Important changes as per Notification No. 94/2020-CT dated 22-12-2020 Applicable from 1 January 2021

Table of Contents

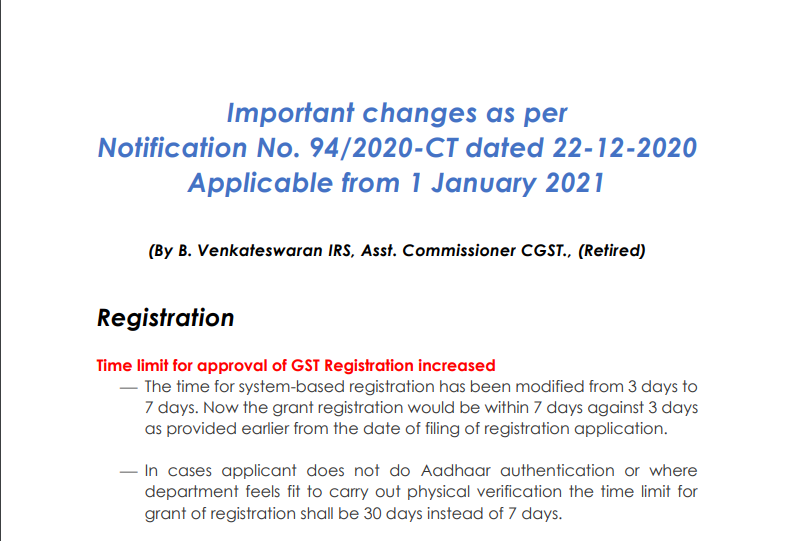

Important changes as per Notification No. 94/2020-CT dated 22-12-2020 Applicable from 1 January 2021

The registration Time limit for approval of GST Registration increased

⎯ The time for system-based registration has been modified from 3 days to 7 days. Now the grant registration would be within 7 days against 3 days as provided earlier from the date of filing of the registration application.

⎯ In cases, the applicant does not do Aadhaar authentication or where the department feels fit to carry out physical verification the time limit for grant of registration shall be 30 days instead of 7 days.

Powers for cancellation of GSTIN to Department increased

⎯ The officer can proceed for cancellation of GSTIN where a taxpayer avails Input Tax Credit (ITC) exceeding than that permissible in Section 16. Clause (e) has been inserted in Rule 21 of CGST Rules 2017. Cancellation without the opportunity of being heard Now, no opportunity of being heard shall be given to a taxpayer for suspension of GSTIN, where the proper officer (PO) has reasons to believe that the registration of person is liable to be cancelled. The words “opportunity of being heard has been omitted from clause (2) of Rule 21A.

Cancellation if there are anomalies in GSTR3B and GSTR-1

⎯ Significant deviation/anomalies between details of outward supply between GSTR 3B and GSTR1 or inward supplies (ITC) between GSTR 3B and GSTR 2B which indicate contravention of Act, the department shall now serve a notice in FORM GST REG 31 to call explanation and Taxpayer shall be required to submit his reply within 30 days of such notice being served to him.

GSTIN has suspended no refund

⎯ Where a GSTIN has suspended no refund u/s 54 of CGST Act 2017 can be availed by the taxpayer. First GSTIN Suspension proceedings have to be closed before applying for a refund.

Input Tax Credit

Restriction on a claim of ITC as per Rule 36(4)

The claim of ITC in respect of invoices not furnished by the corresponding vendors have now been restricted to 5% of the credit available in GSTR 2B. Any claim exceeding the specified limit shall result in a violation of CGST Act read with rules which may result in the suspension of GSTIN. The provision shall come into effect from 1st January 2021.

Restriction to avail ITC as per rule 86B

⎯ New Rule 86B is inserted w.e.f. 1st January 2021 wherein restriction has been placed on utilising more than 99% of tax liability from Input tax credit where the value of taxable supplies other than exempt supply and zero-rated supply exceeds Rs. 50 lakhs in a month.

⎯ Few exceptions have been provided to this rule which is as follows:

(i) Where the taxpayer has paid Income Tax exceeding Rs. 1 lakh in two preceding financial year.

(ii) Where a taxpayer has received refund exceeding Rs. 1 lakhs u/s 54 of CGST Act 2017.

(iii) Where a taxpayer has used electronic cash ledger to pay off liability on outward supplies which cumulatively makes 1% of the total liability up to the said month

(iv) Where a person is a Government Department, Public Sector Undertaking (PSU), local authority or a statutory body.

⎯ Taxpayer whose is restricted to avail ITC as per rule 86B shall also not be permitted to file GSTR 1 where he has not filed GSTR 3b for the preceding tax period.

Return related

GSTR 1 to be blocked in case of non-filing of two GSTR 3B

⎯ Where a taxpayer fails to file GSTR 3B for two subsequent months, his GSTR 1 shall now be blocked.

⎯ Similarly, for quarterly return filers, the taxpayer fails to file GSTR 3B for the preceding quarter shall not be permitted to file GSTR 1 of the subsequent quarter.

Taxable value and tax both should be in a match between GSTR 1 and GSTR 3B.

⎯ The liability declared in GSTR 3B is less than that declared in GSTR 1 in a particular month, the department may now proceed with the cancellation of GSTIN.

E-Way bill

The validity of the E-way bill reduced for 100 Km distance;

⎯ Earlier one day was permitted for a distance up to 100 km under e way bill provision. Now one day was permitted for a distance up to 200 km. This means that two-day validity granted to cover a distance up to 200 km, is reduced to one day.

CBIC today issued a clarification titled “MYTHS VS FACTS” in regard to GST registration cancellations and other steps taken for plugging tax evasion Myth 1 No opportunity of being heard will be given if the proper officer believes that registration is liable to be cancelled.

Fact 1:

GST registration is liable to be cancelled for those who have not filed 6 or more returns. It is, therefore, wrong to say that the cancellation will be done without reasons. To protect the interest of revenue, this provision has been put in the law so that fraudsters do not runway with GST collected from their customers.

No cancellation of registration would be done without giving the proper opportunity of hearing to the taxpayer.

Immediate action for suspension is necessary in cases where unscrupulous operators seek to pass on huge fake credit by gaming the system. Such action will not affect genuine taxpayers and will provide them with a level playing field.

Moreover, the suspension may be revoked by the officer based on the taxpayer’s representation.

Myth 2:

Even if there is a clerical error in filing returns, GSTIN will be cancelled. No option to correct your mistakes.

Fact 2:

This is absolutely not true. Only in fraudulent cases where there are significant discrepancies based on data analytics and sound risk parameters, and not mere clerical errors, the action of suspension and cancellation will be taken up.

An example of a fraudulent case and serious discrepancy is where one has passed on Crores of Rupees of Input Tax Credit and not filed GSTR3B returns, nor has he filed Income Tax returns or disclosed very little liability in Income Tax returns etc,

Myth 3:

The proposed change will impact the ease of doing business.

Fact 3

Not True. Fraudsters are misusing the system to the detriment of the interest of genuine taxpayers.

Consequently, data-driven targeting of the fraudsters is the need of the hour. The data is being collected from Income Tax, Banks, Customs and necessary matching are being done to identify fraudsters and take action of suspension and cancellation after following due process of law.