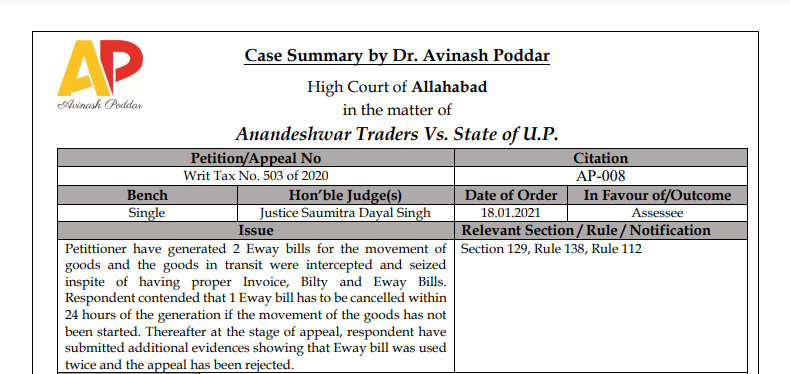

Allahabad HC in the case of Anandeshwar Traders Versus State of U.P.

Table of Contents

Case Covered:

High Court of Allahabad

in the matter of

Anandeshwar Traders Vs. The state of U.P.

Issue:

Petitioners have generated 2 Eway bills for the movement of goods and the goods in transit were intercepted and seized in spite of having proper Invoice, Bilty, and Eway Bills. Respondent contended that the 1 Eway bill has to be cancelled within 24 hours of the generation if the movement of the goods has not been started. Thereafter at the stage of appeal, the respondent has submitted additional evidence showing that the Eway bill was used twice and the appeal has been rejected.

Relevant Section / Rule / Notification

Section 129, Rule 138, Rule 112

Brief Facts of the Case:

- Petitioner is a trader in Pan Masala and other goods.

- The petition is directed against the order dated 3.12.2019 passed by the Additional Commissioner Grade-2 (Appeal)-5, Commercial Tax, Kanpur, whereby the demand of tax and penalty amounting to Rs. 29,76,110/- has been confirmed.

- The petitioner has sold disputed goods to a dealer – Shri Durga Trading Company, Darjeeling, West Bengal, against its Tax Invoice nos. SAT/19-20/0059, dated 24.11.2019, and SAT/19-20/0060, also dated 24.11.2019.

- Two e-way bills were also prepared being e-way bill nos. 491096371734 and 491096371789. Both e-way bills were prepared on 24.11.2019 at 02.32 PM and 02.33 PM respectively.

- It is also undisputed that the goods in question along with the aforesaid two tax invoices, e-way bills and, two Bilty were found accompanying the goods on 28.11.2019 when the same were intercepted by the revenue authorities.

- Only one allegation was proposed to be levelled by the proper officer – of reuse of the aforesaid e-way bills.

- At the stage of the final order passed under Section 129(3) of the Central Goods and Service Tax Act, 2017 (hereinafter referred to as the Act), no finding came to be recorded to that effect. Accordingly, by order dated 3.12.2019, the Assistant Commissioner (Mobile Squad)-4, Kanpur, revised the demand for tax and penalty Rs. 29,76,110/-.

- The petitioner’s appeal against that order came to be dismissed by an order dated 22.6.2020 passed by the Additional Commissioner Grade-2 (Appeal)-5, Commercial Tax, Kanpur.

- At the stage of the appeal, certain additional evidence has been entertained by the appeal authority in the shape of receipt of toll plaza indicating (according to the revenue authority) that the goods had moved on 24.11.2019 itself, at 7.31 PM. Relying on that, the penalty appeal was also dismissed.

Brief Arguments by the Petitioner/ Appellant:

Learned counsel for the petitioner submits that Rule 138(9) of the Rules does not, in any way, provide either automatic cancellation of e-way bills or cancellation of e-way bills by way of necessary option to be adopted by a dealer, in case, the goods are not transported within 24 hours of such e-way bills being generated. Secondly, in any case, the reason for assessment and penalty has to be tested on the strength of the original order.

Relying on Rule 112 of the Rules, it has been further submitted that the right to lead additional evidence at the stage of appeal, has been granted to the appellant only.

Therefore, the appeal authority has wrongly allowed the application of the revenue authority who was the respondent in the appeal.

Brief Arguments by Respondents:

Learned Standing Counsel opposed the petition and submitted that, in case the petitioner had not transported the goods as disclosed on the e-way bills, he should have acted in accordance with the law and cancelled the same under Rule 138(9) of the Rules. The fact that the e-way bills were not cancelled, itself is evidence of the goods having been twice transported, thereon.

Cases Relied Upon by

Petitioner

Mohinder Singh Gill & Anr. Vs. The Chief Election Commissioner, New Delhi & Ors., AIR 1978 SC 851

Respondent

–

Judgement/ Ratio (in brief):

Having heard learned counsel for the parties and having perused the record, the rights of the parties, in the instant case, are found to be governed by Rule 138(9) of the Rules. The Rule does not prescribe that the dealer must necessarily cancel the e-way bill if no transportation of the goods is made within 24 hours of its generation. It certainly does not provide any consequence that may follow if such cancellation does not take place. On the contrary, the Rule permits a dealer to cancel the e-way bill only if the transportation does not take place and the dealer chooses to cancel such e-way bill within 24 hours of its generation.

A mere assertion made at the end of the seizure order that it was clearly established that the assessee had made double use of the e-way bills is merely a conclusion drawn bereft of material on record. It is the reason based on facts and evidence found by the assessing authority that has to be examined to test the correctness of the order and not the conclusions, recorded without any material on record.

Then, as to the power of the appeal authority to entertain additional evidence, again, there can be no doubt that Rule 112 of the Rules does not allow for additional evidence to be led at the instance of the respondent in the appeal. In the case of penalty or assessment, where the appeal may be filed by the assessee alone, the correctness of the order is to be tested on the strength of the reasons given in that order and not on the basis of any supplementary or other material that may be brought on record by the revenue authority during the appeal proceedings.

To do that would be to allow the order impugned in an appeal proceeding to be tested and affirmed on fresh reasons, existing outside the assessment or penalty order.

In view of the above, no useful purpose would be served to remand the proceeding now as that would amount to giving the revenue a second inning to built a fresh case that too after being aware of the defense set out by the assessee in the first leg of the proceedings. The order dated 3.12.2019 passed by the proper authority under Section 129(3) of the Act is found to be perverse and is set aside. Any amount that may have been deposited by the petitioner-assessee, may be returned to it, in accordance with the law.

Head Note/ Judgement in Brief:

Goods were intercepted and seized and demand and penalty were imposed on the grounds that movement of goods has not started within 24 hours of the generation of E-Way bills. Rule 138 does not provide, that the e-way bill needs to be cancelled if the movement of goods does not start within 24 hours of its generation. An appeal has been filed by the petitioner which was rejected further on the grounds that the movement of goods was done twice on the same e-way bill, which was based on the additional evidence/documents submitted by the respondents at the time of appeal. Rule 112 of the CGST Rules, does not allow the respondent to place additional evidence at the time of appeal.

Views of Author: In this case, the Hon’ble court has considered the plea that additional evidence can not be placed further by the respondent at the time of appeal. The respondent must place evidence and reasons in the adjudication order, nothing can be added at the stage of appeal.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).