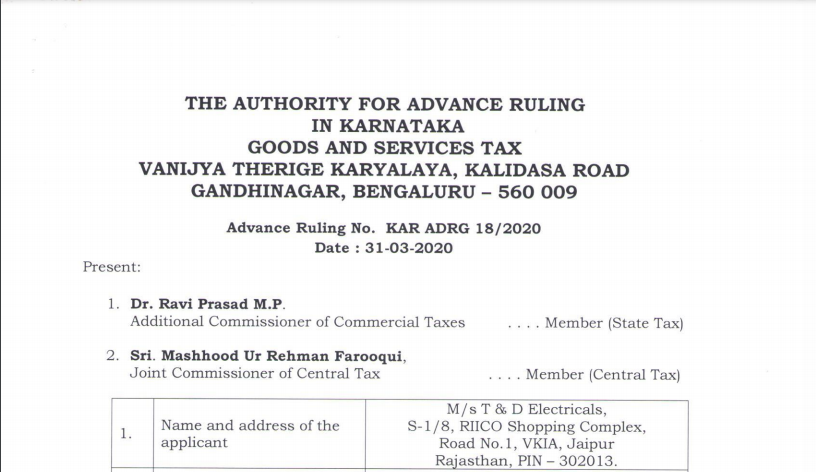

Karnataka AAR in the case of M/s T & D Electricals

Case Covered:

M/s T & D Electricals

Facts of the Case:

M/s T & D Electricals, S-l/8, RIICO Shopping Complex, Road No. 1, VKIA, Jaipur -302013 Rajasthan, having User ID 291900000213ART, have filed an application for Advance Ruling under Section 97 of CGST Act,2017 & KGST Act, 2017 read with Rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01, discharging the fee of Rs.5,000/- each under the CGST Act and the KGST Act.

2. The Applicant is registered under the Goods and Services Act, 2017 as a works contractor and wholesale supplier in Jaipur, Rajasthan, having GSTIN 08AADFT8381Q1Z9. They have been awarded a contract by M/s Shree Cement Limited, Rajasthan for electrical, instrumentation, and IT jobs (works contract) at the township, Karnataka Cement Project (a unit of Shree Cement Ltd.,). The applicant had sought advance ruling, on the same questions & same issues that have been raised in the instant application, before the Authority for Advance Ruling, Rajasthan, Jaipur, who have not passed any ruling on the grounds that the questions pertain to GST registration in Karnataka which is beyond the purview of the said authority. In view of this, the applicant filed the instant application, as an unregistered person, seeking an advance ruling in respect of the following questions:-

1. Whether separate registration is required in Karnataka state? If yes, whether the agreement would suffice as address proof since nothing else is with the assessee and the service recipient will not provide any other proof?

2. If registration is not required in Karnataka state and if we purchase goods from the dealer of Rajasthan and want to ship goods directly from the premises of the dealer of Rajasthan to the township at Karnataka then whether CGST & SGST would be charged from us or IGST by the dealer of Rajasthan?

If registration is not required in Karnataka state and if we purchase goods from the dealer of Karnataka to use the goods at township at Karnataka then whether IGST would be charged from us or CGST & SGST by the dealer of Karnataka?

3. What documents would be required with transporter to transit/ship material at Karnataka site from dealer/supplier of Rajasthan and in case of dealer/supplier is of Karnataka. The advance ruling may kindly be issued in case of registration is required or not required in both the situation?

Ruling:

1) The applicant need not obtain separate registration in Karnataka, to execute the project in Karnataka. However, they are at liberty to obtain the said registration, if they are able & intend to have a fixed establishment at the project site in Karnataka.

2) (a) The dealer in Rajasthan has to charge CGST & SGST when the goods, purchased by the applicant, are shipped to the project site in Karnataka, under the bill to ship to the transaction in terms of Section 10(1)(b) of the IGST Act 2017.

(b) The dealer in Karnataka has to charge IGST when the goods, purchased by the applicant, are shipped to the project site in Karnataka, under the bill to ship to the transaction in terms of Section 10(1)(b) of the IGST Act 2017.

3) No ruling is given on this question as it does not cover under Section 97(2) of the CGST Act 2017.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.