E-invoicing

Table of Contents

What is E-invoicing?

Electronic invoicing / e-invoicing is a form of electronic billing!

Why E-invoicing?

- E-invoicing is increasingly mandated by Governments across the world, particularly due to GST/VAT evasion

- Real-time invoice reporting discourages subsequent fraudulent changes/ adjustment

- Real-time reading of invoice/ data by Government

- Machines can read e-invoices

Invoice – ‘Pulse’ of business!

Inward supply (GSTR-2A) → Business Entity → Outward supply (GSTR-1)

E-invoicing – Globally!

South Korea

• Introduced in 2011 and mandated for most of the taxpayers from 2014

• Transition Phase – 3 years

Germany

• Framework shared in 2017

• At present, evolving

European Union

• EU is also recommending e-invoicing (EU Directive 2014/55/EU and EN 1693 standard)

In 2019, 55 billion (approx.) invoices were exchanged on a paperless basis (Billentis-Compacer Study)

Globally, a number of invoices is likely to encompass 550 billion p.a.

E-invoicing – For whom?

E-invoicing – What to do?

As a supplier

Is it applicable?

• If yes, comply!

• If no, keep track of future phases!

As a recipient

Is it applicable to vendors?

• If yes, make them comply!

• If no, keep track of future phases!

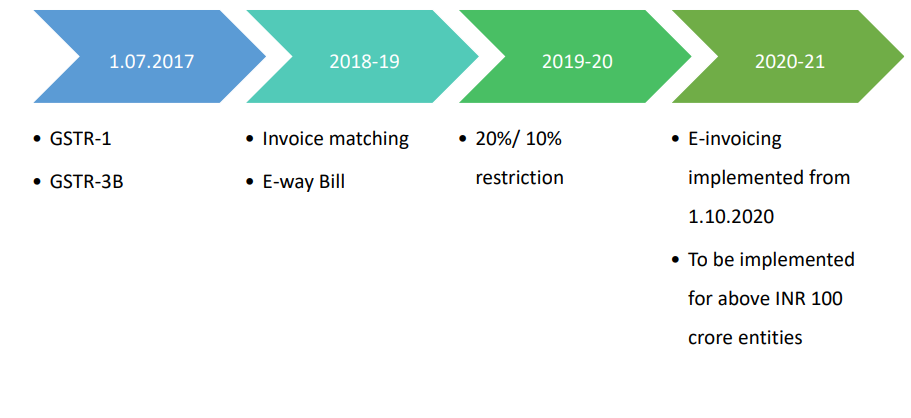

E-invoicing – Evolution in India!

E-invoicing – Evolution

E-invoicing – Status update!

Phase I (Implemented – 1.10.2020)

• Aggregate turnover above INR 500 crore!

Phase II (From – 1.01.2021)

• Aggregate turnover between INR 100 crore to 500 crores (Vide Not. No. 88/2020-CT)

Phase III ( Likely From – 1.04.2021)

• Aggregate turnover above INR 5 crore (hopefully not for below 5 crore taxpayers!)

Invoicing in India

Relevant Provisions!

Act

• Section 2 (66)

• Section 31

• Section 16

• Interest, penal provisions, etc

Rules

• Rule 46

• Rule 46A (TI-cumBoS)

• Rule 48 (Manner)

• Rule 49 (BoS)

• Rule 54 (Special cases)

• Rule 138A (E-way bill)

Notifications

• 2019 •Not. No. 31

• Not. No. 68 to 72 • 2020

• Not. No. 2/2020

• Not. No. 13 and 14

• Not. No. 60 and 61

• Not. No. 70 to 73

• Not. No. 88

Invoice in GST – Supplier

Meaning

• Section 2 (66)

• “Invoice” or “tax invoice” means the tax invoice referred to in section 31 [Sec. 2 (66)]

• Tax invoice includes a revised invoice [Sec. 31]

Supplier

• Section 31 – Tax invoice

• A registered person supplying taxable goods/ taxable services shall.. issue tax invoice

• Provided… by notification… specify… invoice shall be issued, within such time and in such manner as may be prescribed

Rules

• 46. Tax invoice – Subject to rule 54, a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars, namely…

• 54. Tax invoice in special cases