Gist of Quarterly Return Monthly Payment Scheme

Table of Contents

- The gist of Quarterly Return Monthly Payment Scheme

- Change in GST Returns Filing System w.e.f. 1st January 2021

- The gist of Legal Provisions- QRMP Scheme

- The gist of the QRMP Scheme

- Eligibility for the Scheme

- Snapshot of Scheme

- Method 1: Monthly Payment under the QRMP Scheme

- QRMP Scheme- Invoice Furnishing Facility (IFF)

- Why IFF?

- What is IFF?

- Read & Download the full copy in pdf:

The gist of Quarterly Return Monthly Payment Scheme

Change in GST Returns Filing System w.e.f. 1st January 2021

| Existing System | New System from Jan 2021 |

| Monthly filing of GSTR-3B for all taxpayers | Option to file quarterly GSTR-1 and GSTR-3B for taxpayers having aggregate turnover up to 5 Crs. |

| Monthly filing of GSTR-1 for taxpayers having aggregate turnover of more than 1.5 Crs. | Mandatory Monthly filing of GSTR-3B and GSTR-1 for all taxpayers having aggregate turnover of more than 5 Crs. |

| Quarterly filing of GSTR-1 for taxpayers having aggregative turnover up to Rs. 1.5 Crs. | However, tax payment would be monthly for all taxpayers |

| GSTR-3B is monthly and GSTR-1 is either quarterly or monthly | Now, both GSTR-1 and GSTR-3B will either be quarterly or monthly |

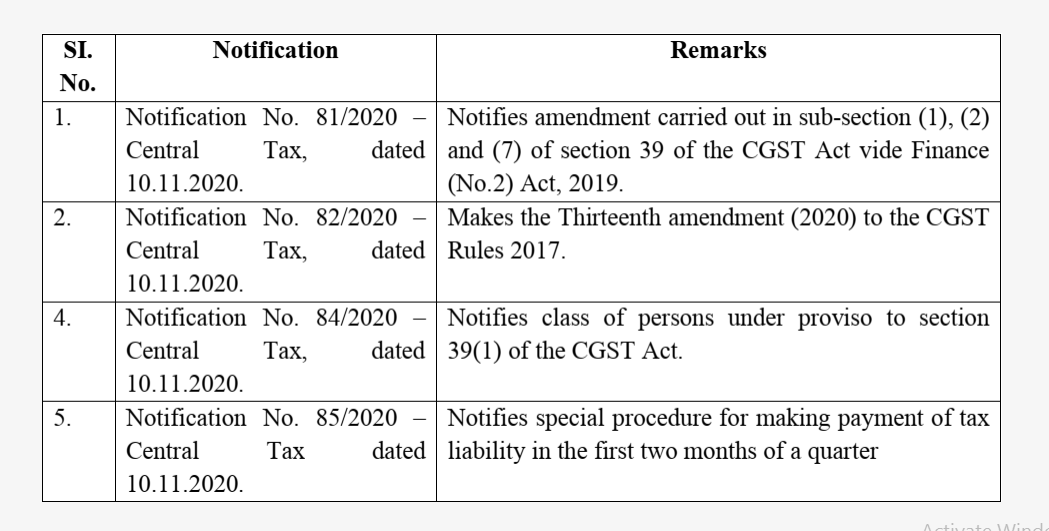

The gist of Legal Provisions- QRMP Scheme

The gist of the QRMP Scheme

Eligibility for the Scheme

- Small regular taxpayers having aggregate turnover up to 5 crs. in a preceding financial year,

- The Scheme is not applicable to those who are not required to file GSTR-3B and GSTR-1.

- The Scheme is optional and not mandatory

Related Topic:

Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift

Snapshot of Scheme

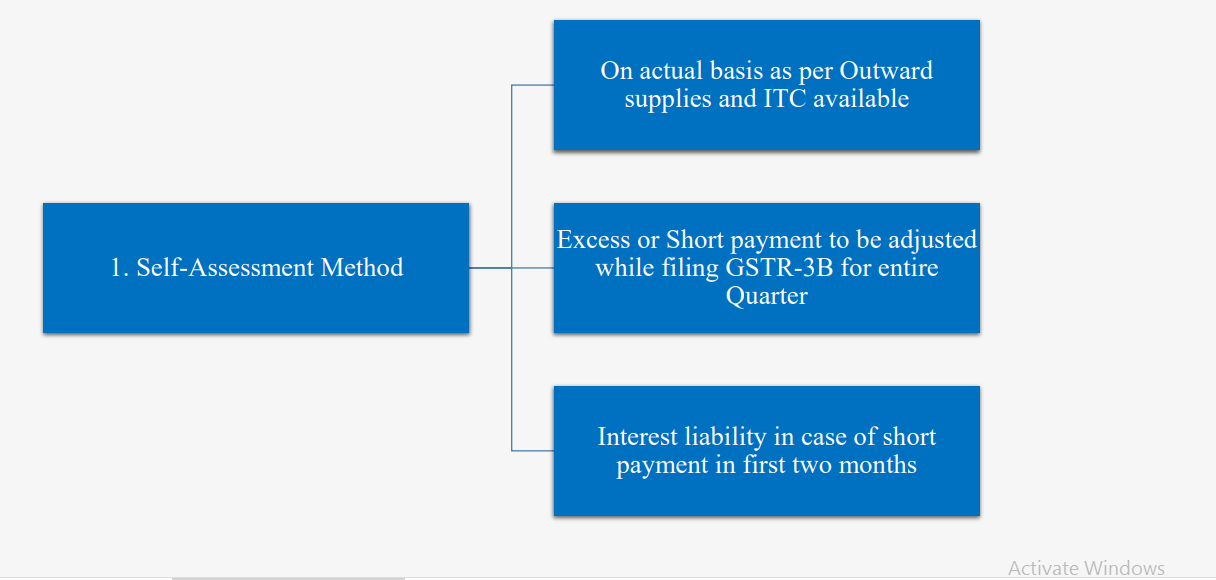

- Pay GST for the first two months by 25th of Next month by depositing liability in Cash ledger in PMT-06 at GST Portal either

-on an estimated basis as per formula as notified by the Government or

-on actual basis on a self-assessment basis

- File GSTR-3B on a quarterly basis by 22nd or 24th of next month including payment of GST liability for the third month and adjustments, if any for the first two months

- File GSTR-1 on a quarterly basis by the 13th of next month

Method 1: Monthly Payment under the QRMP Scheme

QRMP Scheme- Invoice Furnishing Facility (IFF)

Why IFF?

The Invoices of the Taxpayers opting for the Scheme shall appear in GSTR-2A and 2B of the recipient after the end of the quarter whereas the monthly recipient will claim ITC in GSTR-3B on a monthly basis, thereby mismatch of ITC in 3B vs. 2A/2B

What is IFF?

- To ensure monthly reflection of ITC in GSTR-2A and 2B of the monthly recipient, a separate optional facility for furnishing B2B invoices/Debit Notes/Credit Notes during the first two months of the Quarter has been provided through Invoice Furnishing Facility (IFF)

- The cumulative value of supplies of such documents cannot exceed INR 50 lacs for each month.

- The IFF shall be available for the first two months of the quarter between 1st to 13th of the succeeding month

Read & Download the full copy in pdf:

CA Nikhil M Jhanwar

CA Nikhil M Jhanwar

Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.