts notice on behalf of respondent no.4. They are permitted to file their counter-affidavits within four weeks. Rejoinder affidavit, if any, be filed before the next date of hearing.

List on 09th December 2020.

The order be uploaded on the website forthwith. Copy of the order is also forwarded to the learned counsel through e-mail.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.