GST – Changes from 1.1.2021

GST – Changes from 1.1.2021

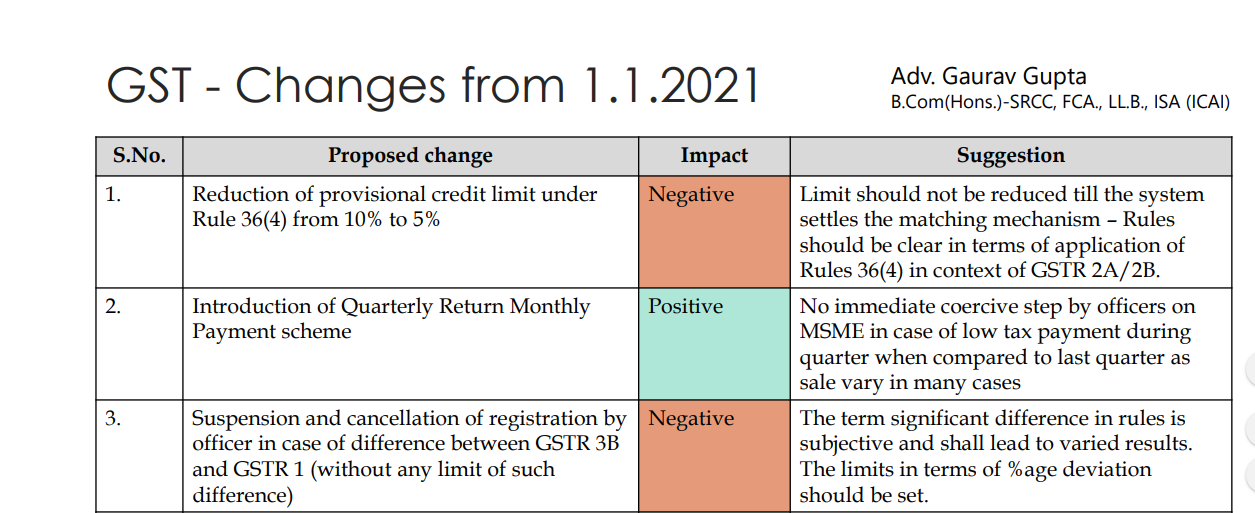

| S. No. | Proposed change | Impact | Suggestion |

| 1. | Reduction of provisional credit limit under Rule 36(4) from 10% to 5% | Negative | The limit should not be reduced till the system settles the matching mechanism – Rules should be clear in terms of the application of Rules 36(4) in the context of GSTR 2A/2B. |

| 2. | Introduction of Quarterly Return Monthly Payment scheme | Positive | No immediate coercive step by officers on MSME in case of low tax payment during the quarter when compared to last quarter as sale vary in many cases |

| 3. | Suspension and cancellation of registration by an officer in case of difference between GSTR 3B and GSTR 1 (without any limit of such difference) | Negative | The term significant difference in rules is subjective and shall lead to varied results. The limits in terms of %age deviation should be set. |

| 4. | No GSTR 1 incase two last period’s GSTR 3B has not been filed | Positive | |

| 5. | Suspension of registration – an opportunity of being heard deleted | Negative | This goes against the very principles of natural justice – Audi alteram partem cannot be deleted from any administrative action |

| 6. | Rule 86B – Restriction of ITC to 99% | Negative | Eligible ITC once availed is a vested right of a taxpayer and such a right is useful when its seamless use for payment of output tax is made. The relaxations shall not be of help to newly established new startups / large infra projects which incur losses in their initial years. |

| 7. | Introduction of stricter control in case of new registrations – Biometric-based Aadhaar authentication and Photograph | Positive | Would make it tough for establishing fake firms. However, the genuine business should not be troubled with lengthy procedural formalities (when the physical visit is already done). |

| 8. | Increase in time for grant of new Registration (3 days to 7 days) | Neutral | The increased time limit should at least be honored in giving registrations |

| 9. | The validity of the E-way bill increased to 200 Kms per day (from 100 Kms per day) | Negative | Considering the road infrastructure, it is not right to push the travel speed of carriers. |

CA Gaurav Gupta

CA Gaurav Gupta

New Delhi, India