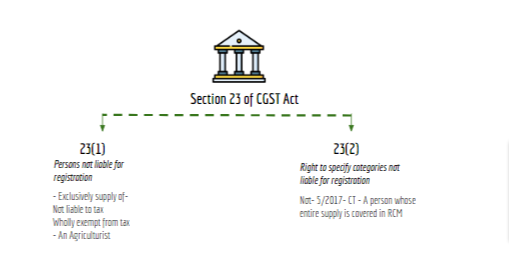

Section 23 of CGST Act: not liable for registration (updated till on July 2024)

Section 23 of the CGST Act as amended by the Finance Act 2023

Note: Section 23 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section:

“(1) The following persons shall not be liable to registration, namely:––

(a) any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under this Act or under the Integrated Goods and Services Tax Act;

(b) an agriculturist, to the extent of supply of produce out of cultivation of land.

(2) The Government may, on the recommendations of the Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act.”

(2) Notwithstanding anything to the contrary contained in sub-section (1) of section 22 or section 24, the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, specify the category of persons who may be exempted from obtaining registration under this Act.

(As given in CGST Act)

chart of the Section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.