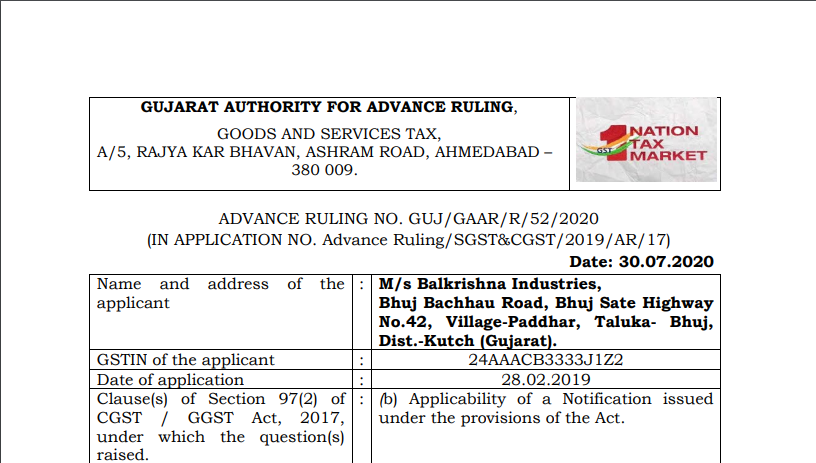

Gujarat AAR in the case of M/s Balkrishna Industries

Table of Contents

Case Covered:

M/s Balkrishna Industries

Facts of the Case:

The applicant submitted that they, M/s Balkrishna Industries, Mumbai, are one of the leading manufacturer and exporters of Tyres mainly used for special applications such as agricultural tractors and their various attachments, industrial and construction equipment, etc. They export more than 85% of their products all over the world including the developed countries viz. UK, USA, France, Germany, Australia, etc. They have been accredited as an ISO9001-2000-Quality Management System and ISO 14001:2015 standard for Environmental Management Systems are accredited with prestigious status as “Four Star Export House”.

They sought for advance ruling in respect of the following questions:

Question 1: Whether availing exemption under Notification No.79/2017-Cus dated 13.10.2017 in respect of additional duty of customs under sub-Section (1), (3) and (5) of Section 3, the anti-dumping duty under section 9A, but opting to pay IGST on the import of goods under Advance Authorization, would tantamount to availing the benefits of exemption under Notification No.79/2017-Cus dated 13.10.2017, as contemplated under Rule 96(10) of CGST Rules, 2017?

Question 2: If the answer to the above question is negative, then whether the applicant is allowed to export goods on payment of IGST and claim refund thereof under Rule 96(10) of CGST Rules, 2017?

Observations:

We note that for implementing the scheme of duty-free import, Notification No. 18/2015–Customs dated 1st April, 2015 was issued under the Customs Act, 1962. This Notification exempts materials imported into India against a valid Advance Authorisation issued by the Regional Authority in terms of paragraph 4.03 of the Foreign Trade Policy (hereinafter referred to as the said authorisation) from the whole of the duty of customs leviable thereon which is specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) and from the whole of the additional duty, safeguard duty, transitional product-specific safeguard duty and the anti-dumping duty leviable thereon, respectively, under sections 3, 8B, 8C and 9A of the said Customs Tariff Act.

Subsequent to the introduction of Goods and Service Tax regime, Integrated GST (IGST) was applicable on import of inputs under Advance Authorisation as the above notification was not amended to provide for IGST exemption. Subsequent to exporters’ representations, Notification No. 79/2017-Customs dated 13th October 2017 was issued amending the above Notification No.18/2015–Customs to allow exemption from the IGST and Compensation Cess on import of goods related to Advance Authorisation(AA). Further, as per the condition (xiii) inserted vide Notification No.79/2017- Customs, the exemption from integrated tax and the goods and services tax compensation cess leviable thereon under sub-section (7) and sub-section (9) of section 3 of the said Customs Tariff Act shall be available up to the 31st March 2018. Further, vide Notification No. 35/2018-Customs dated 28th March 2018, the exemption from integrated tax and the goods and services tax compensation cess leviable thereon is extended up to the 1st October 2018.

Ruling:

Question 1: Whether availing exemption under Notification No.79/2017-Cus dated 13.10.2017 in respect of additional duty of customs under sub-Section (1), (3) and (5) of Section 3, the anti-dumping duty under section 9A, but opting to pay IGST on the import of goods under Advance Authorization, would tantamount to availing the benefits of exemption under Notification No.79/2017-Customs, dated 13.10.2017, as contemplated under Rule 96(10) of CGST Rules, 2017?

Answer: Answered in the Affirmative, as discussed above.

Question 2: If the answer to the above question is negative, then whether the applicant is allowed to export goods on payment of IGST and claim refund thereof under Rule 96(10) of CGST Rules, 2017?

Answer: Answered in the Negative, as discussed above.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.