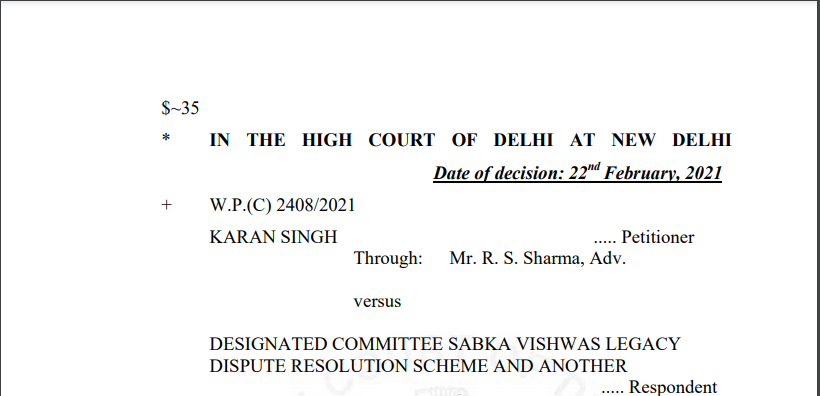

Delhi HC in the case of Karan Singh Versus Designated Committee Sabka Vishwas Legacy Dispute Resolution Scheme

Table of Contents

Case Covered:

Karan Singh

Versus

Designated Committee Sabka Vishwas Legacy Dispute Resolution Scheme

Facts of the Case:

The Petitioner, aggrieved with the rejection of its declaration under the amnesty scheme – Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 [hereinafter referred to as ‘SVLDRS’] for settlement of the service tax dues, by way of the instant petition under Article 226 of the Constitution of India, seeks direction to the respondents to issue discharge certificate under SVLDRS. Besides, relief is also sought for quashing the Demand-cum-Show Cause Notice No. 61/2019-20 dated 20th March 2020 issued by Respondent No. 2 in respect of the period in dispute [hereinafter referred to as ‘SCN’].

Briefly stated, the petitioner, being the proprietor of M/S. Syona Spa is in the business of providing health club and fitness center services. An investigation was initiated by the Anti-Evasion Group-4, Central Excise, and Service Tax Department, in respect of service tax dues for the period of 2014-15 to June 2017. Vide letter dated 10.05.2019, summons were issued to the Petitioner. In reaction thereto, Petitioner deposited service tax of Rs. 20,08,334/- vide challans dated 10.05.2019 and 14.05.2019. Thereafter, by way of letters dated 21.05.2019 and 18.06.2019, the Petitioner sent its response to the summons, submitting, inter alia, month-wise receipts of service tax. Petitioner claims that vide the afore-noted communication dated 18.06.2019, it has quantified the service tax payable for the period 2014-15 to June 2017 as Rs. 20,08, 334/- for the period 2014-15 to June 2017.

Related Topic:

Delhi HC in the case of SKH Sheet Metals Components Versus Union of India

Observations:

It thus clearly emerges that in terms of the afore-noted provisions, the quantification of the amount has to be before 30th June 2019. Moreover, in terms of Section 121(r) of the Act, the word ‘quantified’ has been defined to mean a written communication of the amount of duty payable under the indirect tax enactment. Further, Section 124(1)(d)(ii) provides that with respect to cases where the tax dues are linked to an inquiry, investigation, or audit against the declarant, the relief shall be calculated on the amount quantified on or before the 30th day of June 2019.

Having regard to the aforesaid provisions, the question that arises for our consideration is whether the communication dated 18th June 2019 issued to the Superintendent, Anti Evasion Group-1, Central Excise & Service Tax, can be considered to be as an admission of duty liability so as to render the petitioner eligible under the SVLDRS.

Petitioner’s case falls within the ambit of ‘enquiry or investigation’, as the Petitioner was issued summons dated 10.05.2019 by the Anti-Evasion Group 4, Central Excise & Service Tax. In respect of such cases, by virtue of the aforesaid circulars, the Respondents have clarified that the benefit of SVLDRS can also be given to those cases where the duty involved is quantified before 30.06.2019.

Related Topic:

Writ Petitions not maintainable on Mixed Question of Facts and Law

The Decision of the Court:

We have noticed that there is not much difference between the amounts as mentioned in the communication dated 18.06.2019 and the SCN issued by the department subsequent to the completion of the investigation. However, in our opinion, that in itself cannot be a measure to interpret the concept of ‘quantification’. The quantification of the amount in question, as defined under the relevant provisions noted above, and further clarified under the circulars noted above, can only mean to be a duty liability that has been determined by the department. In view of the above, since the amount could not be said to have been ‘quantified’, the petitioner was not eligible, and therefore, the reasoning given by the respondent in rejecting the application does not call for any interference. Thus, the challenge to the SCN is also not maintainable as the petitioner still has its statutory remedies under the Act to impugn the same.

We do not find any merit in the present petition. Dismissed. The pending application also stands disposed of.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.