Taxability on Retention of Advance Money upon Cancellation of Contract

Table of Contents

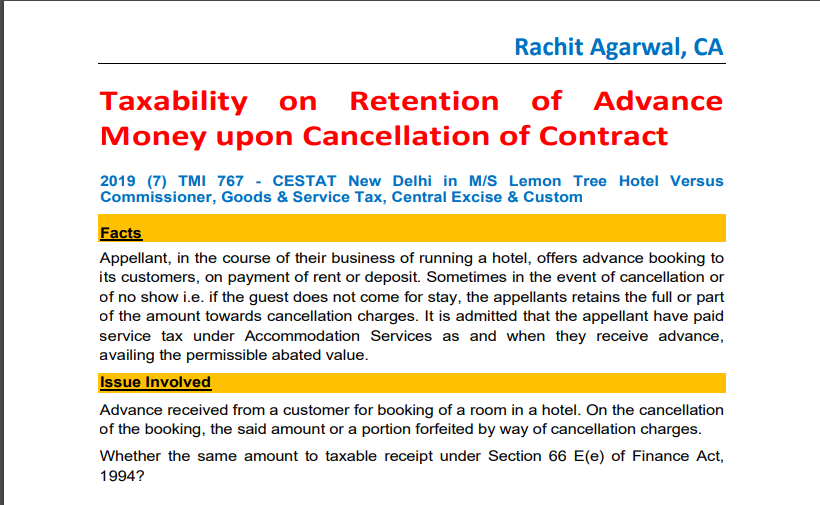

Taxability on Retention of Advance Money upon Cancellation of Contract

2019 (7) TMI 767 – CESTAT New Delhi in M/S Lemon Tree Hotel Versus Commissioner, Goods & Service Tax, Central Excise & Custom

Facts

Appellant, in the course of their business of running a hotel, offers advance booking to its customers, on payment of rent or deposit. Sometimes in the event of cancellation or of no show i.e. if the guest does not come for a stay, the appellants retain the full or part of the amount towards cancellation charges. It is admitted that the appellant has paid service tax under Accommodation Services as and when they receive an advance, availing the permissible abated value.

Issue Involved

Advance received from a customer for booking of a room in a hotel. On the cancellation of the booking, the said amount or a portion forfeited by way of cancellation charges. Whether the same amount to taxable receipt under Section 66 E(e) of Finance Act, 1994?

Held that

1. The customers pay an amount to the appellant in order to avail the hotel accommodation services, and not for agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act; and chargeable on full value and not on abated value.

2. The amount retained by the appellant is for, as they have kept their services available for the accommodation, and if in any case, the customers could not avail the same, thus, under the terms of the contract, they are entitled to retain the whole amount or part of it.

3. Accordingly, I hold that the retention amount (on cancellation made) by the appellant does not undergo a change after receipt.

4. Accordingly, I hold that no service tax is attracted under the provisions of Section 66 E(e) of the Finance Act. Accordingly, this ground is allowed in favour of the appellant.

CA Rachit Agarwal

CA Rachit Agarwal