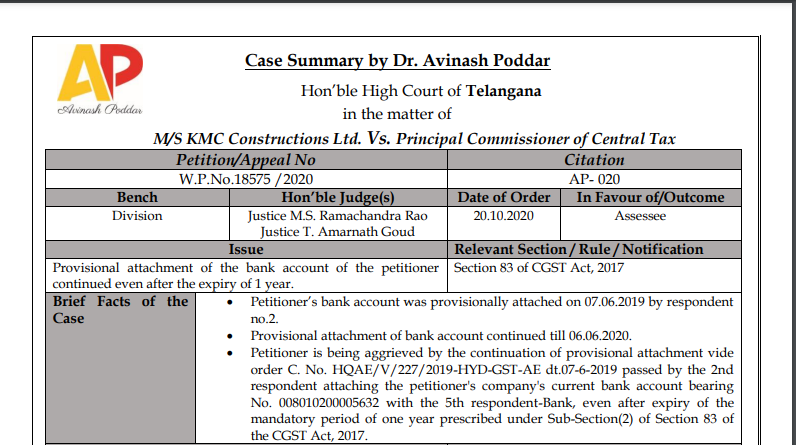

Telangana HC in the case of M/s KMC Constructions Ltd. Versus Principal Commissioner of Central Tax

Table of Contents

Case Covered:

M/s KMC Constructions Ltd.

Versus

Principal Commissioner of Central Tax

Issue:

Provisional attachment of the bank account of the petitioner continued even after the expiry of 1 year.

Brief Facts of the Case:

• Petitioner’s bank account was provisionally attached on 07.06.2019 by respondent no.2.

• Provisional attachment of bank account continued till 06.06.2020.

• Petitioner is being aggrieved by the continuation of provisional attachment vide order C. No. HQAE/V/227/2019-HYD-GST-AE dt.07-6-2019 passed by the 2nd respondent attaching the petitioner’s company’s current bank account bearing No. 008010200005632 with the 5th respondent-Bank, even after expiry of the mandatory period of one year prescribed under Sub-Section(2) of Section 83 of the CGST Act, 2017.

Brief Arguments by Petitioner/ Appellant:

Counsel for the petitioners contends that the continuation of such attachment is wholly illegal, arbitrary, and violates Articles 14, 19(1)(g), 21, 265, and 300A of the Constitution of India.

Counsel for the petitioners has placed reliance on the decision of the Karnataka High Court in A.P. Steels & Sanjay Kumar Mishra v. Additional Director General, DGCI [WP No. 8586 of 2020 dated, 20-07-2020] wherein the Karnataka High Court had held that provisional attachment of a bank account of a party cannot continue beyond a period of one year prescribed under subsection (2) of section 83 of the Act and it directed the respondents to defreeze the petitioner’s bank account within a certain period of time fixed therein.

Brief Arguments by Respondents:

Sri B. Narasimha Sharma, Senior Counsel for Central Taxes does not dispute the above legal position that provisional attachment of a bank account would cease to have affect after the expiry of a period of one year from the date of the order made under sub-Section (1) of Section 83 of the Act.

Learned counsel for Central Tax, contended that the matter is at show-cause notice stage, that there is money in the above-referred bank account of the petitioner, and that this Court should make an observation that it is open to the respondents to issue a fresh provisional order of attachment under section 83 of the Act.

Cases relied upon by:

Petitioner

A.P. Steels & Sanjay Kumar Mishra v. Additional Director General, DGCI [WP No. 8586 of 2020 dated, 20-07-2020] –

High Court of Karnataka

Namaskar Enterprise v. CGST – SCA 18105 of 2019

Respondent

–

Judgement/ Ratio (in brief):

We are of the opinion that the issue in the Writ Petition relates to a provisional attachment order dt.07-6-2019 issued by the 2nd respondent and its continuing existence after 6-6-2020, i.e., after the expiry of one year from 7-6-2019, contrary to subsection (2) of section 83 of the Act. The fact that the said attachment cannot continue in view of the sunset clause in sub-section (2) of section 83 of the Act beyond a period of one year from 7-6- 2019, is not in dispute.

Therefore, the impugned provisional attachment order dt.07-6-2019 issued by the 2nd respondent cannot continue after 6-6-2020 in view of sub-section (2) of section 83 of CGST Act, 2017, and any such continuation would be violative of Articles 14, 19(1)(g) and 300A of the Constitution of India and would be wholly without jurisdiction.

Accordingly, the Writ Petition is allowed directing the 5th respondent to allow the petitioner to operate its current account bearing No. 008010200005632 forthwith. No order as to costs.

Consequently, miscellaneous petitions pending if any shall stand closed.

Head Note/ Judgement in Brief:

Petitioner’s bank account was provisionally attached on 07.06.2019 under Sec 83 of CGST Act, 2017, and such attachment continued even after the expiry mandatory period of one year.

Views of Author:

In this order, the court has viewed that any property including a bank account cannot be provisionally attached after the expiry period of 1 year.

Other Judgments (Similar Ratio):

A.P. Steels & Sanjay Kumar Mishra v. Additional Director General, DGCI [WP No. 8586 of 2020 dated, 20-07-2020] – High Court of Karnataka

Namaskar Enterprise v. CGST – SCA 18105 of 2019

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).