Withholding of Refund Order was Quashed as no Reasons of Fraud or Malfeasance

Table of Contents

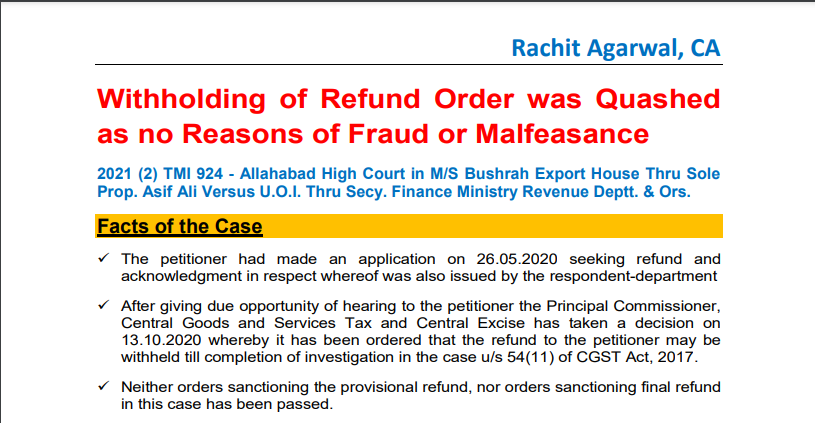

Withholding of Refund Order was Quashed as no Reasons of Fraud or Malfeasance

2021 (2) TMI 924 – Allahabad High Court in M/S Bushrah Export House Thru Sole Prop. Asif Ali Versus U.O.I. Thru Secy. Finance Ministry Revenue Deptt. & Ors.

Facts of the Case

- The petitioner had made an application on 26.05.2020 seeking a refund and acknowledgment in respect whereof was also issued by the respondent-department

- After giving due opportunity of hearing to the petitioner the Principal Commissioner, Central Goods and Services Tax and Central Excise has taken a decision on 13.10.2020 whereby it has been ordered that the refund to the petitioner may be withheld till completion of investigation in the case u/s 54(11) of CGST Act, 2017.

- Neither orders sanctioning the provisional refund nor orders sanctioning final refund in this case, has been passed.

The decision of Hon’ble Court

- For exercising the authority vested by subsection 11 of section 54 of the Act for withholding the refund, the officer concerned has to form an opinion regarding refund having the tendency of adversely affecting the revenue in some proceedings.

- It is not only that the opinion of the officer concerned needs to be recorded but that opinion regarding refund adversely affecting the revenue has to be based on some malfeasance or fraud.

- Sub-rule 2 of rule 92 as quoted above, requires the proper officer or the Commissioner to pass an order in Part B of FORM GST RFD- 07 if he is of the opinion that the amount of refund is liable to be withheld under subsection 10 or

subsection 11 of section 54, as the case may be. - Recording of reason, in this case, has to be mandatory for the reasons inter alia,

o there is such a statutory requirement flowing from section 54(11) of the Act and Rule 92(2) of the Rules and

o if any person aggrieved by such an order intends to file an appeal then to facilitate the appellate authority to arrive at a correct decision, reasons are required to be indicated by the subordinate authority.

- The file contains the decision dated 13.10.2020 passed by the Principal Commissioner, however, it only says “in the facts and circumstances of the case, we may withhold refund till completion of the investigation in the case”. The said decision does not assign any other reason regarding on which basis the Principal Commissioner has arrived at his opinion that the refund claimed by the petitioner is likely to adversely affect the revenue in the investigation (which is said to be pending) and such opinion is based on some material indicating some malfeasance or fraud said to have been committed by the petitioner.

- Form RFD 07 contains a separate specific column where a requirement is to record reasons for withholding the refund and those reasons are to be in conformity with the requirement of section 54(11) of the Act and Rules 92(2) of the Rules. The order withholding the refund can be passed only if the prerequisites of the recording of the opinion in terms of the aforesaid provision are found present in a particular case.

- That the matter is pending consideration before the department for the last about eight months and because of non-finalization of the proceedings for refund, the petitioner-firm is suffering in its business.

Directions issued by Hon’ble Court

- The decision by the Principal Commissioner, dated 13.10.2020 as is available in the record produced by the learned counsel representing the respondents is hereby quashed.

- The fresh decision under this order shall be taken by the competent authority of the department on the basis of a record already available

- Once any order under section 54(11) of the Act is passed, the same shall be communicated to the petitioner forthwith and shall be served upon the petitioner through an appropriate mode of service.

- An investigation said to be pending against the petitioner shall be expedited and completed as far as possible within a period of four months from today. The authority concerned shall also pass an order on the prayer made by the petitioner for a provisional refund.

CA Rachit Agarwal

CA Rachit Agarwal