Notification No. 2/2021-Customs

Notification No. 2/2021-Customs

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 2/2021-Customs

New Delhi, the 1st February 2021

G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962) and sub-section (12) of section 3 of Customs Tariff Act, 1975 (51 of 1975), the Central Government, on being satisfied that it is necessary for the public interest so to do, hereby makes the following further amendments in the notification of the Government of India, Ministry of Finance (Department of Revenue), No. 50/2017- Customs, dated the 30th June 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 785(E), dated the 30th June 2017, namely:-

In the said notification, –

I. in the Table, –

(1) against S. No. 20, in column (3), for the entry, the entry “Pulses [other than Peas (Pisum sativum), Tur, Chickpeas, Kabuli Chana, Bengal Gram and Masoor (Lentils)]” shall be substituted;

(2) against S. Nos. 20A, 21A, 21B, 21C, 21D in column (4), for the entry, the entry “10%” shall be substituted;

(3) S. No. 21E and the entries relating thereto shall be omitted;

(4) against S. No. 32A, in column (4), for the entry, the entry “15%” shall be substituted;

(5) against S. No. 32B, in column (4), for the entry, the entry “35%” shall be substituted;

(6) S. No. 44 and the entries relating thereto shall be omitted;

(7) against S. Nos. 57, 61, 70 in column (4), for the entry, the entry “15%” shall be substituted;

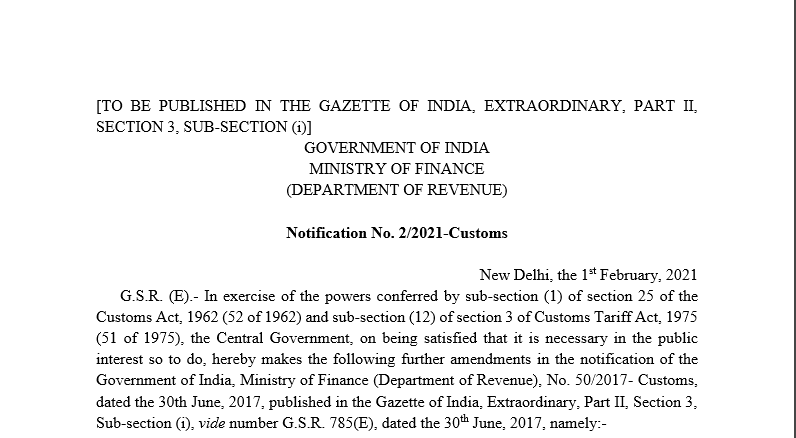

(8) after S. No. 104 and the entries relating thereto, the following S. No. and entries shall be inserted, namely: –

(9) S. Nos. 107, 109, 110, 111, 112, 114, 116, 118 and the entries relating thereto shall be omitted;

(10) against S. No. 119, in column (3), for the entry, the entry “Shrimp larvae feed” shall be substituted;

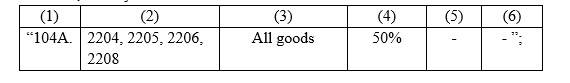

(11) after S. No. 119 and the entries relating thereto, the following S. No. and entries shall be inserted, namely: –

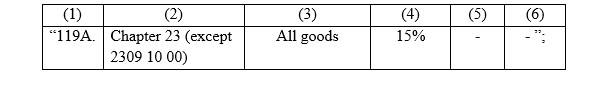

(12) for S. No. 130 and the entries relating thereto, the following S. No. and entries shall be substituted, namely: –

(13) S. Nos. 131, 140 and the entries relating thereto shall be omitted;

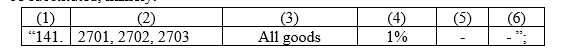

(14) for S. No. 141 and the entries relating thereto, the following S. No. and entries shall be substituted, namely: –

(15) against S. No. 147A, in column (4), for the entry, the entry “2.5%” shall be substituted;

(16) against S. No. 175, in column (2), for the entry, the entry “2501” shall be substituted;

(17) S. Nos. 202, 203, 209 and the entries relating thereto shall be omitted;

(18) against S. No. 210, in column (4), for the entry, the entry “5%” shall be substituted;

(19) against S. No. 219, in column (2), for the figures “3102 21 00”, the figures “3102 21 00, 3102 30 00,” shall be substituted;

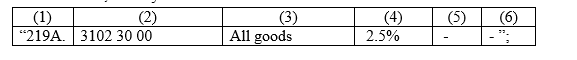

(20) after S. No. 219 and the entries relating thereto, the following S. No. and entries shall be inserted, namely: –

(21) against S. Nos. 221, 226, 228 in column (4), for the entry, the entry “Nil” shall be substituted;

(22) S. No. 229 and the entries relating thereto shall be omitted with effect from the 1st day of April 2021;

(23) S. No. 230 and the entries relating thereto shall be omitted;

(24) against S. No. 237, in column (6), for the entry, the entry “9 and 22” shall be substituted;

(25) against S. Nos. 254, 255, in column (6), for the entry, the entry “9 and 24” shall be substituted;

Read & Download the full Notification in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.