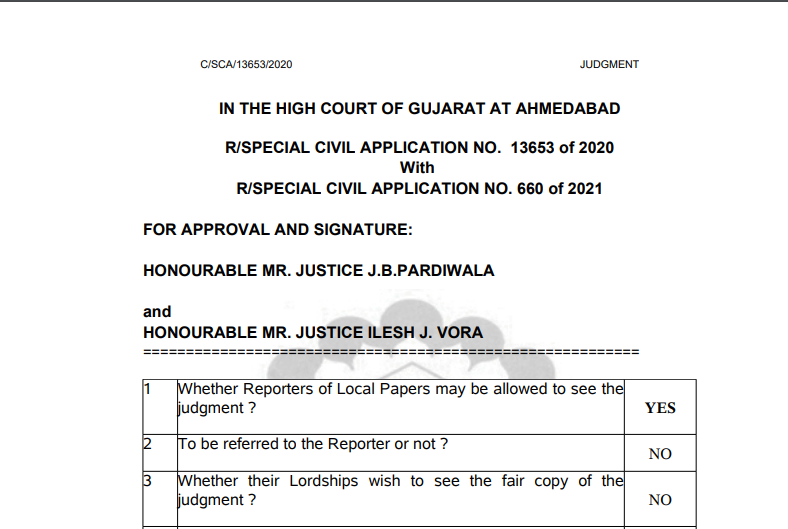

Gujarat HC in the case of The All Gujarat Federation of Tax Consultants Versus Union of India

Table of Contents

Case Covered:

The All Gujarat Federation of Tax Consultants

Versus

Union of India

Facts of the Case:

The operative part of the order passed by this Court dated 8th January 2021 in the Special Civil Application No. 13653 of 2020 reads as under:

“21 We are of the view that the respondent No.1 – Union of India, Ministry of Finance should immediately look into the issue, more particularly, the representation dated 12th October 2020 at Annexure: I of the paper book (page 108) and take an appropriate decision at the earliest in accordance with the law. We, accordingly, direct respondent No.1 to do so. While taking an appropriate decision, the Union shall bear in mind the observations made by this High Court in the two above noted judgements, more particularly, the observations of the Supreme Court in the case of Vaghjibhai S. Bishnoi (supra) that the powers given to the CBDT are beneficial in nature to be exercised for the proper administration of fiscal law so that undue hardship may not be caused to the taxpayers. The purpose is of just, proper and efficient management of the work of assessment and the public interest. One additional aspect that needs to be kept in mind before taking an appropriate decision that the time period for the officials of the tax department has been extended up to 31st March 2021 having regard to the current covid19 pandemic situation. If that be so, then some extension deserves to be considered in accordance with the law. Let an appropriate decision be taken by 12th January 2021.

22 Post this matter on 13th January 2021 on top of the Board.

23 Mr. Patel, the learned Senior Standing Counsel appearing for the respondents Nos. 2 and 3 shall apprise this Court of any decision or development in the matter on the next date of hearing.”

Observations:

To sum up, (a) certain conditions have to be satisfied before a writ of mandamus is issued; (b) the petitioner for a writ of mandamus must show that he has a legal right to compel the respondent to do or abstain from doing something; (c ) there must be in the petitioner a right to compel the performance of some duty cast on the respondents; (d) the duty sought to be enforced must have three qualities. It must be a duty of public nature created by the provisions of the Constitution or of a statute or some rule of common law; (e) the remedy of a writ of mandamus is not intended to supersede completely the modes of obtaining relief by an action in a Civil Court or to deny defense legitimately open in such actions; (f) the power to issue a writ of mandamus is a discretionary power. It is a sound use of discretion to leave the party to seek his remedy by the ordinary mode of action in a Civil Court and to refuse to issue a writ of mandamus; (g) a writ of mandamus is not a writ of course or a writ of right but is, as a rule, a matter for the discretion of the Court; (h) in petitions for a writ of mandamus, the High Courts do not act as a Court of appeal and examine the facts for themselves. It is not the function of the Court to substitute its wisdom and discretion for that of the person to whom the judgment in the matter in question was entrusted by law. The High Court does not issue a writ of mandamus except at the instance of a party whose fundamental rights are directly and substantially invaded or are in imminent danger of being so invaded; (i) a writ of mandamus is not issued to settle private disputes or to enforce private rights. A writ of mandamus cannot be issued against the President of India or the Governor of State; (j) A writ will not be issued unless the Court is certain that its command will be carried out. The Court must not issue a futile writ.

The Decision of the Court:

It is the case of the CBDT that it has declined to exercise its power under Section 119 of the Act as the conditions for the exercise of such power do not exist. It is the case of the Revenue that the issue of hardship was dealt with considerably at the relevant point of time and that is the reason why three times the time limit came to be extended. The Board has now thought fit in the interest of the Revenue not to extend the time period any further. There are so many vital issues which the Revenue needs to keep in mind before taking such a decision. The question is whether this Court should go into all such issues which weighed with the CBDT in taking a particular decision one way or the other and substitute the same with that of this Court on the ground that if the time limit is not extended, then the people at large would be put immense hardships? Interference at the end of this Court, at this point in time, in the matters relating to the Revenue may have far-reaching implications. This Court may find it very easy to issue a writ of mandamus, as prayed for, saying that if the time limit has been extended in the past on three occasions, then why not for one last time up to 31st March 2021. However, such a line of reasoning or approach may upset the entire functioning of the Government and may lead to undesirable results.

In the overall view of the matter, we have reached the conclusion that we should not interfere in the matter.

As a result, both the writ applications fail and are hereby rejected. At this stage, we may only observe that the CBDT may consider issuing an appropriate circular taking a lenient view as regards the consequences of late filing of the Tax Audit Reports as provided under Section 271B of the Act. We leave it to the better discretion of the CBDT in this regard.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.