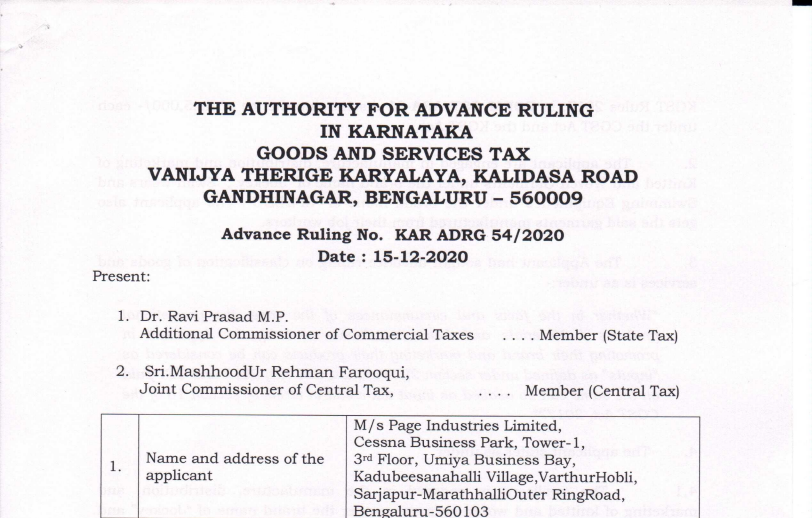

Karnataka AAR in the case of M/s. Page Industries Limited.

Table of Contents

Case Covered:

M/s. Page Industries Limited.

Facts of the Case:

The applicant is engaged in the manufacture, distribution, and marketing of Knitted and Woven Garments under the brand name of “Jockey”, swim-wears and Swimming Equipment under the brand name of “SPEEDO”. The applicant also gets the said garments manufactured from their job workers.

The applicant had sought a ruling on the classification of goods and services is as under:-

“Whether in the facts and circumstances of the case, the promotional products/ Materials and Marketing Items used by the Applicant in promoting their brand and marketing their products can be considered as “inputs” as defined under section 2(59) of the CGST Act, 2017 and GST paid on the same can be availed as an input tax credit in terms of Section16 of the CGST Act, 2017?”

Observations:

The applicant in the instant case disposes of/issues the distributable goods free of cost i.e., without any consideration to two categories i.e., Franchisees (Exclusive Show Rooms) and other shops/retailers, where all brands are sold (Retailers/ All brands stores). Now we examine each category whether they become related persons to the applicant or not.

Ruling:

- The ITC on GST paid on the procurement of the “distributable” products which are distributed to the distributors, franchisees are allowed as the said distribution amount to supply to the related parties which are exigible to GST. Further, the said distribution to the retailers for their use cannot be claimed as gifts to the retailers or to their customers free of cost, and hence ITC of the GST paid on such procurement is not allowed as per Section 17(5) of the GST Acts.

- The GST paid on the procurement of “non-distributable” products qualify as capital goods and not as “inputs” and the applicant is eligible to claim an input tax credit on their procurement, but in case if they are disposed of by writing off or destruction or lost, then the same needs to be reversed under Section 16 of the CGST Act, 2017 read with Rule 43 of the CGST Rules, 2017.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.