Summary of Important GST Changes By Budget – Finance Bill, 2021

Table of Contents

Summary of Important GST Changes By Budget – Finance Bill, 2021

Introduction:

Hon’ble Finance Minister Smt. Nirmala Sitharaman Ji has placed her third consecutive budget after taking charge of the Finance Ministry. This Budget will be the first of this new decade 2021-2030. This time, due to COVID-19, budget printing was not undertaken and therefore it is declared that this Budget is “Digital Budget”.

Related Topic:

Memorandum To Hon. FM On GST Problems

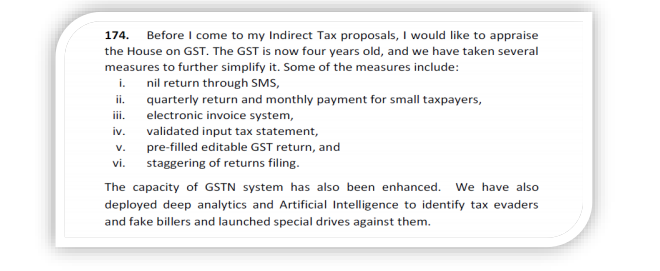

Budget Speech – GST Matter:

Hon’ble Finance Minister Smt. Nirmala Sitharaman said, “As Chairperson of the Council, I want to assure the House that we shall take every possible measure to smoothen the GST further, and remove anomalies such as the inverted duty structure”. She also categorically said below:

Analysis

BELOW IS ANALYSIS OF AMENDMENT MADE IN GST BY THE FINANCE BILL, 2021. SOME OF THE AMENDMENTS ARE GOING TO BE ADVERSE IMPACT ON TRADE AND BUSINESS:

| HEADING | SECTION REFERENCE | AMENDMENT MADE BY BUDGET |

| GST on Club/ Association | Sec 7(1)(aa) introduced retrospectively from 1st July 2017 | This section is introduced to clarify governments’ stand on GST on AOP/ Societies etc. The section is introduced to ensure levy of tax on activities or transactions involving the supply of goods or services by any person, other than an individual, to its members or constituents or vice-versa, for cash, deferred payment, or other valuable consideration. |

| ITC Matching provision made more stronger now | Clause (aa) introduced in Sec 16(2), to allow ITC only if details are uploaded by the supplier | This clause is being inserted to provide that input tax credit on invoice or debit note may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note. This amendment will ack like backing up for Rule 36(4). |

| Audited GST Reconciliation Statement not required. | Sec 35(5) Removed. Also, Amendment made in Sec 44 accordingly. | This section is being omitted so as to remove the mandatory requirement of getting annual accounts audited and reconciliation statements submitted by specified professionals. Now GSTR 9C can be filed without certification. This amendment will be effective from a future date.

In a real sense, the Taxpayer will still get this work done and verified by professionals, so as to ensure that information is correctly reported so that there will not be an issue during the Departmental Audit / Assessment. |

| Interest on Net Liability | Proviso under Sec 50(1) is substituted retrospectively from 1st July 2017 | This provision is being amended, retrospectively from 1st July 2017, so as to charge interest on net cash liability. |

| Seizure and Confiscation | Amendment to Sec 74 | Section 74 of the CGST Act is being amended so as make seizure and confiscation of goods and conveyances in transit a separate proceeding from the recovery of tax. |

| Provisional Attachment is now valid from day one of proceeding | Sec 83(1) is replaced to allow attachment from day one | Provision is being amended so as to provide that provisional attachment shall remain valid for the entire period starting from the initiation of any proceeding under Chapter XII, Chapter XIV, or Chapter XV till the expiry of a period of one year from the date of the order made thereunder |

| Filing of Appeal under Sec 129(3) for detention/sizer of goods | Proviso inserted in Sec 107(6), to make 25% penalty payment mandatory for filing Appeal | A proviso is being inserted to provide that no appeal shall be filed against an order made under Sec 129(3) unless a sum equal to 25% of the penalty has been paid by the appellant. |

| The penalty in case of E Way Bill default | Sec 129 (1) Penalty in case of E way Bill default increased to 200% |

• Earlier for the release of goods, the tax was also required to be paid. Now no such requirement. Meaning thereby tax can be paid on the same in GSTR 3B • Time list of 7 days for notice and 7 days for the order provided in the act. Earlier no such time limit was provided. • If the vehicle is also detained, the same can be released by the transporter, now on payment of a penalty or Rs 1 lakhs, whichever is lower. |

| Para 7 of Sch II omitted | Para 7 of Schedule II omitted retrospectively from 1st July 2017 | Consequent to the amendment in section 7 of the CGST Act paragraph 7 of Schedule II to the CGST Act is being omitted retrospectively, with effect from the 1st July 2017 |

| Export condition for supply to SEZ | Sec 16(1) of IGST is amended to add the condition of authorized operation for SEZ | Section 16 of the IGST Act is being amended so as to:

(i) zero rate the supply of goods or services to SEZ unit only when the said supply is for authorized operations; (ii) restrict the zero-rated supply on payment of integrated tax only to a notified class of taxpayers or notified supplies of goods or services; and (iii) link the foreign exchange remittance in case of export of goods with a refund |

Related Topic:

Applicability of GST on a Bill to Ship to transaction where Supplier and Recipient of goods are located outside India.

Conclusion:

Vide The Finance Bill 2021, the government has made some amendment, which is going to have an adverse impact on Trade and Industry in a big way. such as

- Allowability of ITC only if it is uploaded by the supplier,

- E Way Bill Penalty increased to 200%,

- Supply to SEZ will be treated as Zero Rate only if it is for Authorised Operation,

- Limited applicability of Export on Payment of Tax,

- Compulsorily realization of Export proceeds within the time limit for Refund

Said amendment is demotivating for Trade and Business. There is no such smell of simplifications as assured by the finance minister in her speech. Rather, now trade and industry need to more cautious and alert, for GST Compliances.

Related Topic:

Who is required to make an E-way bill in GST? procedure and liability

[Disclaimer: This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. We cannot accept any responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication.]

Swapnil Munot

Swapnil Munot

Delhi, India

CA Swapnil Munot is having keen interest & expertise in Indirect Tax and Foreign Trade policy. He has authored a book on GST, titled “HANDBOOK ON GST”. Also authored E-Book on “GST E Way Bill” and “GST Amendment Act”. He has conducted 290+ Seminars across India on GST for Government Officers, Commissioners, Professionals and Industries at the various forums – FIEO, ICAI, MCCIA, MSME, WMTPA, CII, NACIN, ICMA (Now ICAI), YASHADA, Various Associations, Institution, and Colleges, etc.