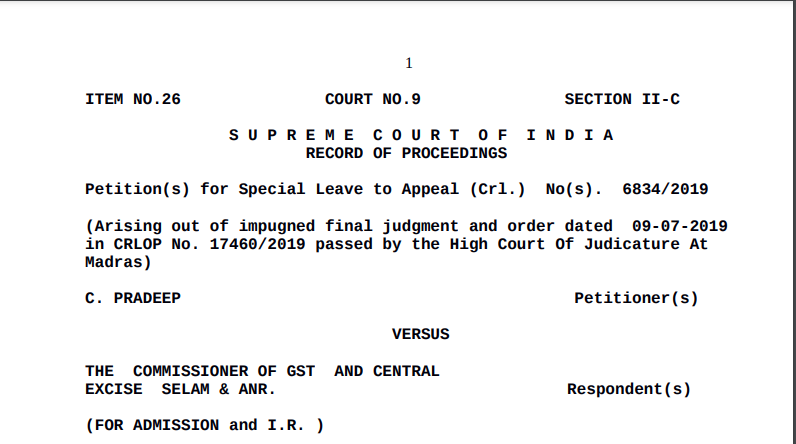

Supreme Court in the case of C. Pradeep Versus The Commissioner of GST And Central Excise

Table of Contents

Case Covered:

C. Pradeep

Versus

The Commissioner of GST And Central Excise

Order:

Learned counsel for the petitioner submits that indisputably assessment for the relevant period has not been completed by the Department so far. In which case, invoking Section 132 of the Central Goods and Services Tax Act, 2017 does not arise. He further submits that, even if, the alleged liability of Rs. 19 crores as is assumed by the Department is accepted, it is open to the petitioner to file an appeal after the assessment order is passed; and as per the statutory stipulation, such appeal could be filed upon deposit of only 10% of the disputed liability. In that event, the deposit amount may not exceed Rs. 2,00,00,000/- (Rupees Two Crores), which the petitioner is willing to deposit within one week from today without prejudice to his rights and contentions in the assessment proceedings and the appeal to be filed thereafter, if required.

Issue notice on condition that the petitioner shall deposit Rs. 2,00,00,000/- (Rupees Two Crores) to the credit of C.No. IV/16/27/201HPU on the file of the Commissioner of GST & Central Excise, Salem, Tamil Nadu and produce receipt in that behalf in the Registry of this Court within ten days from today, failing which the special leave petition shall stand dismissed for nonprosecution without further reference to the Court.

Subject to the above, notice returnable within three weeks.

Related Topic:

Supreme Court in the case of M/s Vellanki Frame Works

Dasti, in addition, is permitted.

For a period of one week, no coercive action be taken against the petitioner in connection with the alleged offense and the interim protection will continue upon production of receipt in the Registry about the deposit made with the Department within one week from today, until the disposal of this Special Leave Petition.

List the matter on 12.09.2019.

Liberty to serve the Standing Counsel for the State of Madras is granted.

Read the Order:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.