Patna HC in the case of Pinax Steel Industries Pvt Ltd Versus State of Bihar

Table of Contents

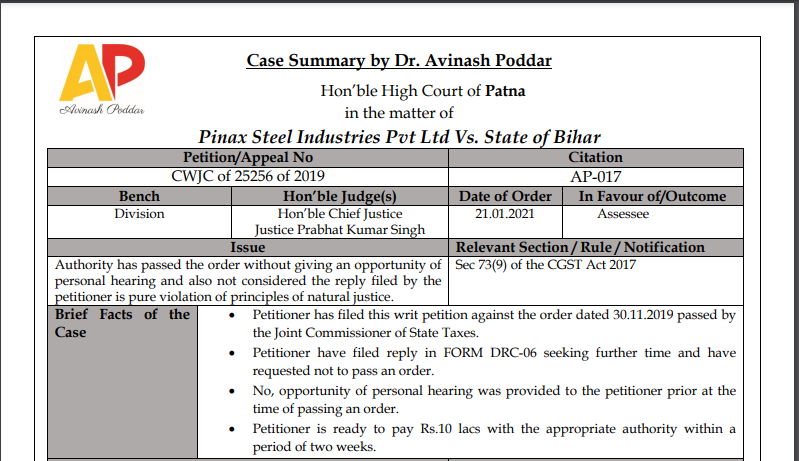

Case Covered:

Pinax Steel Industries Pvt Ltd

Versus

State of Bihar

Issue:

Authority has passed the order without giving an opportunity of personal hearing and also not considered the reply filed by the petitioner is pure violation of principles of natural justice.

Brief Facts of the Case:

• Petitioner has filed this writ petition against the order dated 30.11.2019 passed by the Joint Commissioner of State Taxes.

• Petitioner have filed a reply in FORM DRC-06 seeking further time and has requested not to pass an order.

• No, the opportunity of a personal hearing was provided to the petitioner prior to the time of passing an order.

• Petitioner is ready to pay Rs.10 lacs with the appropriate authority within a period of two weeks.

Brief Arguments by Petitioner/ Appellant:

Shri Gautam Kejriwal learned counsel for the petitioner states that without prejudice to the respective rights and contentions of the parties, the petitioner is ready and willing to deposit a sum of Rs. 10 lacs with the appropriate authority within a period of two weeks from today.

Brief Arguments by Respondents:

–

Judgement/ Ratio (in brief):

Having heard learned counsel for the parties, as also perused the record, we are in agreement with Sri Gautam Kejriwal, learned counsel for the petitioner, that the principles of natural justice, in passing the order stands violated.

Also, we are of the view that the impugned order dated 30.11.2019 passed by Respondent No.2, the Joint Commissioner of State Taxes, Danapur Circle, Patna needs to be quashed and set aside, for the same to have been passed without following the principles of natural justice. In terms of the impugned order, financial liability stands fastened. Thus, it entails civil consequences, seriously prejudicing the petitioner inasmuch as, without affording any adequate opportunity of hearing or assigning any reason.

It stands clarified that deposit of such amount would be without prejudice to the respective rights and contentions of the parties and the order in which the authority may pass upon the matter being remanded for consideration afresh.

As such, purely on the limited ground, we quash and set aside the impugned order dated 30.11.2019 passed by the Respondent No.2, the Joint Commissioner of Sate Taxes, Danapur Circle, Patna for the period 1st quarter of 2017-18 under Section 73(9) & (50) of Bihar Goods and Service Tax Act, 2017, as contained in Annexure-8 series, with further mutually agreeable directions that-

(a) the petitioner shall deposit a sum of Rs. 10 lacs with the authority on or before 6th February 2021;

(b) the petitioner shall appear before the authority on 6th February 2021 in his office at 10:30 A.M., on which date he shall place on record additional material if so required and desired;

(c) also, further opportunity shall be afforded to the parties to place additional material, if so required and desired;

(d) petitioner undertakes to fully cooperate and not take any unnecessary adjournment;

(e) the authority shall decide the matter on merits, in compliance with the principles of natural justice, on or before 3rd April 2021;

(f) liberty reserved to the parties to take recourse to such remedies as are otherwise available in accordance with law;

(g) we have not expressed any opinion on merits and quashed the order only on the ground of violation of principles of natural justice.

(h) if necessary, proceedings during the time of the current Pandemic [Covid-19] would be conducted through digital mode;

(i) needless to add, with the passing of the order, if it is eventually found that the deposit made by the petitioner is in excess of the amount determined due and payable, the same shall positively be refunded expeditiously as per the provisions of the statute. The instant petition stands disposed of in the aforesaid terms

Head Note/ Judgement in Brief:

The authorities have violated the principles of natural justice and have passed an order without giving an opportunity of personal hearing and have not considered the reply of the petitioner that he seeks further time for submissions.

Views of Author:

In this order, the court has viewed that there are clear violations of principles of natural justice and the opportunity for personal hearing was not given to the petitioner.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).